F&O Manual: Volatility very high, experts to take a call after market opens tomorrow

Volatility will be high as February 2 is the weekly expiry and the market will also react to the US Fed outcome

1/6

The market had a rollercoaster session on February 1 as the Budget was cheered by investors but the concerns around the Adani made traders nervous. The Nifty closed 0.26 percent, or 46 points, down at 17,616.30. The bulls were in control in the first half but the scene reversed as the session progressed. (The blue bars show volume and the golden open interest or OI)

2/6

On the options front, 17,700 and 17,800 saw heavy call writing, emerging as key hurdles for the index now. Some put writing was also seen at 17,500. Given that February 2 will be the weekly expiry and the market will also react to the US Fed outcome scheduled later tonight, volatility will be high. “We should take a view depending on how the market opens tomorrow,” said Nandish Shah - Senior Derivative Analyst - HDFC Securities. (Bars reflect a change in OI during the day. Red bars show call option OI and green put option OI.)

3/6

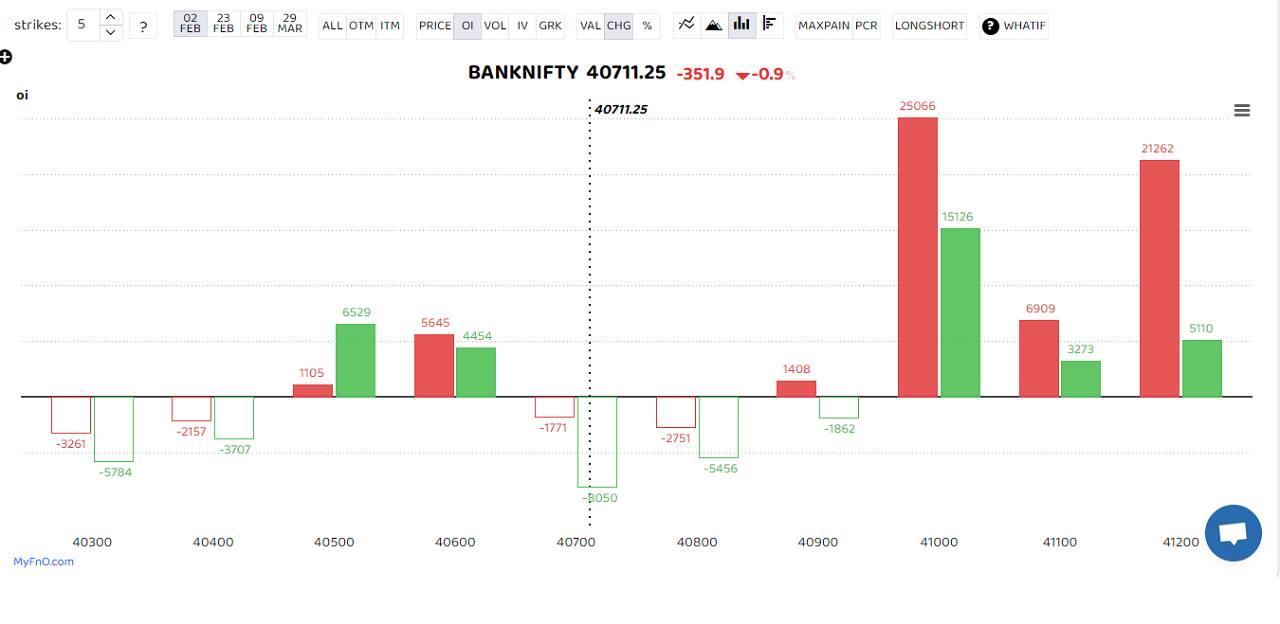

The Bank Nifty also closed with cuts of 0.35 percent at 40,513. The banking index too had a highly volatile session, as it moved in a 2,500-point range. “On the daily chart, the index has sustained below the 50 EMA. The daily momentum indicator RSI is in a bullish crossover. The sentiment is likely to remain weak as long as it remains below 41150. On the lower end, support is placed at 39500/38800. On the higher end, resistance is visible at 41150," said Kunal Shah, Senior Technical Analyst at LKP Securities. (The bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.)

4/6

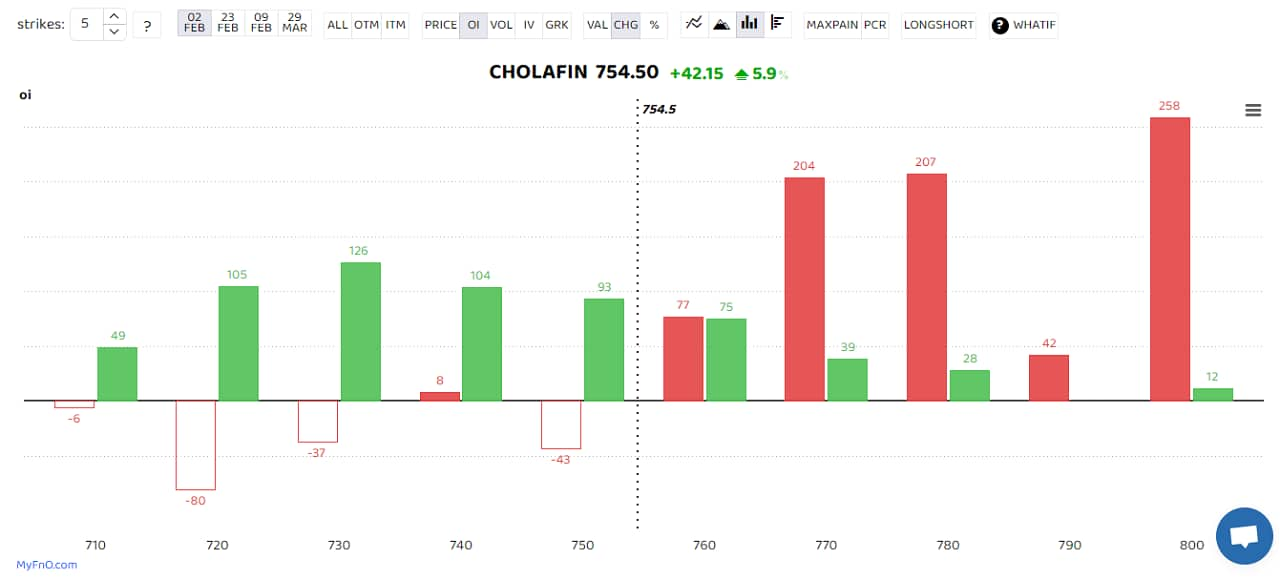

Chola Finance saw a heavy long buildup with open interest rising 25 percent. The stock was among the top stocks to see a long build-up. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Indian Hotels, Jindal Steel, Dixon Tech and Apollo Tyres were among others. (The bars reflect a change in OI during the day. Red bars show call option OI and green put option OI.)

5/6

All life insurance stocks were flashed red. HDFC Life saw a heavy short buildup after some budget announcements were seen as detrimental to the industry’s growth. The open interest in the stock rose 63 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (The bars reflect a change in OI during the day. The red bars show call option OI and the green put option OI.)

6/6

Several other stocks also saw a short buildup. The list was led by Adani Enterprises, Adani Ports, ICICI Prudential Life Insurance and Max Financials Services. (Numbers in the boxes reflect changes in futures price.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!