F&O Manual: Expect high volatility on budget day; buy on dips, say analysts

On the options front, call writing shifted to 17,900 from 17,800 level, a signal that traders are expecting some bounce-back from current levels

1/6

The markets traded dull in a narrow range and ended marginally in the green in continuation of the rebound of the previous session. The Nifty closed at 17,662.15, up 0.07 percent. Analysts said with uncertainty over Adani FPO behind, a lot will now depend on what is announced in the Budget 2023 on February 1. (The blue bars show volume and the golden bars open interest or OI)

2/6

On the options front, call writing shifted to 17,900 from 17,800, a signal that traders are expecting some bounce-back from current levels. More put writing at 17,600 makes it a good launchpad for the index. On February 1, it will be a volatile day as the market mood will shift with budget announcements. Analysts also pointed out that if FIIs turn positive, things may improve further. “Traders should buy the dip,” said Ruchit Jain, CMT-Lead Research Analyst at 5paisa. (The bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.)

3/6

The Bank Nifty outperformed and closed with gains of 0.66 percent at 40,655.05. The bank index managed to hold the support level of 40,200 and continued moving upward throughout the day. “The index's immediate resistance is at 41,000, where the highest open interest is built up on the call side. The index, if it sustains above 41000, will experience sharp short-covering on the upside towards 41,500–41,800 levels," said Kunal Shah, Senior Technical Analyst at LKP Securities. (The bars reflect changes in OI. The red bars show call option OI and the green put option OI.)

4/6

Ahead of the Budget 2023, traders took bullish bets on Bharat Electronics. The scrip was among the top stocks too saw a long build-up. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Bank of Baroda, Shree Cement and REC were among others. (The bars reflect changes in OI during the day. The red show call option OI and the green put option OI.)

5/6

Tech Mahindra saw a heavy short buildup after its earnings disappointed the Street. The short build-up is a bearish sign that occurs when the price of a stock falls, along with high open interest and volume. (The bars reflect a change in OI during the day. The red show call option OI and the green put option OI.)

6/6

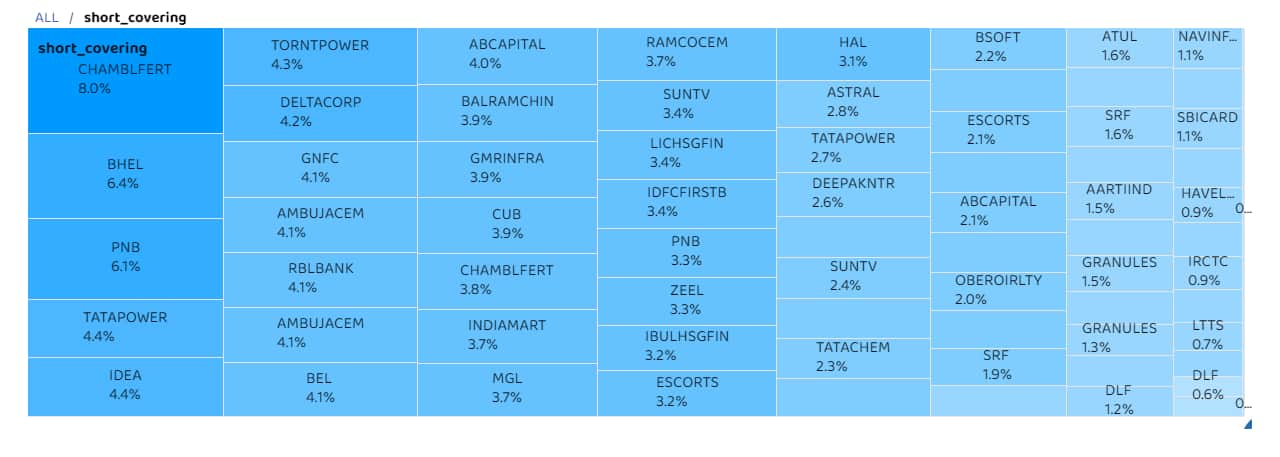

Several stocks also saw short covering, a signal that they may have bottomed The list was led by Chambal Fertilisers, BHEL, PNB and Tata Power. (Numbers in the boxes reflect changes in futures price.)

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!