MONEYCONTROL-RESEARCH

Attractive valuations, focus on new growth avenues make Subros a worthy buy

Subros has planned to set up the second manufacturing unit by H2 FY19 while the third plant is in the planning stage. These are expected to increase the capacity to 2.5 million units from the current 1.5 million units.

BUSINESS

Endurance Tech: A fundamentally strong business; accumulate

Leadership position, strong management at helm, strong clientele, coupled with strong financial performance make this business worth considering for long-term portfolio.

MONEYCONTROL-RESEARCH

Automobile October 2018 numbers: Adverse macros weigh, but festivity brings cheer in select pockets

Weakening macroeconomic condition marked by rise in crude oil prices, rupee depreciation, rising interest rate regime coupled with regulatory challenge coming from mandatory long-term insurance as well as natural calamity like floods in Kerala had dampened the demand for most of the auto majors in India in September 2018. However, festive season brought cheers to selected pockets in the month of October 2018.

BUSINESS

CEAT Q2 FY19 review: Outlook remains positive despite subdued numbers

We believe the company is poised to gain from increase in market share in passenger vehicle (PV) and 2/3 Wheeler segments and capacity expansion in selected pockets. This coupled with reasonable valuations make CEAT worth considering for a long-term portfolio.

BUSINESS

Lumax Industries' Q2 FY19: LEDs continue to shine; good long-term bet

The stock is currently trading at 20.0 and 15.5 times its FY19 and FY20 projected earnings. We advise investors to accumulate it with an eye on the long term

BUSINESS

Bajaj Auto Q2 FY19 review: Margin disappoints, outlook positive

Operating margin was marred by adverse raw material prices and the price cut initiated by the management in the entry-level motorcycle segment

BUSINESS

IndiGo Q2 marred by costly jet fuel, low yields, weak rupee; avoid stock

A tough operating environment led to the company reporting losses. Investors should tread cautiously and bottom fish only after some improvement in the operating environment

BUSINESS

Mahindra CIE Q3 CY18 review: Outlook positive; accumulate

Mahindra CIE’s domestic and Europe revenues grew significantly. Its EBITDA margin remained flat, despite adverse raw material prices. New orders, strong demand outlook and reasonable valuations make it a stock worth considering

BUSINESS

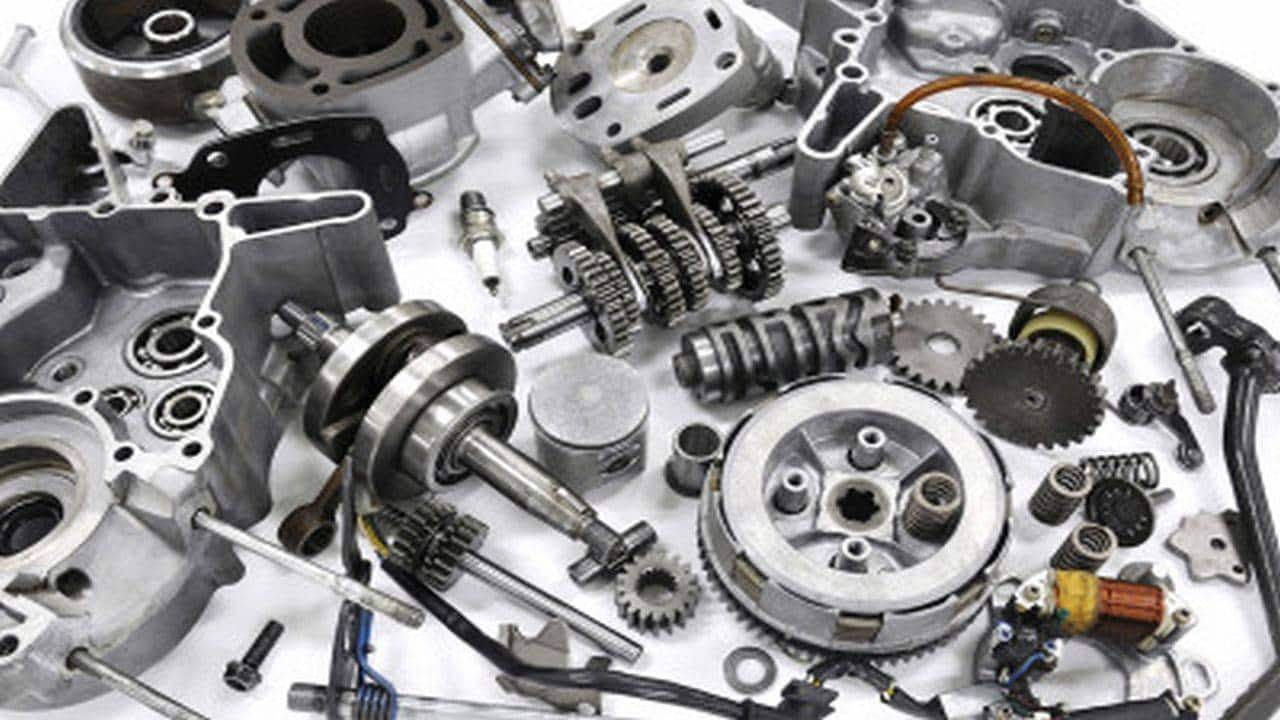

Endurance Tech: The future-ready auto ancillary stock

Given the unique position of Endurance Tech in auto component segment and its track record, it deserves premium valuations.

BUSINESS

Why Reliance Industries decided to pick stake in SkyTran

Partnership with SkyTran would help RIL continue to achieve its aim of investing in future technology and making its business future relevant in a fast changing world

EARNINGS

Reliance Industries Q2: Telecom, retail drive healthy results

Jio continued to impress with quarterly performance and despite strong competition, operating revenue increased and the company sustained operating margins as well.

BUSINESS

Here’s why Hero MotoCorp is a long term buy

The current market weakness provides a great opportunity for investors to enter a fundamentally strong business available at a reasonable price and run by a strong management

BUSINESS

September 2018 auto sales hit speed bump on cocktail of adverse factors

Auto majors hit a speed bump in the month of September 2018 and posted a mixed bag on numbers on the back multiple factors such as delayed festive season, floods in Kerala and increasing cost of total ownership on the back to rising interest rate, fuel prices and insurance cost.

MONEYCONTROL-RESEARCH

Steel Strip Wheels: CVs, alloy wheels to drive growth; buy for the long term

We continue to like the business on the back of its focus on CV exports and foray into high margin alloy wheels segment to drive the next leg of growth

BUSINESS

Jamna Auto Industries: A strong play on a revival in CV demand

Recent correction in the stock has made valuations attractive for the long term

BUSINESS

August auto sales hit by delayed festive season and Kerala floods

The commercial vehicle segment continues to remain strong on the back of factors like normal monsoon, improved rural sentiments and investment in infrastructure

BUSINESS

Q1 FY19 review: Like SNL, Menon and NRB Bearings

While the bearings sector looks interesting from a growth versus valuation standpoint, we like SNL Bearings, Menon Bearings and NRB Bearings

BUSINESS

Jet Airways: Continues to face turbulence

While the current state of affairs in the company doesn’t excite us, we would be carefully monitoring this restructuring journey given the favourable industry dynamics.

BUSINESS

Motherson Sumi Systems: Multiple long term growth drivers; buy

Strong demand in domestic and export markets, robust order book, expansion at various locations globally, shift towards electric vehicles and new emission norm should boost topline as well as operating margin

BUSINESS

Bharat Forge: A leading auto ancillary with multiple growth levers; accumulate

The positive outlook for industrials and Class 8 truck demand in the US and multiple growth avenues make it an ideal investment call, although the rich valuation tempers our excitement

BUSINESS

Aviation times: Jet hits turbulence, prefer IndiGo and SpiceJet

The financials of airline companies are clearly feeling the heat, despite an increase in passenger traffic, improving utilisation and government’s accommodative policy

MONEYCONTROL-RESEARCH

Ramkrishna Forging Q1FY19 review: Firing on all cylinders, long-term buy

The new press line and products, increase in market share, strong financials and above all the reasonable valuation, beckons investor attention.

BUSINESS

Auto July 2018 sales review – CVs, tractors, 2-wheelers continue to ride well

The revival of the rural economy and expectations of normal monsoon continue to make the outlook positive for the tractor segment.

BUSINESS

Accumulate IndiGo for the long term, Q1 marred by fuel prices and forex losses

We are cautiously optimistic on the back of operational efficiencies, capacity addition plans and multiple growth drivers. We see fuel prices and rupee depreciation versus the dollar as short term challenges