Lumax Industries, a lighting solutions provider for automobile manufacturers that caters to all major segments, posted an impressive set of numbers for Q2 FY19 on the back of increasing penetration of LEDs in India.

The company reported strong growth in net sales and operating profit. However, its operating profit margin remained largely unchanged due to a rise in raw material cost.

We believe that given its market leadership, marquee clients in its kitty, its strong focus on research and development, increasing adoption of LED-based products, and its reasonable valuation, this stock should be on investors' radar.

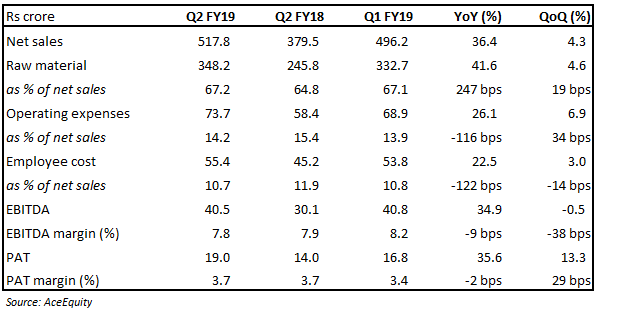

Quarter in a snapshot

In the quarter gone by, Lumax's net revenue from operations grew 36.4 percent year on year (YoY) on the back of strong volume and value growth, which was driven by higher adoption of LED products. LED sales now account for around 35 percent of the company's total sales, up from 8 percent in FY17.

On the profitability front, the company posted a 34.9 percent YoY rise in earnings before interest, tax, depreciation and amortisation (EBITDA), but its margin remained largely unchanged. In fact, on a quarter-on-quarter (QoQ) basis, it was 38 bps lower. This was because of higher import of raw material for its LED products. The pass through of rise in raw material cost is expected to happen with a time lag. Profit after tax (PAT) grew 35.6 percent on year, but PAT margin too remained flat.

Positives:LED – a game changerFaster and wider adoption of LEDs continues to augur well for the company, as is reflected in its financial performance. LEDs are high value and high margin products for the company and as mentioned above, their sales now make up 35 percent of the company's total sales.

LED penetration is India is still very low (15-20 percent) and so, there is huge potential for the company in terms of both sales growth and margin expansion.

Moreover, the government's decision to make 'Automatic Headlamp On (AHO)' mandatory for two-wheelers from 2017 has started providing an additional kicker to growth, as is evident from its increasing share in sales (25 percent in Q2 FY19 vs 23 percent in Q2 FY18) from two-wheeler original equipment manufacturers (OEMs).

Strong clienteleAs a percentage of total revenue, Maruti is Lumax's largest client, bringing in 34 percent of its revenue. It is followed by Honda Motorcycle and Scooter India (HMSI) and Honda Motors (HML), who account for 14 percent and 11 percent of the pie, respectively. In all, the company earns 72 percent of its revenue from its top five customers.

Strong focus on research and development (R&D)Strong financial and technical collaboration with Stanley Electric Company Ltd (Stanley), Japan, a world leader in vehicle lighting and illumination products for automobiles, has given Lumax access to world class technologies that will help keep it ahead of competition.

In addition to this, Lumax has also set up in-house R&D facilities and a design studio that enables it to design and manufacture innovative and future-ready products.

Industry outlookMajor OEMs are facing challenges in terms of demand, primarily due to adverse macroeconomic factors such as rising oil prices, increase in interest rates and mandatory long-term insurance. The management, however, indicated that the company may report a weak Q3 but that demand is expected to bounce back from Q4 FY19.

Opportunities arising from upcoming BSVI and EV adoptionBharat Stage (BS)-VI norms, which are to be implemented by 2020, would require the vehicles to be more energy efficient, which in turn is expected to lead to faster adoption of LEDs. The management expects huge growth from this in the coming year.

Additionally, the company’s products are unaffected by the upcoming electric vehicle (EV) disruption. In fact, EV adoption would lead to increasing adoption of LED products as well, as EVs require products to be energy efficient.

New facility commissioned – to meet additional demandA new facility in Sanand, Gujarat, with a capacity to manufacture 300,000 lamps annually had been commissioned during the quarter gone by to supply primarily to Maruti and Tata Motors in the passenger vehicle segment. The company plans to add capacity to manufacture another 100,000 units there.

Additionally, Lumax plans to have a plant in Gujarat to manufacture 700,000 units to cater, primarily, to Honda and Hero in the two-wheeler segment. The management believes they can get 100 percent utilization from these facilities by FY20.

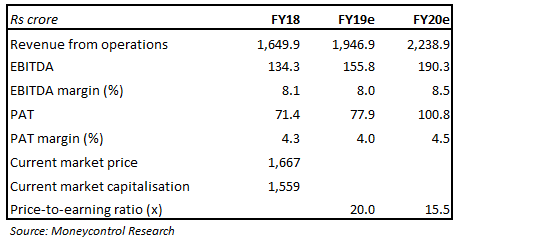

Valuation at very reasonable levelsOn the back of weaker demand outlook and market volatility, the share price of the company has witnessed a sharp 36 percent drop from its 52-week high, making it quite attractively valued. It currently trading at 20.0 and 15.5 times its FY19 and FY20 projected earnings. We advise investors to accumulate the stock with an eye on the long term.

.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.