Nitin Agrawal

Moneycontrol Research

With strong demand from the domestic commercial vehicle industry and for Class 8 trucks (15-tonne and above) in North America, Ramkrishna Forgings (RMKF) is in a sweet spot as is evident from the strong set of Q1 FY19 earnings. The new press line and products, increase in market share, strong financials and above all, the reasonable valuation, beckons investor attention.

Quarter in a nutshell

Strong volume growth

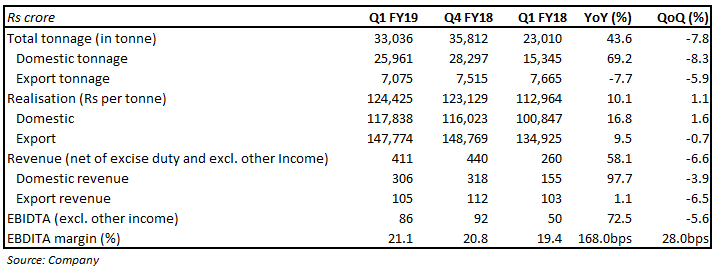

Volumes grew 43.6 percent year-on-year (YoY), primarily driven by 69.2 percent growth in domestic business. Growth in the domestic business was on account of a strong pick-up in commercial vehicle demand on the back of government focus on infrastructure, increase in mining activity and good monsoon lifting rural sentiment.

Pickup in demand for Class 8 trucks in North America continues to be strong. The management said export volumes witnessed a YoY decline of 7.7 percent due to maintenance and inventory re-adjustment.

Continuous enrichment of the product mix with leading original equipment manufacturers (OEM) led to 16.8 percent and 9.5 percent YoY rise in domestic and export realisations, respectively.

Net operating revenue registered a strong 58.1 percent YoY growth on the back of substantial volume growth and an increase in average realisation.

Improved EBITDA margin

Earnings before interest, tax, depreciation, and amortisation (EBITDA) margin expanded 168 basis points YoY on the back of favourable product mix and operating leverage. Raw material (RM) cost continues to spike up, but it’s a pass-through for the company with a time lag.

Growth drivers

A robust new product line-up

RMKF develops over 150 new products per year as is evident from its track record over the last five years. This has helped in increasing content per vehicle and increase its share in key OEMs. The management indicated it would continue to focus on developing new products.

Strong tailwinds in the domestic market

Thanks to its new heavy‐tonnage press, the company is well-positioned to manufacture heavy‐ and critical‐forged products. With its long-standing relationships with leading OEMs such as Tata Motors and Ashok Leyland, it continues to bag fresh orders on the back of increasing content per vehicle and growth in CV demand.

As per the management, the new axle load norms are expected to slow down demand for 15-20 days because of the implementation. In light of the new norms, the company is working on its products.

Overall, the management is quite optimistic about the demand growth for medium and heavy commercial vehicles (M&HCV) in FY19 on the back of the government’s thrust on infrastructure development and mining activities.

Pickup in demand for Class‐8 trucks in North America

After witnessing a sharp 36 percent drop in Class‐8 truck orders in CY16, demand picked up strongly. It witnessed a growth of 23.4 percent in CY18 and is expected to grow at 11.7 percent (YoY), which is expected to augur well for the company.

Focusing on the oil & gas space

In the oil and gas space, RMKF caters to offshore and drilling companies. The company has achieved a target of $1 million in Q1 FY19. The company targets $6-7 million for FY19 from this segment.

New press line: A huge opportunity

The company has set up four new heavy presses with an aggregate capacity of 12,500-tonne per annum. This makes it the only company after Bharat Forge to command such a capacity and provides an opportunity to meet the strong demand.

Immune to shift to electric vehicles

The management said it is not affected by the shift towards EVs and plans to work on aluminium forging for EVs.

Valuations at reasonable levelsDue to overall weakness in the market, the stock has corrected 26 percent from its 52-week high. At the current market price, it trades at 19.2 times FY19e (estimated) and 17.1 times FY20e earnings, which is reasonable given the strong earnings growth in the next two years. We advise investors to buy this for long-term.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.