Nitin Agrawal Moneycontrol Research

The aviation sector is reeling under multiple blows -- lower passenger yields, higher fuel cost and a weaker rupee -- affecting operating profitability of companies in this space. InterGlobe Aviation,

the parent company of IndiGo airlines, is no exception and reported its first-ever quarterly loss since listing. On year-on-year (YoY) basis, it posted a decent growth in Q2 FY19 revenue from operations. However, a tough operating environment led to the company reporting losses. Investors should tread cautiously and bottom fish only after some improvement in the operating environment.

Quarterly snapshot In terms of quarterly performance, net revenue from operations grew 16.9 percent YoY led by a 29.1 percent increase in volumes. This was, however, offset by a 9.8 percent fall in yields. Passenger load factor, however, witnessed a 50 basis points (100 bps = 1 percentage point) growth over the same quarter last year.

Cost per available seat km (CASK) increased 24.3 percent, leading to a 2,761 bps contraction in earnings before interest, tax, depreciation, amortisation, tax and rent (EBITDAR) margin. Contraction was primarily driven by a rise in fuel cost, forex losses (booked a loss of Rs 335 crore compared to a loss of Rs 46 crore in the same quarter last year) and fall in passenger yields. This impacted the bottomline as well, with the company reporting a loss of Rs 652 crore as compared to a profit of Rs 552 crore in the same quarter last year.

Factors that are causing turbulence in the air

Yields not at optimal levels Intense competition has led to significant pricing pressure in the domestic market, primarily in the 0-15 day window, leading to a significant fall in yields. The management said these pricing levels are not optimal given the significant rise in fuel prices and a weaker rupee. The industry needs to pass on higher fuel prices to customers.

Weaker rupee leads to higher expenses Significant rupee depreciation against the dollar has also put profitability under pressure. This is due to dollar denominated expenses such as maintenance cost.

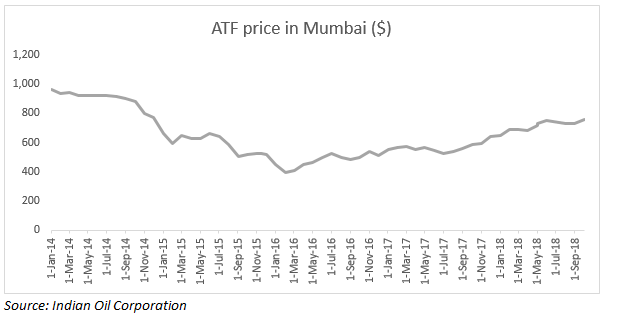

Rising oil prices the biggest challenge The paradigm shift in the industry came from a decline in crude price in the past couple of years. As fuel alone contributes around 30-35 percent of total cost of airline operations, declining prices had improved profitability of the company.

However, a global trade war along with weather anomalies in the US, internal problems within major oil exporting countries and their inability to pump up production, and approaching winters have resulted in a negative sentiment leading to a strong uptick in oil prices.

Airline turbine fuel (ATF) prices have risen almost 92 percent from February 1, 2016, putting profitability of the airline under a lot of pressure.

However, following factors may help it navigate through these turbulent times

Capacity addition on track to capture rising demand During the quarter gone by, the company added 20 aircraft to its fleet, taking its fleet size to 189. It has also placed huge aircraft orders, the delivery of which will help IndiGo retain its leadership position in the Indian market. Most of these additions would be of fuel efficient A320neo aircrafts. Capacity in Q2 grew 12 percent sequentially and the management sees it growing 35 percent and 30 percent in Q3 and FY19, respectively.

Foray into the international market

The company continues to step up its presence in the long-haul international market and continues to expand its global reach organically. It plans to add many new international destination such as Male, Kuwait, Hong Kong, and Jeddah. It has allocated 15 percent capacity to its international operations from 11 percent last year.

UDAN scheme may power regional growth The government’s regional air connectivity scheme, UDAN, is another avenue for IndiGo to capture growth originating from non-trunk routes. The airline has started connecting non-trunk routes aggressively and has added three routes under the scheme in Q2 FY19.

ATR operations As part of its regional connectivity programme, the management has sourced an ATR aircraft and started operations from December last year. In the quarter gone by, it added 3 new ATRs and now have 12 ATRs in its fleet of 189 aircraft.

Operational cost saving through aircraft ownership The management plans to use its existing cash flow to finance purchase of aircrafts. The primary reason for it owning aircrafts is because new technology has just been introduced into the market and the company sees lesser chance of it going obsolete soon. This technology will usher in additional cost savings, if the aircrafts are flown for a longer duration.

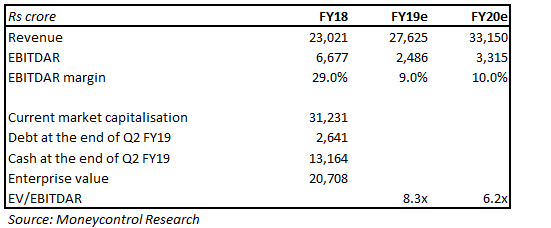

Valuation at elevated levels due to huge operating underperformance IndiGo has all the right ingredients required to retain its leadership position in the Indian aviation sector. However, a tough operating environment would continue to put it under a lot of pressure. The stock has corrected 46 percent from its 52-week high on the back of weak set of numbers for last two quarters. Investors need to tread with caution and avoid it till the time crude prices soften and rupee stabilises.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.