Nitin Agrawal

Moneycontrol Research

CEAT posted a mixed set of numbers for Q2 FY19. While the top line continues to witness a strong growth, its operating profitability continues to be under pressure on the back of rise in raw material (RM) prices, employee cost and other operating expenses.

We believe the company is poised to gain from an increase in market share in passenger vehicle (PV) and 2/3 Wheeler segments and capacity expansion in selected pockets. This coupled with reasonable valuations make CEAT worth considering for a long-term portfolio.

Quarter snapshot

In terms of CEAT’s quarterly performance, it posted a year-on-year (YoY) growth of 15.2 percent in its net revenue from operations driven, primarily, by volume growth of 12.4 percent (YoY). The volume growth was led by growth coming in from both original equipment manufacturer (OEM) and export market demand. Realisation witnessed a YoY growth of 2.8 percent on the back of favorable mix titled towards replacement and passenger tyres and the price hike taken by the company.

In terms of operating profitability, earnings before interest, tax, depreciation and amortization (EBITDA) witnessed a decline of 8.8 percent (YoY) on the back of significant increase in operating expenses (higher ad expenses) and employee cost (increase in salaries, new employee cost and one-time expense of Rs7–10 crore because of a settlement with workers in Bhandup and Nasik). This led to YoY EBITDA margin contraction of 239 bps.

Factors to watch out for:

Raw material to put pressure – price hike helping

Tyre companies have, historically, been unable to pass on the full rise in the raw material (RM) prices to the customers, leading to huge margin pressure. However, the company has started passing on the rise in RM prices to its customer without significantly denting its volume. CEAT took an average price hike of 1.7 percent in Q2 FY19 and took another 2 percent in trucks and 4 percent hike in two-wheeler (2W) in October 2018, which should get reflected in next quarter’s result. These price hikes should help the company in maintaining its operating margin.

The management expects that RM inflation to continue and expects RM price to rise 3.5 percent on quarter-on-quarter (QoQ) basis in Q3 FY19 and indicates that further price hike needs to be taken to pass on the same.

Areas to drive growth – passenger vehicle segmentThe company caters to clients across all segment. However, its dependence on truck and busses is much higher (contributed 35 percent in sales in H1 FY19). In light of this, to reduce dependence from truck segment, the management has identified passenger vehicle (PV) and 2/3W segments as a focus areas to drive the growth for the company as these have the ability to boost margins for the company. The company is scaling up its operations in these areas. In H1 FY19, contribution of PV segment in sales has increased by 2 percentage points and now stands at 16 percent and 2/3W remained flat at 32 percent.

Demand outlook

Though, major OEMs across segments are facing challenges in terms of demand, primarily, due to adverse macroeconomic factors such as rising oil price, increase in interest cost and mandatory long-term insurance. The management, however, has indicated there has been no dip in demand from OEMs and continues to maintain guidance of achieving double-digit growth in the current fiscal year.

Capacity expansion

In light of multiple macro headwinds, the management has lowered the capital expenditure (CapEX) guidance to Rs3,100 crore from original Rs3,500 crore over the next two years. And has lowered it to Rs1,000-1,500 crore from Rs1,500-1,700 crore over the current fiscal.

CEAT has been facing supply constraints in 2W and hence It plans to incur capex to increase 2W capacity to 3 million units from 2 million units currently in next 1-1.5 years. Further, new plant in Nagpur is on track to put up capacity of 80,000 units for TBR (truck and bus radial) and expects it to commence from Q4 of this fiscal year.

Additionally, de-bottlenecking at PCR (passenger car radial) capacity is being done which has led to 10-12 percent increase in the capacity with a further scope for 10 percent in second half of the current fiscal.

Valuations – at attractive levels

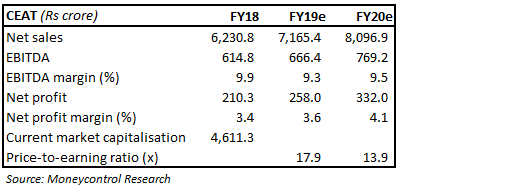

Recent volatility in overall market and concerns over rise in RM prices have led the stock to correct by 44 percent from its 52-week high. The correction has led to significant drop in the valuations of the company. CEAT is currently trading at 17.9 times and 13.9 times FY19 and FY20 projected earnings considering the likely increase in interest expense and depreciation owing to the big capex plan.

We have comfort on CEAT’s strategy and business and valuation is also reasonable. We advise investors to accumulate this business for long-term on any weakness arising out of weak demand outlook and/or rise in RM prices.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!