Nitin Agrawal Moneycontrol Research

Endurance Technologies, one of the leaders in the automotive component space, posted a strong set of Q2 FY19 earnings, driven by a strong year-on-year (YoY) growth in net revenue and tight cost controls that helped offset the sharp rise in raw material (RM) prices.

Leadership position, pedigree management at the helm, strong clientele and robust financial performance make this business worth considering for the long term.

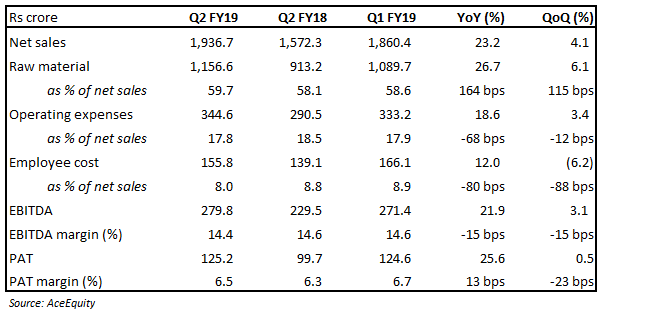

Quarter at a glance

The company posted a net revenue growth of 23.2 percent, fuelled by strong growth accruing from both India and Europe businesses. Despite subdued two-wheeler (2W) industry growth of 7 percent and automotive industry growth of 7.1 percent, the India business significantly outperformed and grew 26 percent YoY. Growth in the India business (72 percent contribution in consolidated revenue) was on the back of market share gains from its original equipment manufacturers (OEMs). Sizable growth in orders came from Bajaj Auto (32 percent), Honda Motorcycle & Scooter India (22 percent), Royal Enfield (12 percent), Hero MotoCorp (46 percent) and Yamaha India (17.5 percent).

Europe business grew 15 percent YoY led by a 6.7 percent growth in the euro-rupee and the balance on account of a weaker rupee.

Despite a significant rise in raw material prices, the company posted a 15 bps YoY contraction in earnings before interest, tax, depreciation and amortisation (EBITDA) margin. Fall in margin was arrested by reduction in operating expense and employee cost as percentage of net sales. Geography-wise, India business saw margin contract 40 bps, whereas Europe business expanded 80 bps.

Factors working in favour of these companies

Best play in the 2W segment; strong franchise The company is the best proxy play in the 2W segment, with strong management at the helm and leadership position in its product categories. It is the largest aluminium die casting company in India in terms of output and installed capacity. It is also among the top two companies in suspensions, transmissions and braking systems for 2W. In the domestic market, it caters to five out of the top six 2W OEMs.

New order wins provides earnings visibility Endurance Technologies continues to receive new orders from its clients, indicating strong demand for its products. In H1 FY19, it received orders worth Rs 733.4 crore and 22.5 million euro in its domestic and European business, respectively. The company bagged new business in Europe from Volkswagen, Fiat Chrysler and Daimler. A robust order book provides strong earnings growth visibility.

Technological prowess – a moat Focus on technology is an important aspect of this business as evident from its four dedicated R&D centres, of which three are located in Aurangabad and one in Pune. It also has one technical engineering centre for aluminium die castings in Chivasso, Italy. The company manufactures highly technology-intensive products such as rear disc brake assemblies, upside-down front forks, fully machined castings, paper clutch assemblies and rear mono shock absorbers.

Robust client base On the back of technological superiority, proven execution track record of new projects and quality products, the company has been able to partner with strong clients both in India and abroad. In the domestic market, it caters to five out of the top six 2W OEMs. It also supplies to marquee clients in Europe as well and its top five clients in Europe are Fiat Chrysler, Daimler, the Volkswagen Group (including Porsche and Audi), BMW and Opel, which is now owned by Peugeot.

Replacement market offers huge opportunities The replacement market continues to offer huge growth opportunities. In H1 FY19, revenue grew 24 percent to Rs 121.7 crore. The management said it will continue to focus on aftermarket and is increasing its share there.

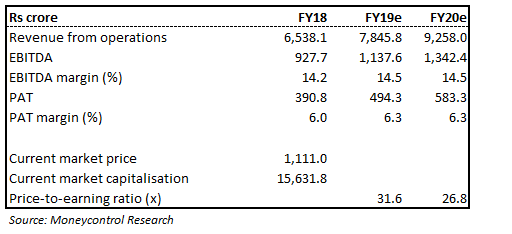

Valuation continues to be elevated Amid market weakness and overall muted market sentiment, the stock has corrected 30 percent from its 52-week high. The valuation, however, continues to remain at elevated levels, but the stock deserves premium valuation given its past performance. The counter currently trades at 31.6 times and 26.8 times FY19 and FY20 projected earnings, respectively. We advise investors to accumulate stock in a staggered manner.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.