Jet Airways (Jet) continues to face turbulence and posted an extremely bad set of Q1 FY19 earnings. Financial performance was marred by multiple challenges: lower passenger yields, higher fuel cost and rupee depreciation versus the dollar.

Quarter in a snapshot: Fuel cost played spoilsport  Revenue from operations grew 5.1 percent year-on-year (YoY), led by increase in passenger revenue (7.5 percent), partially offset by fall in yields (2.3 percent). Load factor dipped 130 bps over the same quarter last year as capacity increased 9.5 percent over the same period.

Revenue from operations grew 5.1 percent year-on-year (YoY), led by increase in passenger revenue (7.5 percent), partially offset by fall in yields (2.3 percent). Load factor dipped 130 bps over the same quarter last year as capacity increased 9.5 percent over the same period.

Despite growth in topline, the company reported negative earnings before interest, tax, depreciation, amortisation and rental (EBITDAR) margin primarily because of the rise in fuel expenses (up 1,168 bps as a percentage of operating revenue), aircraft maintenance cost (up 155 bps) and other expenses (up 693 bps. The company has, however, been able to manage its selling and distribution cost (down 253 bps as a percentage of operating revenue).

What is on the cards to keep it afloat?Raising money to keep on going The management indicated that the company continues to be an on-going concern and is working on finding avenues to raise money.

The company through sale and lease back garnered around $300 million during Q1, which has been used to reduce cash losses and debt by Rs 785 crore. It currently has a debt of Rs 7,364 crore sitting on its balance sheet. The management plans to retire Rs 2,200 crore debt in FY19. This will be done through capital infusion, monetisation of the JetPrivilege programme and wet leasing of ATR aircraft.

As per media reports, the company has approached non-banking financial companies (NBFCs) to raise around Rs 1,500-2,000 crore by monetising forward sales to reduce capital stress.

Focusing on cost optimisation The airline continued its focus on operational efficiencies across its entire business, thereby reducing costs. The management indicated they are working towards cost optimisation, which is currently highly inefficient, when compared to its peers due to higher employee, maintenance and selling cost. The company plans to cut non-fuel cost by 12-15 percent over the next two years.

The management said the B737-max aircraft, which are about to join Jet’s fleet, are 15 percent more fuel efficient than the current aircraft. The company has also improved its aircraft utilisation.

Focus on improving revenue management The company is focusing aggressively on revenue management and plans to enhance it by 3-4 percent through various tactical and strategic initiatives around its network, inventory management, pricing and sales.

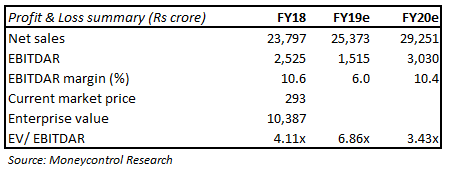

Valuations At the current price, the stock is quoting at 3.43 times FY20 projected EBITDAR. While the current state of affairs in the company doesn’t excite us, we would be carefully monitoring this restructuring journey given the favourable industry dynamics.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.