Nitin Agrawal

Moneycontrol Research

Auto majors hit a speed bump in the month of September 2018 and posted a mixed bag on numbers on the back multiple factors such as delayed festive season, floods in Kerala and increasing cost of total ownership on the back to rising interest rate, fuel prices and insurance cost.

What continues to do well is the commercial vehicle (CV) segment, on the back of improved rural sentiments, the government’s focus on infrastructure and increase in mining activities. Three-wheeler (3W) sales also continue to rise on the back of the government’s decision to end permit raj.

Tractors and two-wheeler sales, on the other hand, were hit by delayed festive season and deficit in rainfall. The outlook for these two continues to be positive on the back of the revival of rural economy and festive season which starts in October. Passenger vehicle (PV) sales also disappointed primarily because of Kerala flood, delayed festivity and high base of last year.

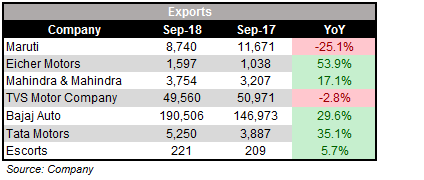

The improvement in global market is helping export sales for Indian auto majors.

Commercial Vehicle – Continues to be Robust

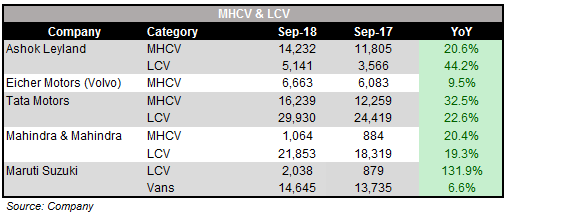

CV segment continues to post strong monthly sales volume and remained resilient. This was on the back of increasing demand from construction, focus on infrastructure, increase in mining activities and growth in Index of Industry production (IIP).

Notably, LCV (Light Commercial Vehicle) segment continues to post robust volume numbers, primarily, because of FMCG and E-commerce sectors and increasing demand coming from container and refrigerated trucks.

Tata Motors registered a 26 percent year-on-year (YoY) growth in CV volume in the month of September 2018. It posted strong growth in LCV segment on the back of new Tata Ultra range of trucks which are gaining significant acceptance and contributing to volumes.

M&M posted a healthy growth on the back of its power brands and the range of commercial vehicles. The management expects the growth momentum to continue on the back of some recent refresh launches as well as the better performance of its product portfolio.

Eicher Volvo also witnessed a significant year-on-year (YoY) growth of 9.5 percent in the month. Ashok Leyland posted a strong YoY growth of 26 percent in September 2018.

Cars Segment – leader hit by floods and delayed festive season

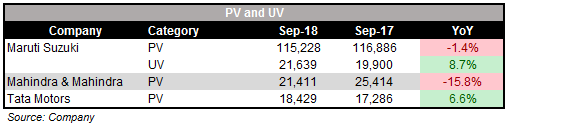

Amid rising cost of total cost of ownership on the back of increasing fuel prices, rising interest rate and mandatory long-term insurance coupled with flood in Kerala (around 11 percent exposure), the leader, Maruti, posted a flat domestic volume for the month.

For Tata Motors, passenger car segment witnessed a growth of 7 percent (YoY). This was a significant growth given the industry witnessed de-growth in the month.

M&M posted de-growth of 15.8 percent. The management indicated that with the launch of the Marazzo, it hopes to see buoyancy in passenger vehicle numbers, going forward.

Two-wheeler (2W) segment: Bajaj is gaining momentum

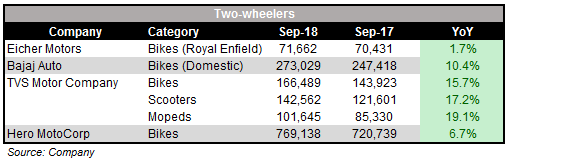

In two-wheeler space, TVS posted a strong YoY growth of 17 percent in the month on the back of growth coming in from all three segments: bikes (15.7 percent), scooters (17.2 percent) and mopeds (19.1 percent).

Bajaj Auto also posted a heathly growth of 10.4 percent in the month while Eicher posted a meagre 1.7 percent YoY growth in its volume numbers, impacted by Kerala flood.

Hero, on the other hand, posted a growth of 6.7 percent, which is significant given the base it has.

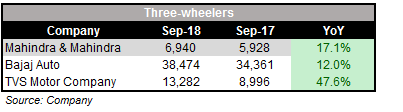

Three-wheeler (3W): Steller show

The overall 3W market continues to be robust. Bajaj Auto, the leader in the space, posted a decent 12 percent (YoY) growth in the domestic 3W segment. TVS also posted a strong growth of 47.6 percent (YoY) in 3W volumes and M&M posted a YoY growth of 17.1 percent.

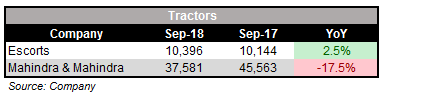

Tractors: gaining on positive rural sentiments

Delayed festive season and deficit in rainfall hurt tractors volumes for the month of September. However, the revival of the rural economy on the back of farm loan waivers and minimum support price (MSP) hikes would continue to augur well for the companies in the space. Escorts posted a YoY growth of 2.5 percent and M&M posted a YoY decline of 17.5 percent. The management of M&M expects positive momentum in the festive season, which starts in October.

Exports: Revival is onThe overall revival in global economy is getting reflected in the numbers of some of the leading automobile exporters. All auto majors barring Maruti and TVS posted strong YoY growth in the overseas market.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.