Nitin Agrawal Moneycontrol Research

Airline companies are facing twin challenges: pressure on passenger yields on the back of fever pitch competition and significant rise in air turbine fuel (ATF) prices. Their financials are clearly feeling the heat, despite an increase in passenger traffic, improving utilisation and government’s accommodative policy. It is no surprise that the one weakest on the cost curve, Jet Airways, is the worst hit.

Players having excellent network, cost management, performance and sound financial health are well placed.

Jet Airways worst hit Despite falling ATF prices and industry dynamics in last 2-3 years, Jet Airways could not gather enough dry powder to keep it viable during the current turbulence. Deferment of its Q1 FY19 earnings has added to investor worries.

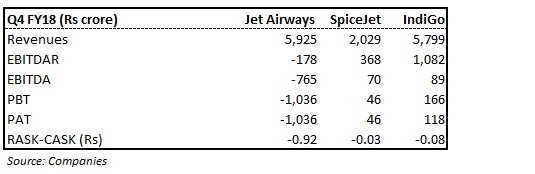

Jet Airways was the worst hit in Q4 FY18 on the back of a rise in ATF prices and reported negative EBITDAR (earnings before interest, tax, depreciation, amortisation and restructuring or rent costs), courtesy its inefficient cost structure.

Though the spread between revenue per available seat kilometer (RASK) and cost per available seat kilometer (CASK) has declined sharply to negative territory for all companies in Q4 FY18, Jet Airways had a negative spread for many quarters and fared poorly in Q4.

Balance sheet quality is also a cause for concern. As on FY18, the company had net debt of Rs 8,149 crore with a heavy repayment schedule. Its net debt-to-EBITDAR ratio, based on FY18 numbers, stands at a disturbing 9 times.

What could help? Jet in the recent past has taken various steps to improve its cash flow situation for debt servicing and operational functioning. A strategic investment by Etihad Airways (operational synergies) has helped in reducing CASK (excluding fuel) by about 2 percent year-on-year.

The management has renegotiated maintenance contracts, which can help it save $100 million annually (effective January next year). The company has also started a formal stake-sale process to raise nearly $400 million from private equity (PE) firms to fund its operations.

We believe that unless a structural change in the operating strategy is implemented, the company may not be able to weather the storm. Should a rival airline pick up stake and run it with an efficient cost structure, the fortune of Jet Airways could be salvaged.

Which company should investors prefer in the space? The biggest challenge for airline companies is rising ATF prices. We believe crude oil prices will stabilise in the $65-70 per barrel range. Companies with efficient cost structure should be able to manage the rise in ATF prices and continue to do well. We prefer InterGlobe Aviation (IndiGo) and SpiceJet from this space.

We prefer IndiGo on the back of:

IndiGo dominates the Indian skies with an over 40 percent domestic market share. Though the company had a weak start to FY19, there are multiple levers which can work in its favour.

The company posted a decent growth in Q1 FY19 revenue from operations. However, operational profit was marred by multiple challenges: lower passenger yields, higher fuel cost and foreign exchange losses. We are optimistic on its long term journey led by operational efficiencies, capacity addition plans and multiple growth drivers.

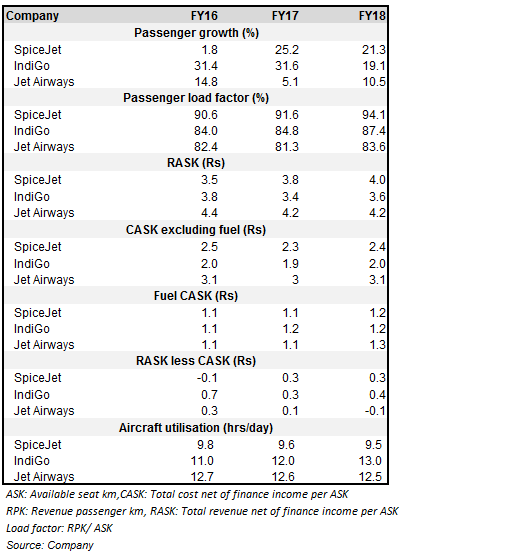

Cost optimisation The management is focused on reducing every component that appears in its cost structure. IndiGo’s per unit cost is lower compared to other industry players as shown in the table below. The company has started inducting fuel-efficient A320neo aircraft in its fleet, which would help it reduce fuel cost by close to 15 percent.

Well-timed aircraft ownership IndiGo’s management plans to use its existing cash flow to finance the aircraft purchase. The prime reason for it owning the aircrafts is because new technology has just been introduced into the market and will usher in additional cost savings if the aircrafts are flown for a longer duration.

Significant capacity addition to capture rising demand It has placed huge orders for aircrafts, the delivery of which will help IndiGo retain its leadership position in the Indian market. Capacity grew 18 percent YoY in Q1 FY19. The management sees its capacity growing 25 percent in FY19.

Reasonable valuation In spite of industry challenges, IndiGo has performed well in the past. Recent weakness in the stock price has made valuations comfortable. Our estimates indicate that the stock currently trades at 5.6 times and 4.5 times projected FY19 and FY20 EV/ EBITDAR multiple, respectively.

We prefer SpiceJet on the back of: SpiceJet, coming out from the brink of bankruptcy, has been navigating well over the last few quarters. The company is the second best cost efficient player in the industry as is evident from the table above.

Focus on non-competitive routes As a part of its business strategy, the management continues to focus on routes which are less crowded. The company deploys around 23 percent of its capacity to these kinds of routes. Operating on these routes also helps it incur lower charges related to airport duty or maintenance.

Low cost structure The company has also been taking cost reduction efforts and has been able to keep its costs low. Its cost structure now is the second best in the industry as can be seen in the table above.

Focus on capacity expansion Most of the company’s flight are running at more than 90 percent load factor. In order to continue to maintain/expand its market share it needs to expand capacity. In light of this, the management has placed orders for new aircraft. It has a current order book of 243 aircraft, the second highest after IndiGo.

Reasonable valuations The company is currently trading at reasonable valuations. Our estimates indicate that the stock currently trades at around 4.1 times and 3.2 times projected FY19 and FY20 EV/ EBITDAR multiple, respectively, which is very reasonable.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.