BUSINESS

Larsen & Toubro: This large-cap stock offers deep value, good margins of safety

Our SOTP suggests that the L&T stock is valued about 20 percent lower than its intrinsic value

BUSINESS

Shakti Pumps: Near-term pressure on margins and revenue growth

Shakti Pumps is mainly banking on orders in hand, apart from those from the government's Kusum scheme towards the end of 2021-22

BUSINESS

EV sales are running up in India. Seven stocks to ride

In a bid to move towards cleaner energy and environment-friendly transportation, the world has been moving away from internal combustion engine (ICE)-driven vehicles to battery-driven electric vehicles (EVs). In this note, we identify companies, across the EV ecosystem, which could benefit when EV penetration starts to pick up at a faster pace

BUSINESS

IRCON and RVNL: What can a merger achieve for the stakeholders?

As a merged entity, IRCON and RVNL can possess a solid portfolio of services, which can help them bring down cost and build capabilities that can shield them against competition

BUSINESS

Global coal crisis is playing out big. Who wins, who loses at home?

International coal prices are likely to remain elevated for some time due to supply issues and companies with exposure to imported coal is likely to be impacted

BUSINESS

At Tata Power, business revamp is talking it loud

Focus on restructuring, cost reduction, lower debt and emerging business to support stock valuation

BUSINESS

Why has MTAR rallied so much? Many factors are at work

Strong earnings visibility of MTAR Tech to give a leg-up to valuation and stock

BUSINESS

Paras Defence IPO: Move with extreme caution

The IPO of Paras Defence and Space Technologies lacks a convincing story for investors

BUSINESS

Grauer and Weil: Strong traction in business to aid earnings growth

We are expecting a strong 18-20 per cent earnings growth for Grauer and Weil over the next two years

BUSINESS

Railway engineering stocks: Growth gets on to a stable track

Railway stocks such as IRCON, RITES and RVNL are riding on the assessment that execution will only improve in the coming quarters

MONEYCONTROL-RESEARCH

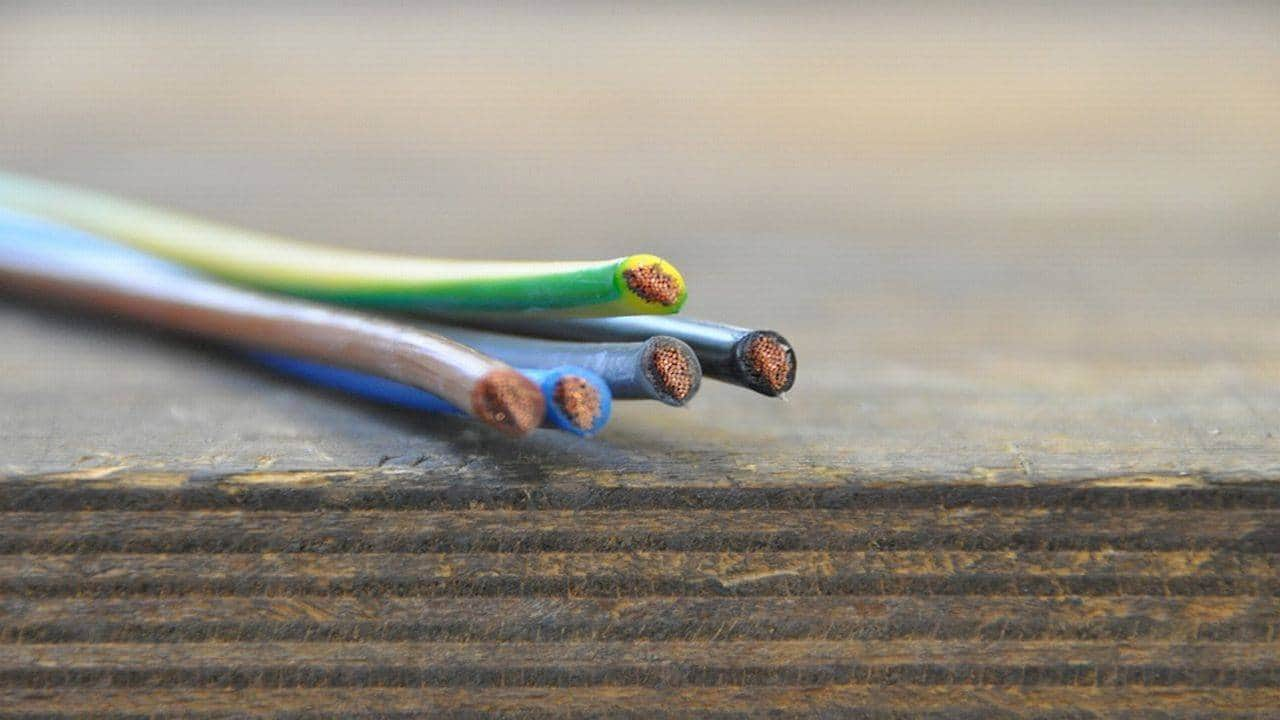

KEI Industries: Retail demand provides the spark

Despite a recent run-up, the KEI Industries stock is still reasonably valued

BUSINESS

Defence stocks move to restock their ammo

Valued attractively, defence stocks could be the best bet in a rising market

BUSINESS

JSW Energy: Stock run-up fully covers earnings growth

JSW Energy stock turns expensive after the recent rally in share price

BUSINESS

Praj Industries: Strong order, execution deliver the goods

Higher valuation could cap upside in the near term for Praj Industries

BUSINESS

Cummins India: Higher valuation bakes in strong earnings momentum

Higher valuation could cap upside in the near term for Cummins India

BUSINESS

Va Tech Wabag: Strong order book and execution to sustain growth

With cash in the books and the control over working capital, VA Tech is now in a much better position to keep the execution cycle up

BUSINESS

Power Grid Corporation of India: Earnings growth stable, valuation attractive

Low valuation and high dividend yield to support Power Grid stock

BUSINESS

Bharat Electronics: Growth takes a short-term pause

Earnings take a hit marginally this year, but the BEL stock remains reasonably valued

BUSINESS

Thermax: Business trajectory good, but valuation appears stretched

Earnings visibility of Thermax is improving, but valuation remains high

BUSINESS

KEC International: Margin pressure, higher valuations can pose near-term risk

While financial performance improving recent run up in share prices could limit returns in the near term

BUSINESS

Adani Ports & SEZ: Back on the growth path

Strong earnings visibility and relatively low valuations could support Adani Ports & SEZ stock in the near term

BUSINESS

NTPC: A stock that can provide certainty, consistency and predictability

NTPC offers a good risk reward at current market price

BUSINESS

ABB India: Strong recovery reflects in the valuation

While recovery is swift, ABB India is expensive

BUSINESS

L&T: Earnings recovery led by higher execution and order book to continue

Strong order book and expectations of high margins provide good earnings support to L&T. However, the stock is trading on the higher side of the historical range