BUSINESS

How PMS and AIF have gained investors and expanded asset base

Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs) have become popular investment avenues among high networth individuals (HNIs) looking for sophisticated investment options

BUSINESS

These MFs cushioned your fall during market slump… And those that couldn’t

Factors such as rising inflation, weakness of Rupee, rising interest rates and ongoing Russia-Ukraine conflict have impacted different sectors and different segments of the stock markets.

BUSINESS

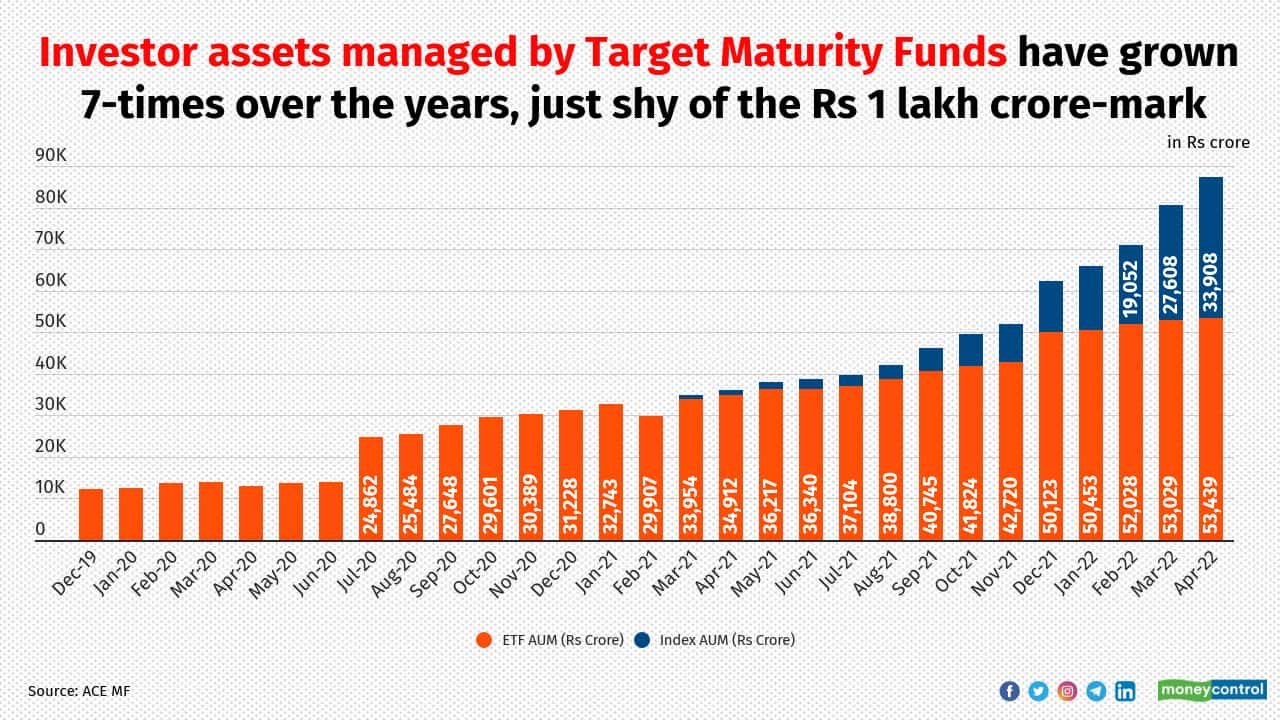

Target Maturity Funds see surge in assets as investor traffic multiplies

As bond yields rise, investors can use target maturity funds to lock in their investments at higher yields

BUSINESS

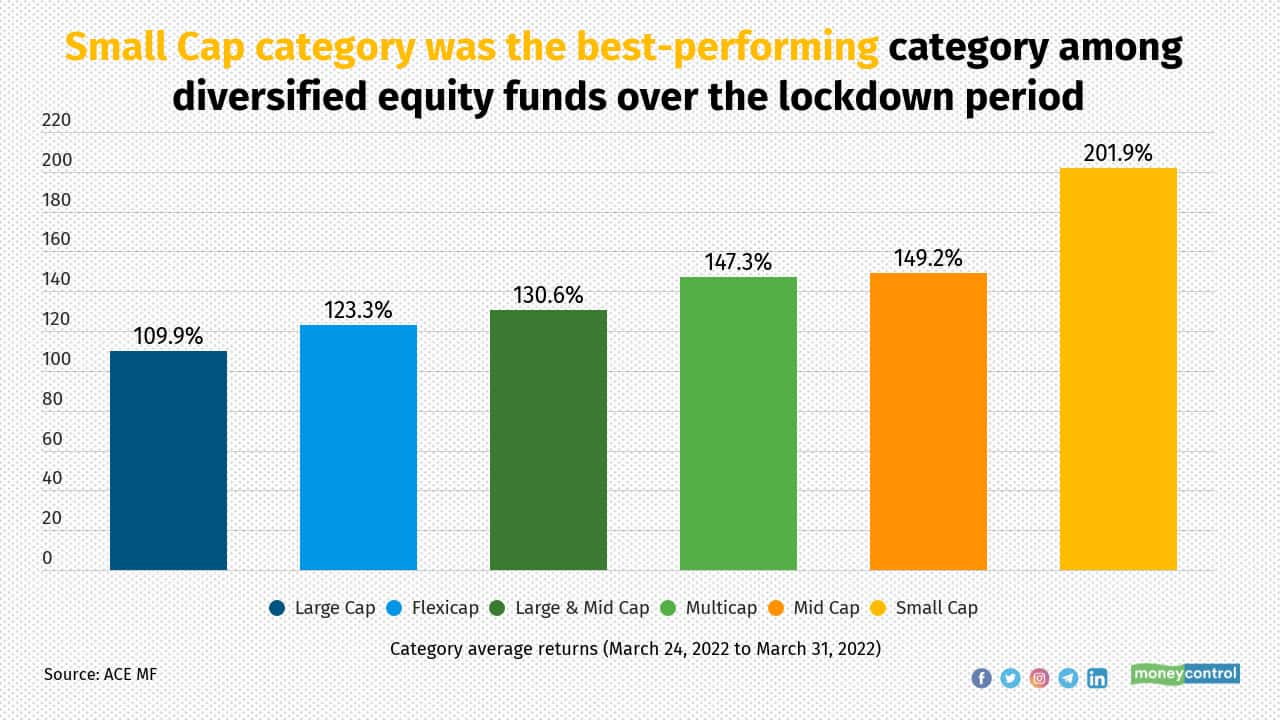

These small cap funds delivered up to 365% returns during 2 years of Covid-19

Five of the top performing schemes outperformed benchmark during Covid-19 lockdown between March 24, 2020 and March 31, 2022

BUSINESS

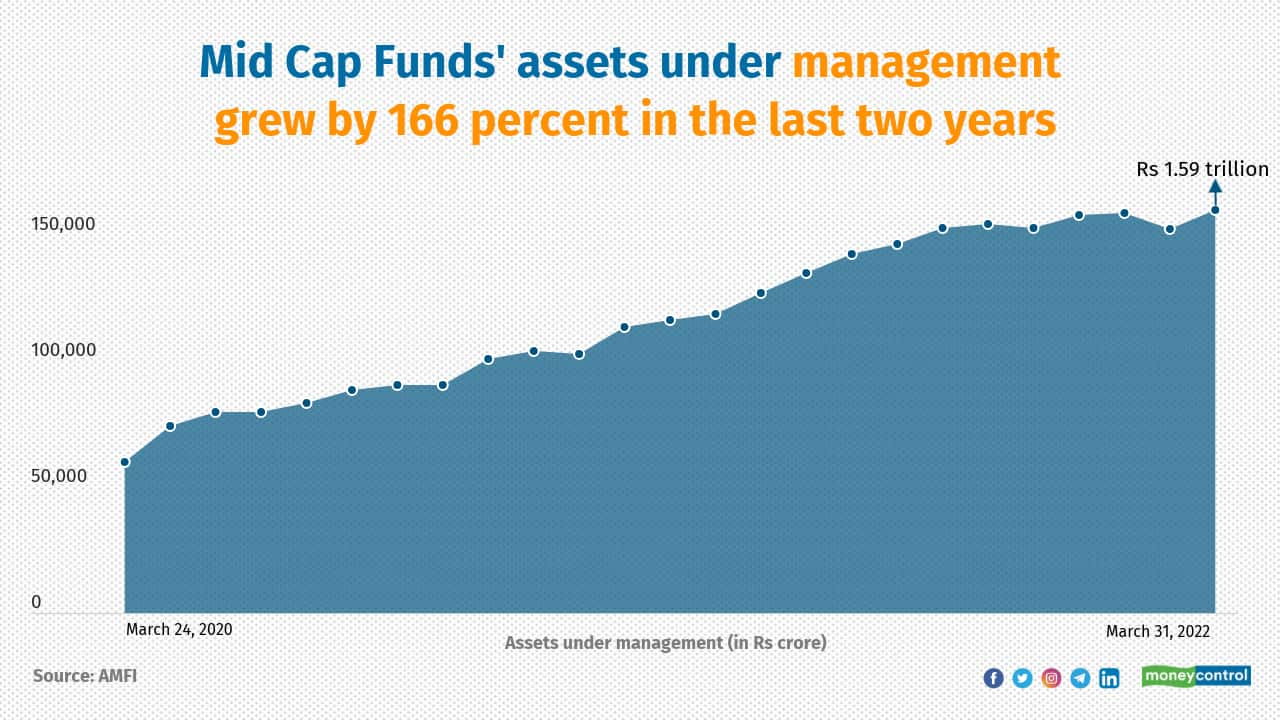

These mid cap mutual funds delivered up to 220% returns during two years of COVID-19

Mid cap schemes delivered strong returns, with few schemes outperforming the mid cap benchmark index

BUSINESS

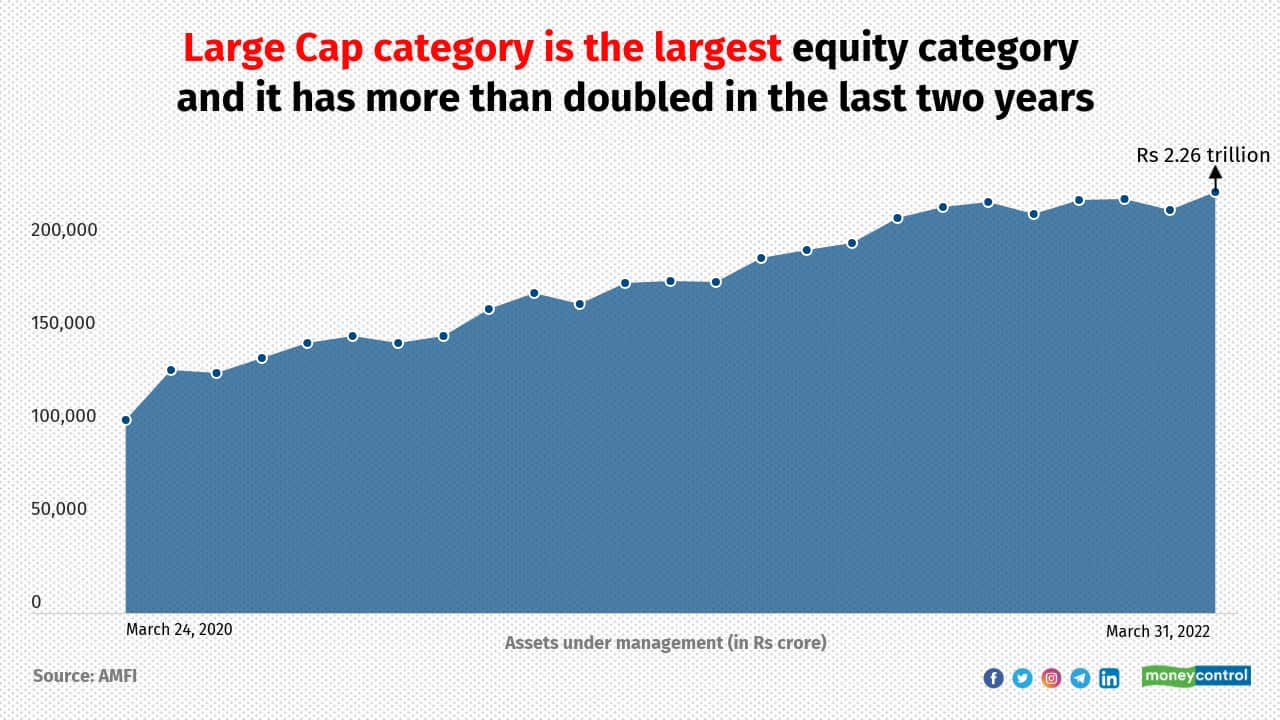

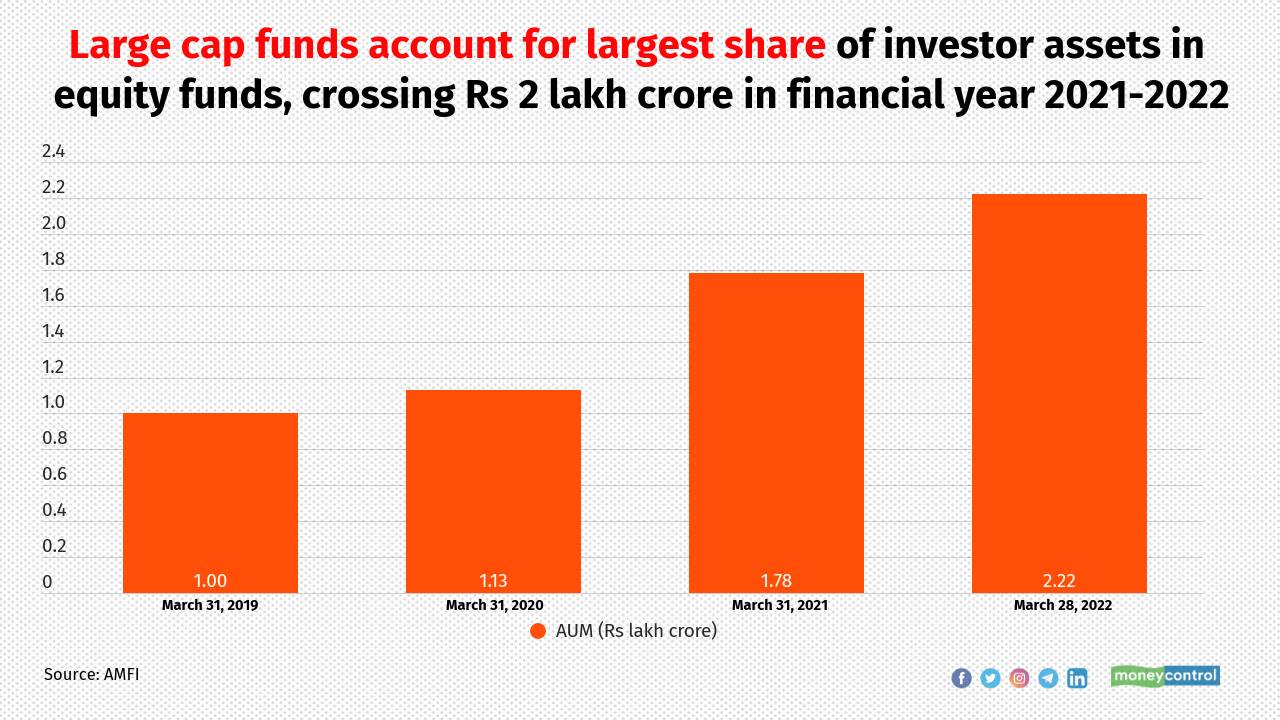

These large cap mutual funds delivered 118-126% returns during 2 years of Covid-19

Large cap funds manage Rs 2.26 lakh crore of investor assets, accounting for 16.5 percent of total assets managed by equity schemes

BUSINESS

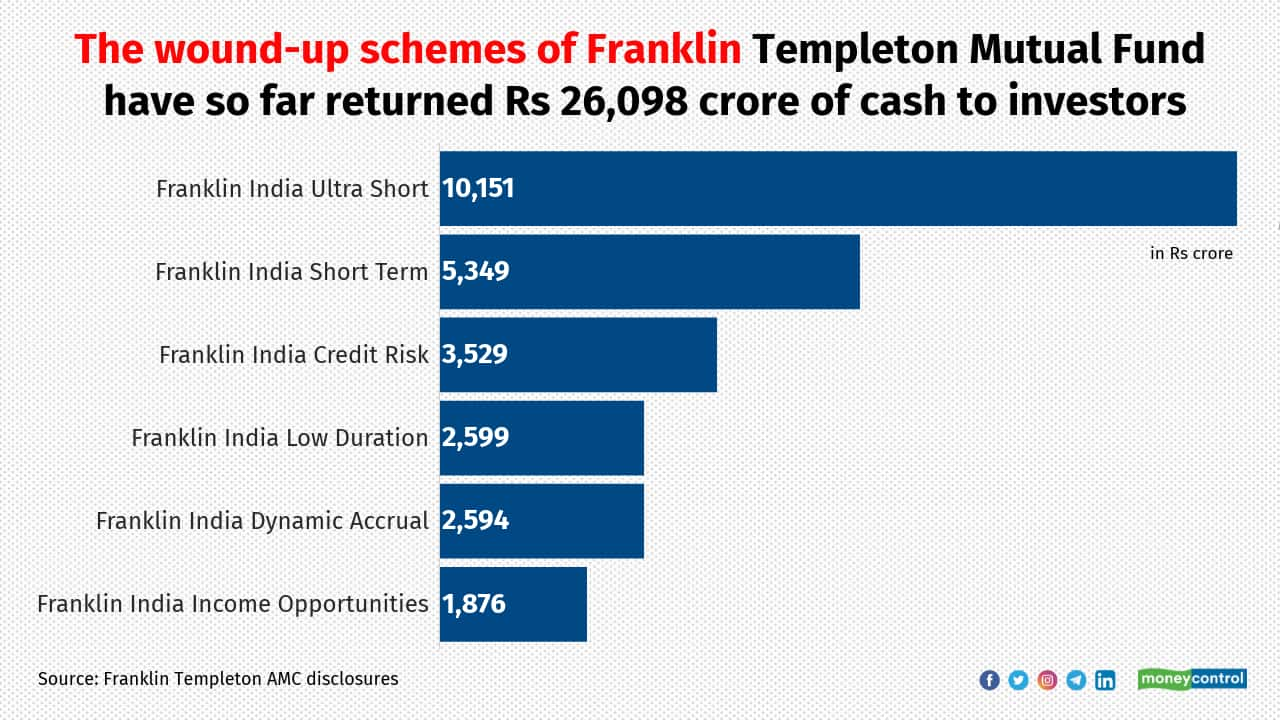

How much has Franklin Templeton Mutual Fund repaid its investors?

After two years of winding-up and eight tranches of payments, recovery from few exposures remains.

BUSINESS

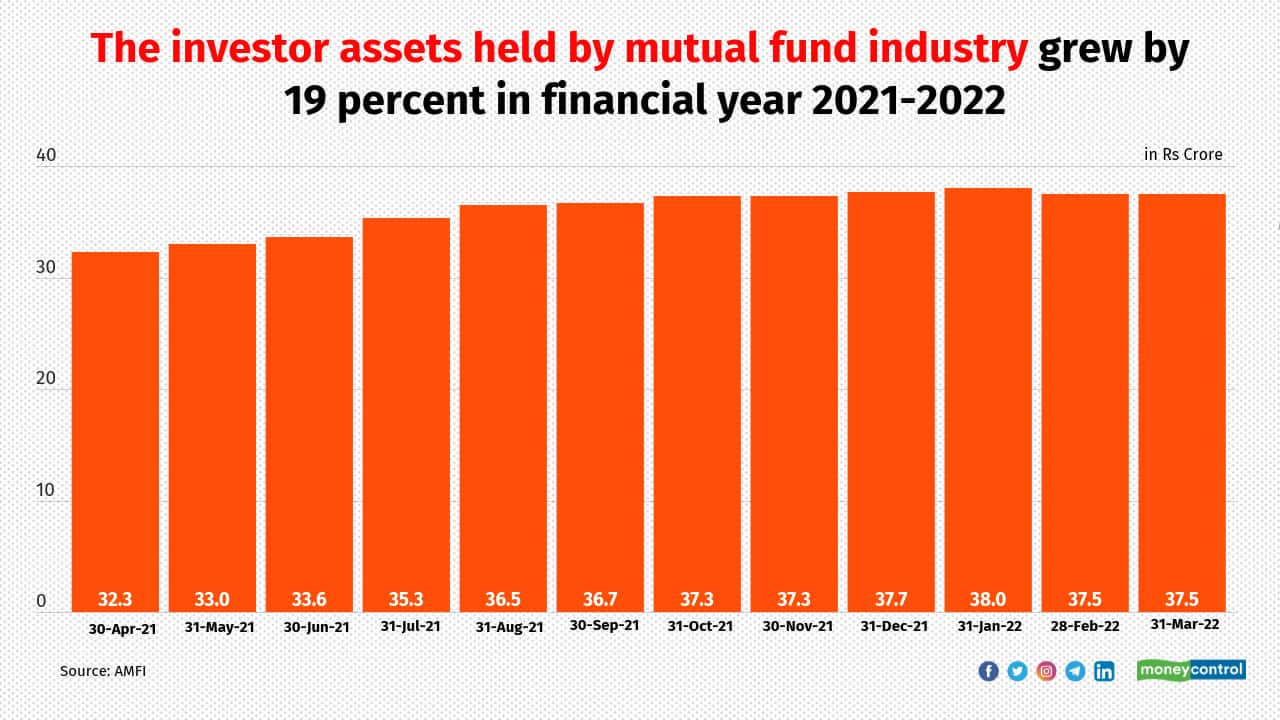

How mutual fund industry made new records in financial year 2021-22

Investor confidence returned to mutual fund industry after a tough year

BUSINESS

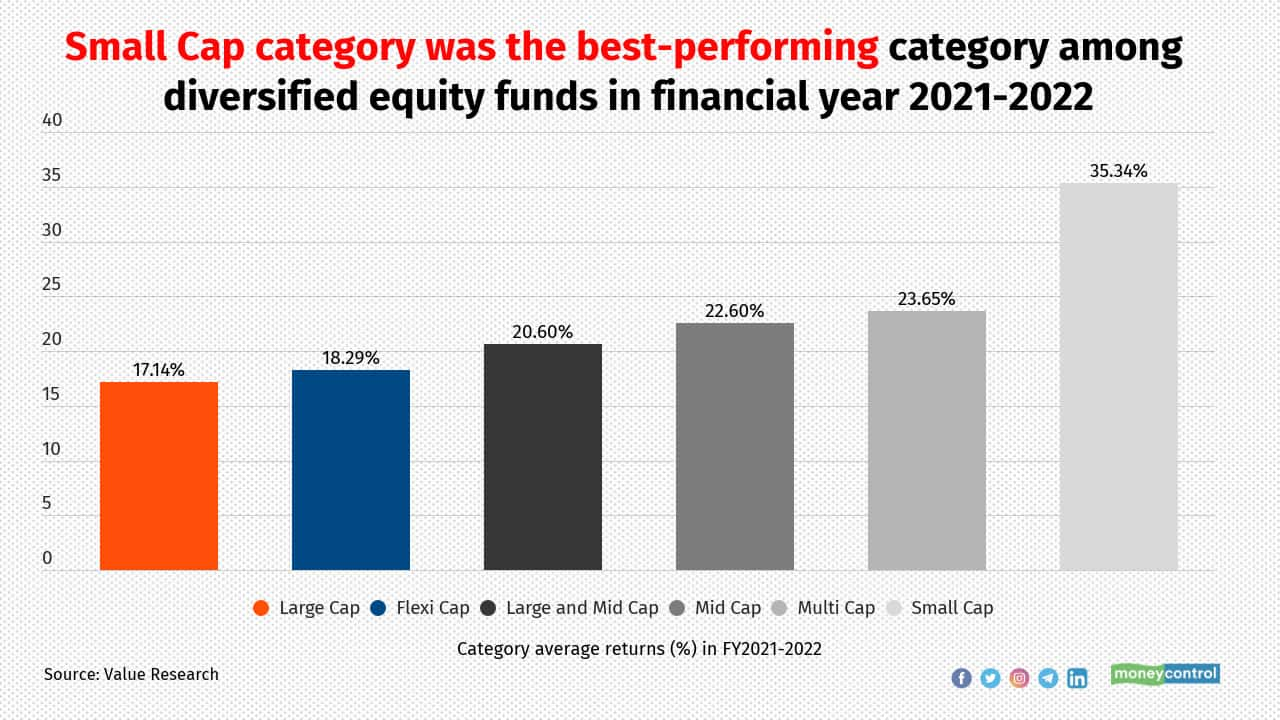

These large cap fund winners delivered up to 23% returns in FY21-22

Despite fierce competition from passive funds, some large cap mutual fund schemes outperformed markets and peers

BUSINESS

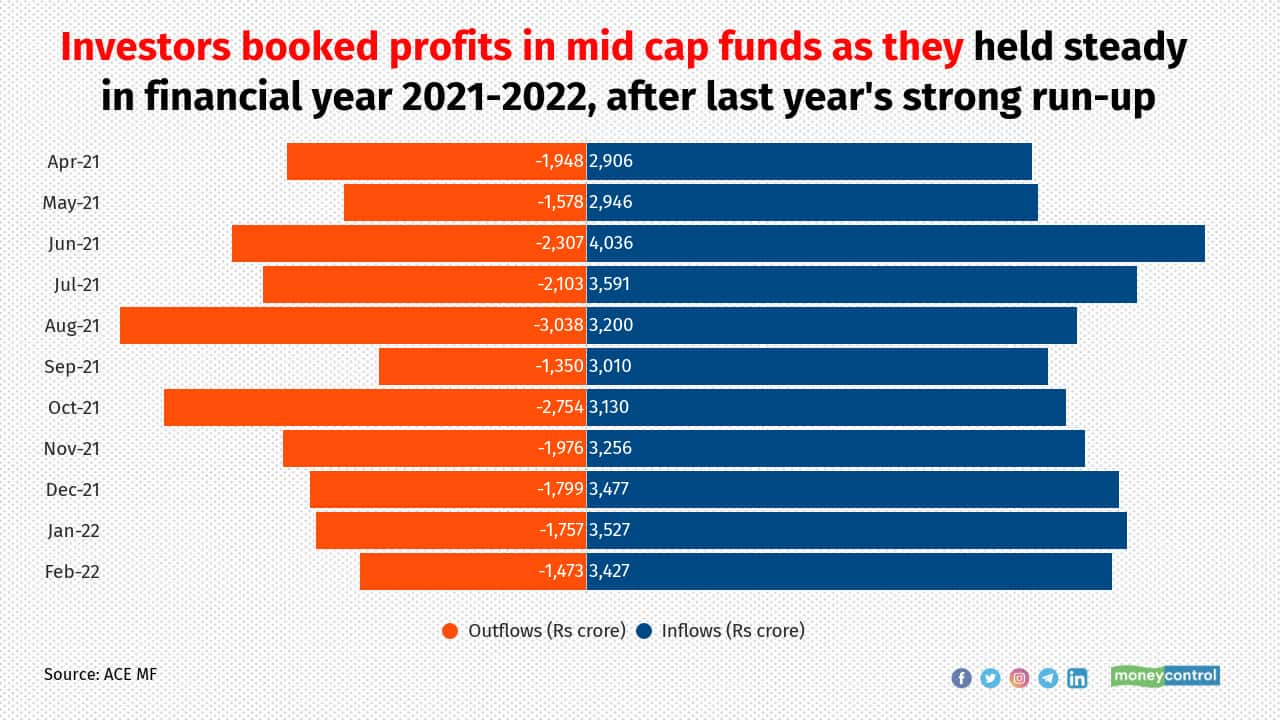

These mid cap mutual funds delivered upto 43 percent returns in FY22. Do you hold any?

In three-year period, half of the mid cap schemes have outperformed mid cap benchmark returns

BUSINESS

These small cap mutual funds delivered up to 56% returns in FY22. Take a look

In five- and three-year periods, 71-75 percent of small cap schemes have outperformed their benchmarks, but small caps can go through highly volatile periods

BUSINESS

These multicap schemes delivered upto 35% returns in financial year 2021-2022

Multicap schemes invest 25 percent each in large-cap, mid-cap and small-cap stocks, giving investors exposure to different segments of the markets

BUSINESS

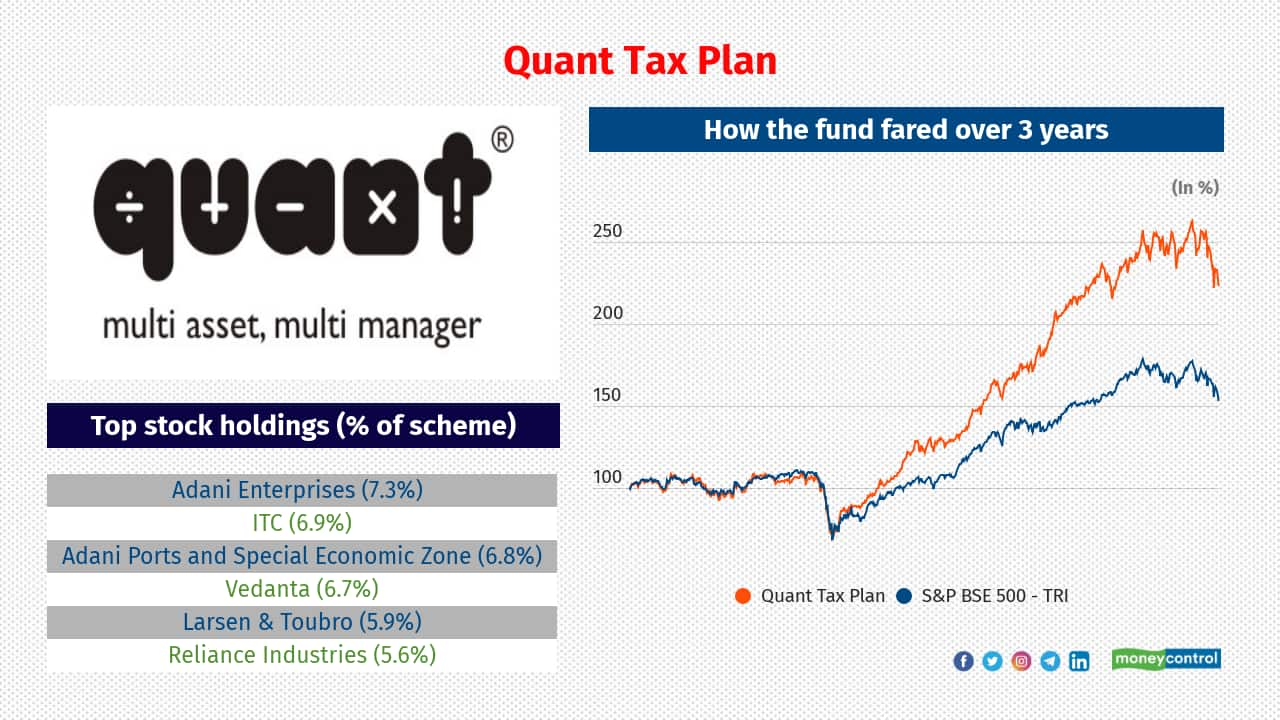

These tax-saving mutual funds have given the best returns over three years

Equity-linked savings schemes (ELSS) come with a three-year lock-in and can help investors make their last-minute tax-savings before the financial year ends

BUSINESS

Four international funds that are still open for investment

The Russia-Ukraine crisis has hammered prices of several global stocks, but most international funds are not accepting fresh investor flows due to overseas investing limits

BUSINESS

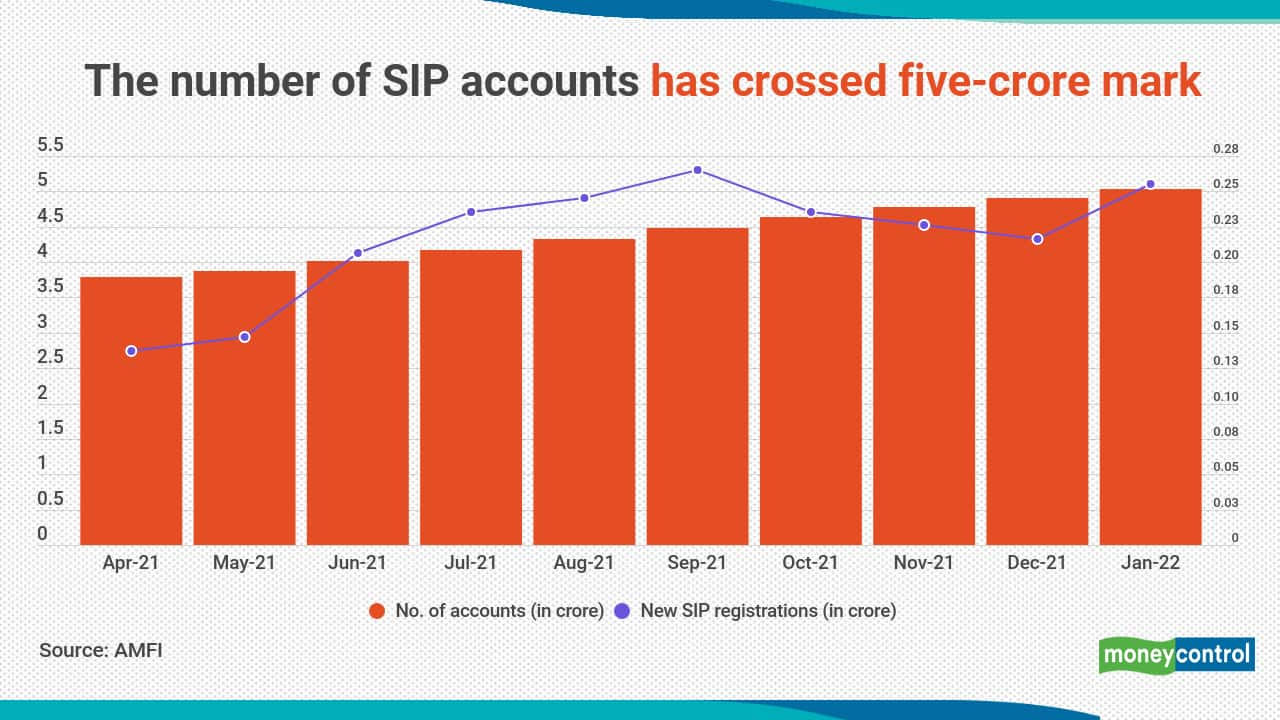

How SIPs became the most popular mode of investing in mutual funds

Investors are using SIPs to park their savings for the long term as well as short-term financial goals

BUSINESS

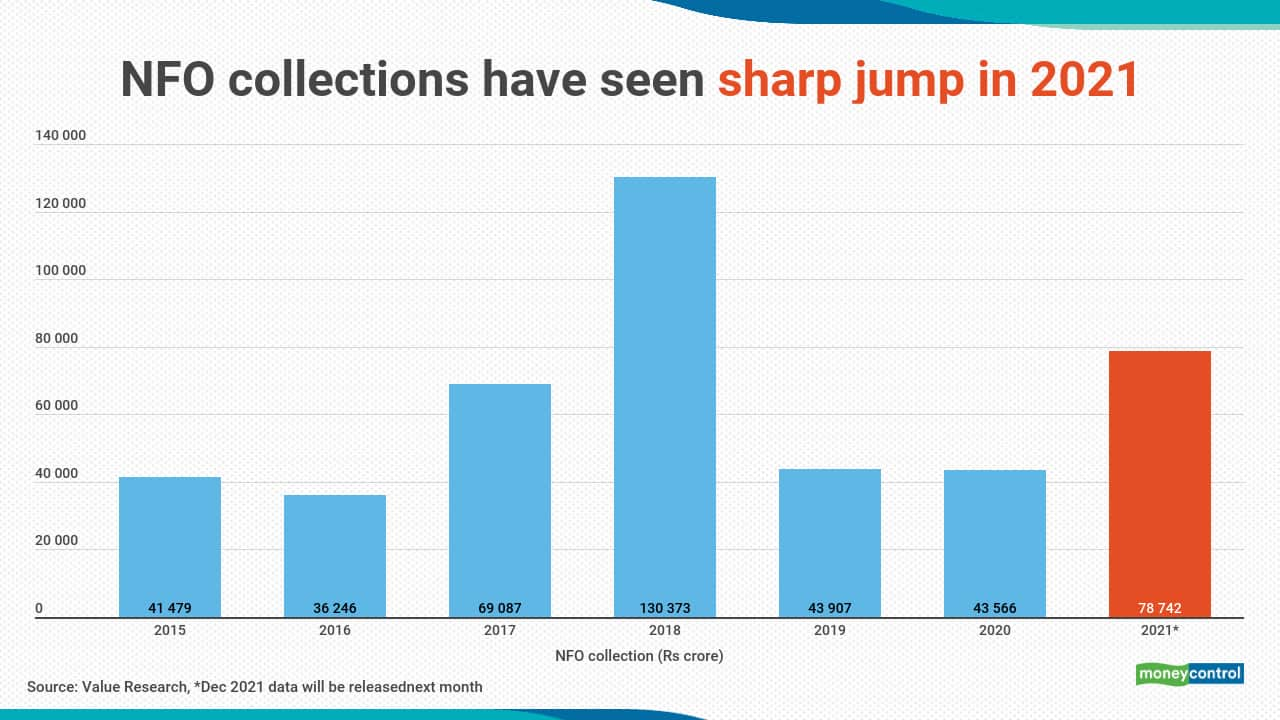

Five mutual funds that had record collections during their NFOs in 2021

Market buoyancy and in-house distribution reach helped in registering heavy inflows during new fund offers (NFOs)

BUSINESS

Ten newbies that could shake up the mutual fund industry

From Rakesh Jhunjhunwala and Nithin Kamath to Sachin Bansal...several firms backed by investment giants have applied for mutual fund licenses, and some have already got SEBI's go-ahead

BUSINESS

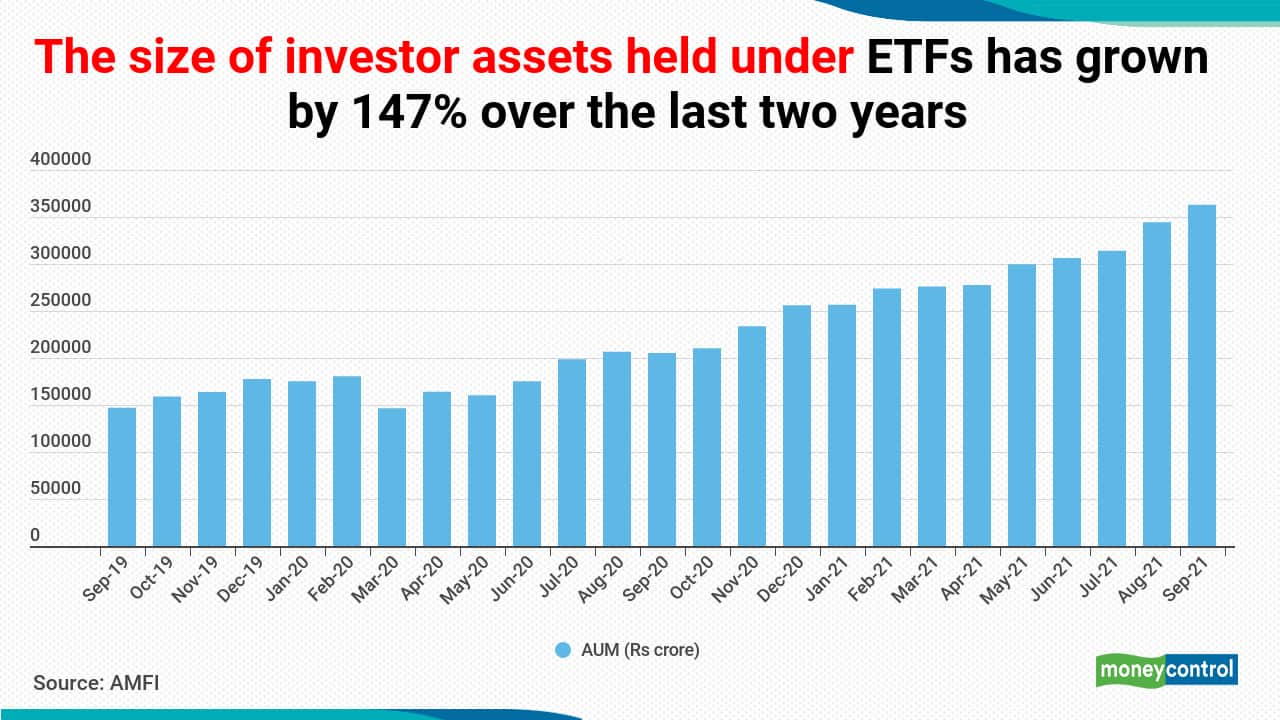

ETFs are becoming popular and gathering assets: Here's why

Exchange traded funds have Rs 3.62 lakh crore worth of assets under management