These tax-saving mutual funds have given the best returns over three years

Equity-linked savings schemes (ELSS) come with a three-year lock-in and can help investors make their last-minute tax-savings before the financial year ends

1/5

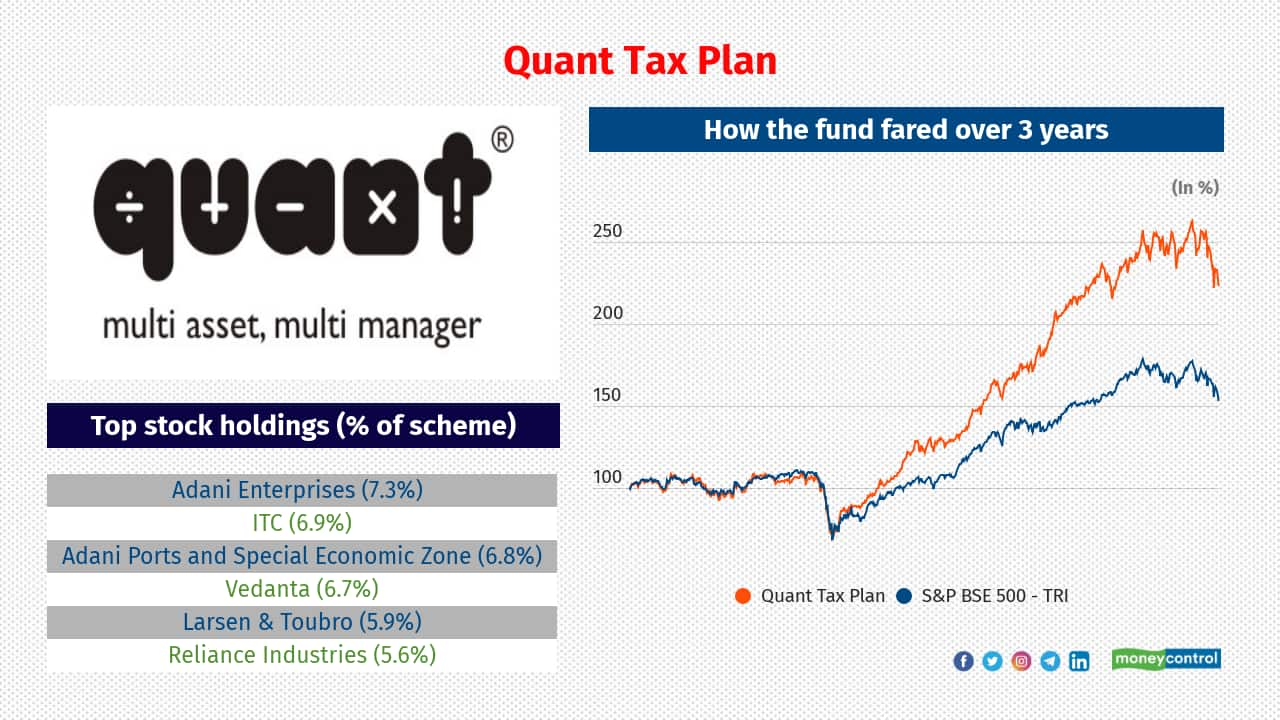

Quant Tax Plan has delivered 30 percent compound annualised returns over three years. The fund is managing investor assets worth Rs 789 crore. Quant Mutual Fund follows rule-based investment strategies across its funds.

2/5

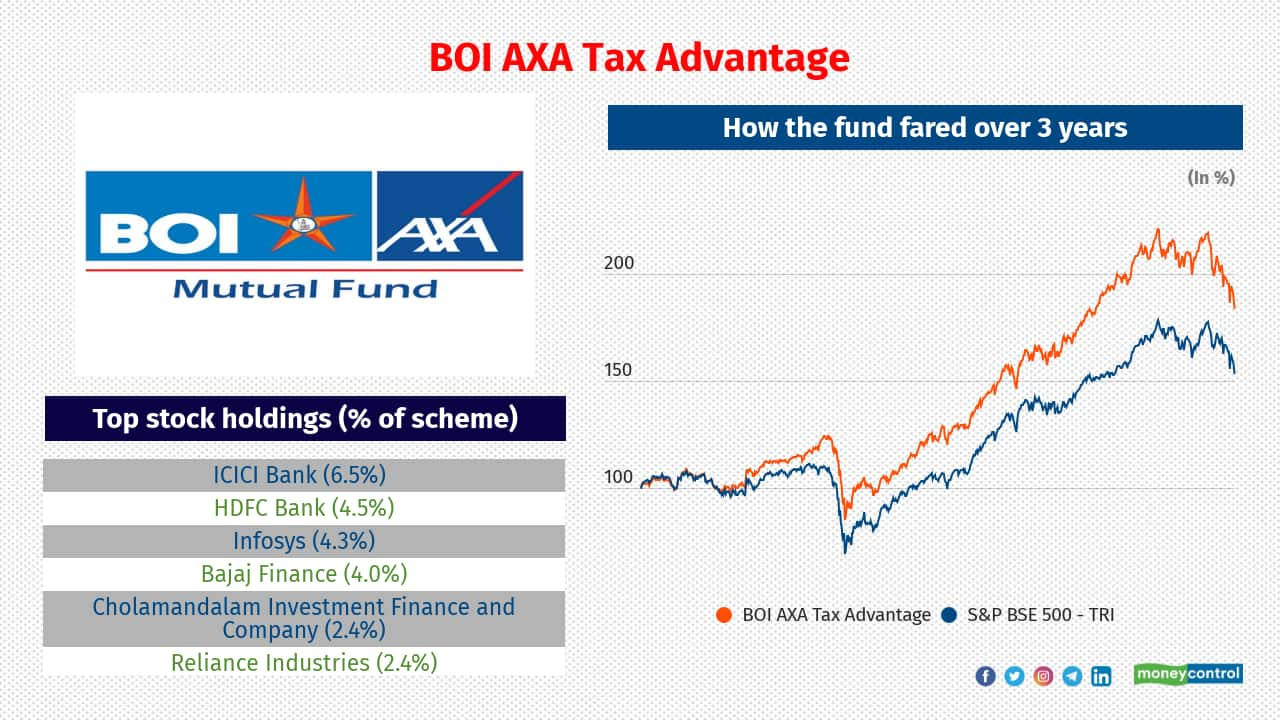

BOI AXA Tax Advantage Fund has delivered compound annualised returns of 22.4 percent over three years. It manages investor assets worth Rs 546 crore.

3/5

Canara Robeco Equity Tax Saver Fund has delivered compound annualised returns of 18.5 percent over three years. It manages investor assets worth Rs 3,209 crore.

4/5

Mirae Asset Tax Saver has delivered compound annualised returns of 18.2 percent over three years. It manages investor assets worth Rs 10,972 crore.

5/5

IDFC Tax Advantage Fund has delivered compound annualised returns of 17.5 percent over three years. It manages investor assets worth Rs 3,583 crore.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!