How SIPs became the most popular mode of investing in mutual funds

Investors are using SIPs to park their savings for the long term as well as short-term financial goals

1/5

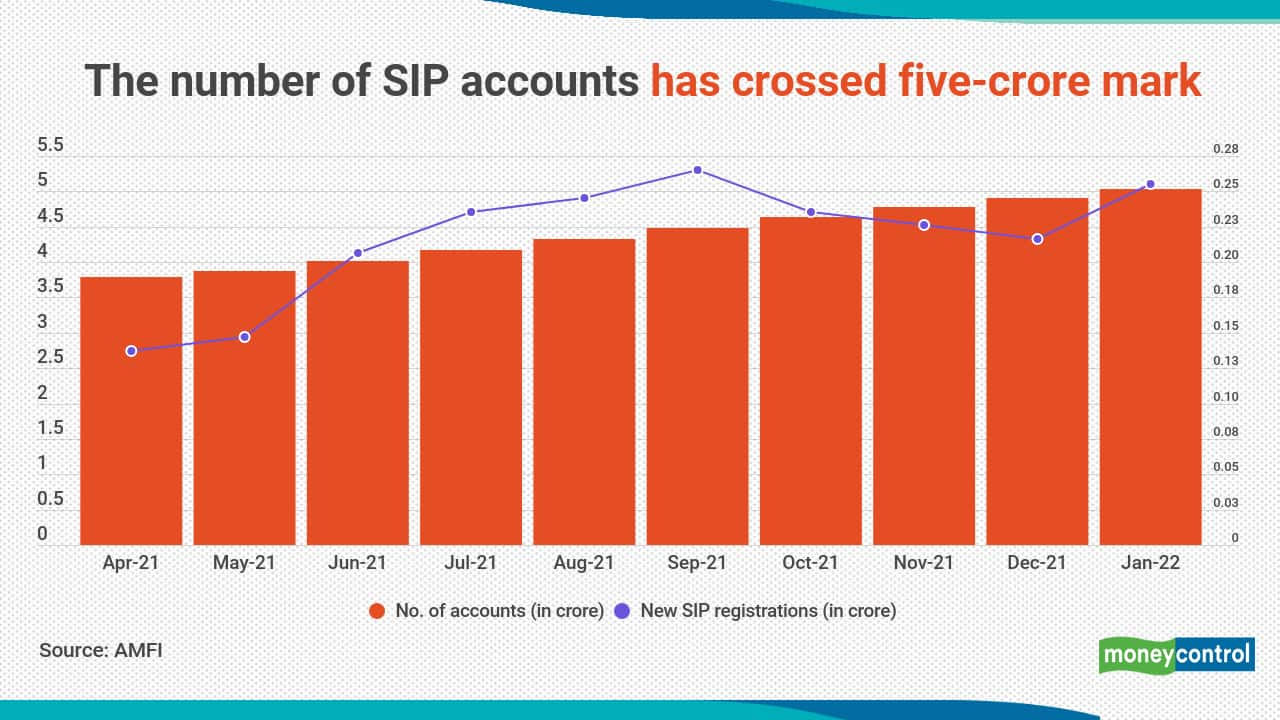

After just eight months of touching the four-crore mark, the mutual fund industry now has more than five crore SIP (systematic investment plan) accounts. Despite market volatility, 26 lakh new SIP accounts were registered in January 2022, showing the growing popularity of this investment tool.

2/5

Investors understand the importance of rupee-cost averaging via SIPs how it can be used to build a large corpus over the long term. With SIPs, investors can bring down their average cost of purchase. With SIPs, you can accumulate more units at lower market prices. So, SIPs actually benefit investors when markets are going through volatile phases. On the other hand, SIPs bring in lesser units when stock markets trade higher.

3/5

SIPs have also become popular in smaller cities. That is, these are places that are beyond the pale of the top 30 cities. In industry parlance, these are known as B30 cities. While the average SIP investment from retail investors from these cities is less than that from top-30 cities, investors from these locations understand that they can make small investments through SIPs and, over time, build a large corpus.

4/5

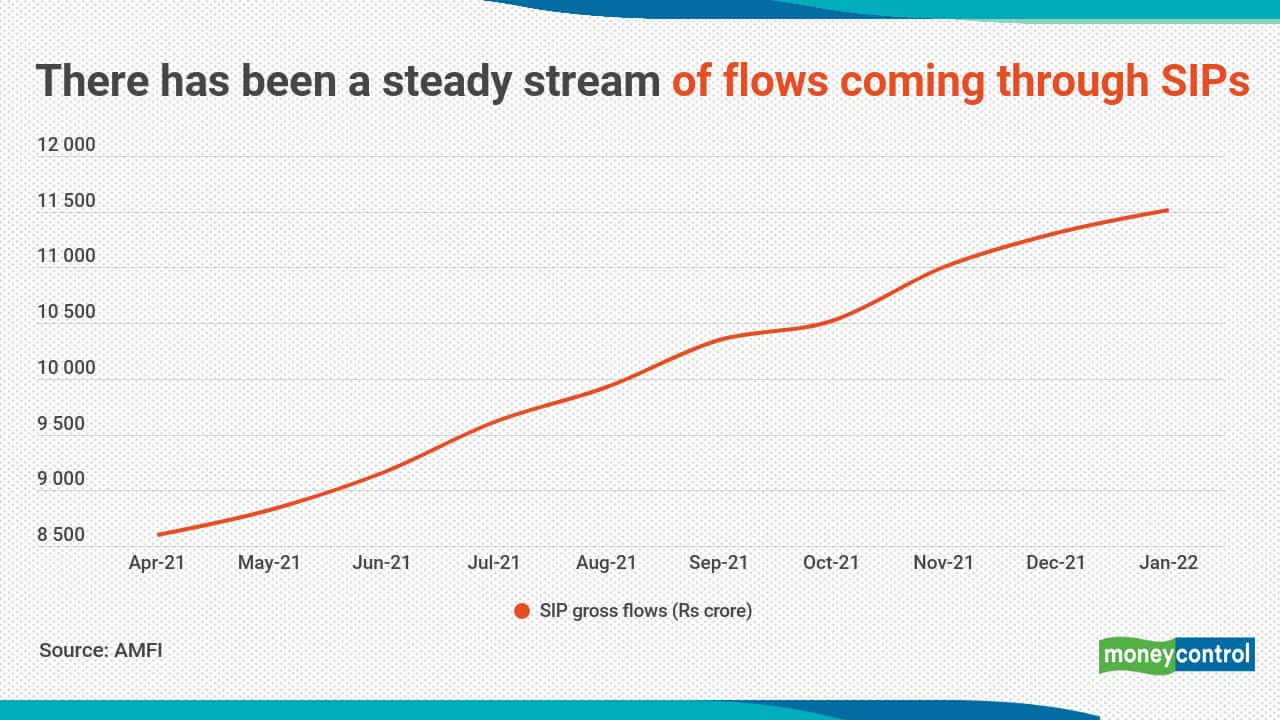

While the mutual fund industry has seen sharp fluctuations in lumpsum flows, SIP investments have been steadily growing. In January 2022, monthly SIP flows stood at Rs 11,517 crore.

5/5

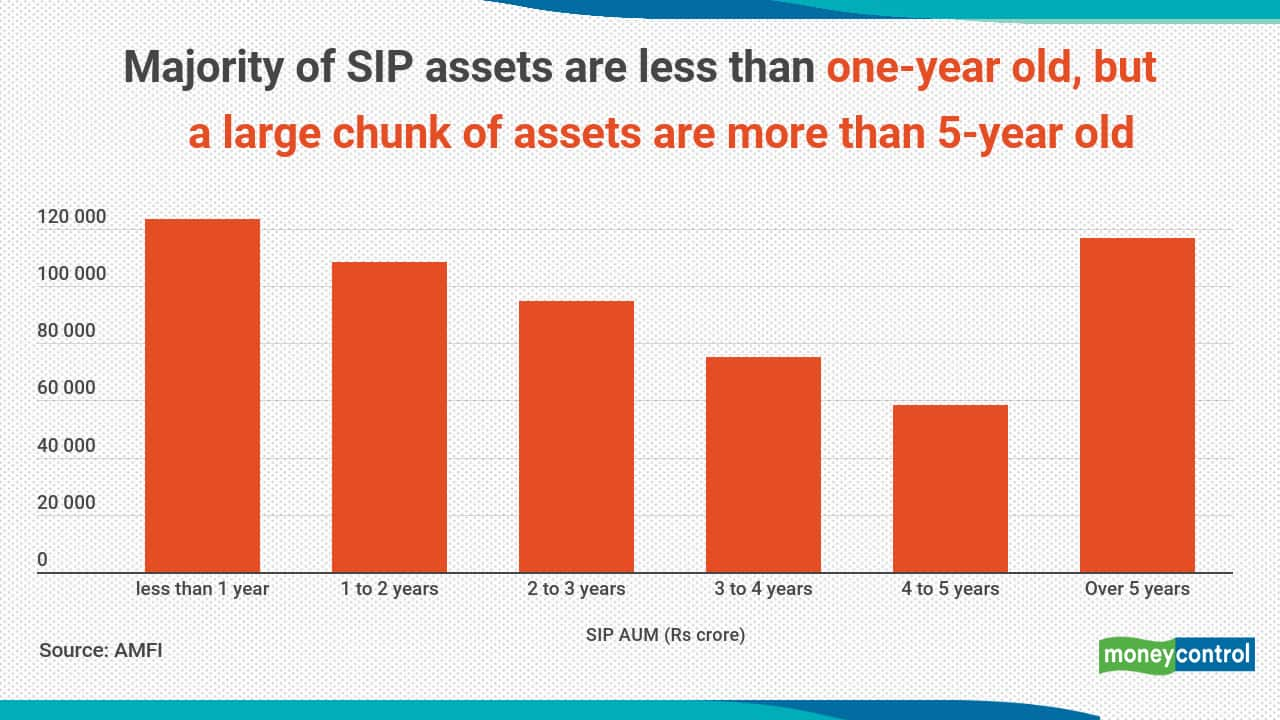

Of the Rs 38 lakh crore worth of investor assets managed by the mutual fund industry, over 15 percent or Rs 5.76 lakh crore worth of investor assets comes are accounted by SIP assets. As share of SIP assets will grow, the mutual fund industry will see more stability in investor flows.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!