These mid cap mutual funds delivered upto 43 percent returns in FY22. Do you hold any?

In three-year period, half of the mid cap schemes have outperformed mid cap benchmark returns

1/11

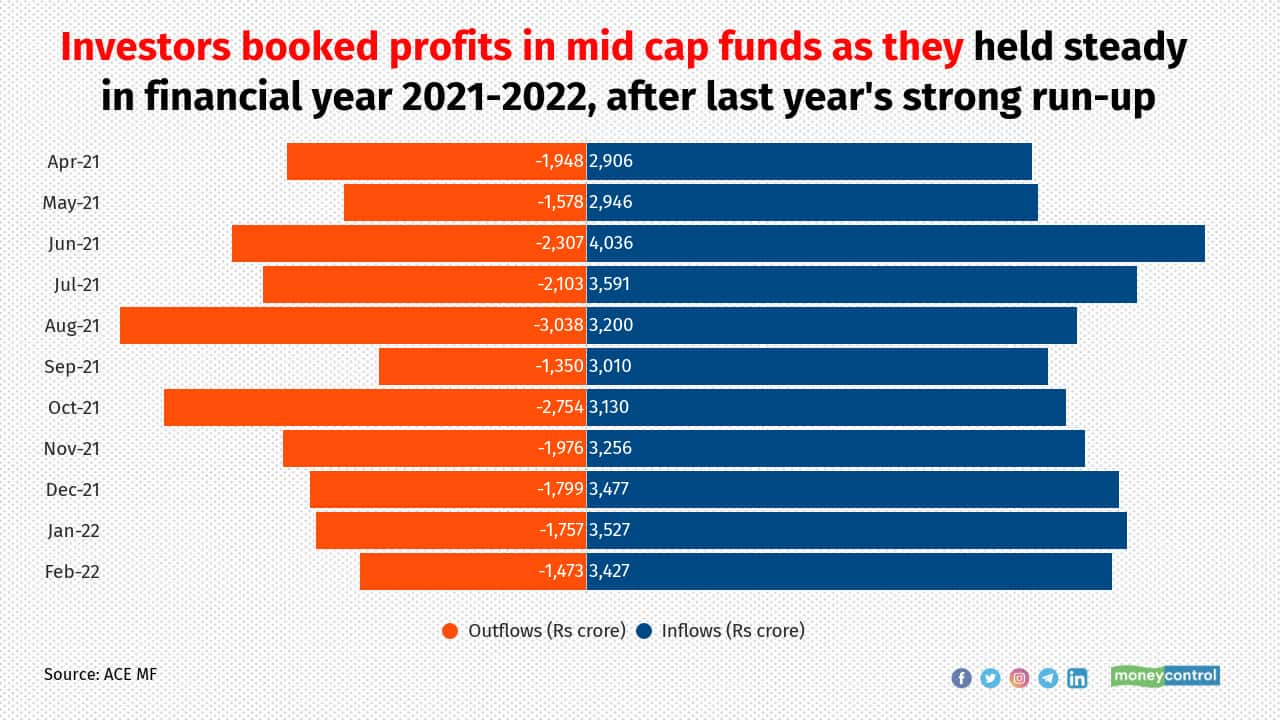

Mid cap schemes garnered more than Rs 36,000 crore worth of investor flows in financial Year 2021-2022. At the same time, as the mid cap funds remained steady after last year's strong rally, investors booked profits. The outflows from mid cap funds were to the tune of Rs 22,000 crore.

2/11

Quant Mid Cap Fund has delivered returns of 43 percent in financial year 2021-2022. The fund manages investor assets worth Rs 337 crore. Quant Mutual Fund follows rule-based investment strategies across its funds.

3/11

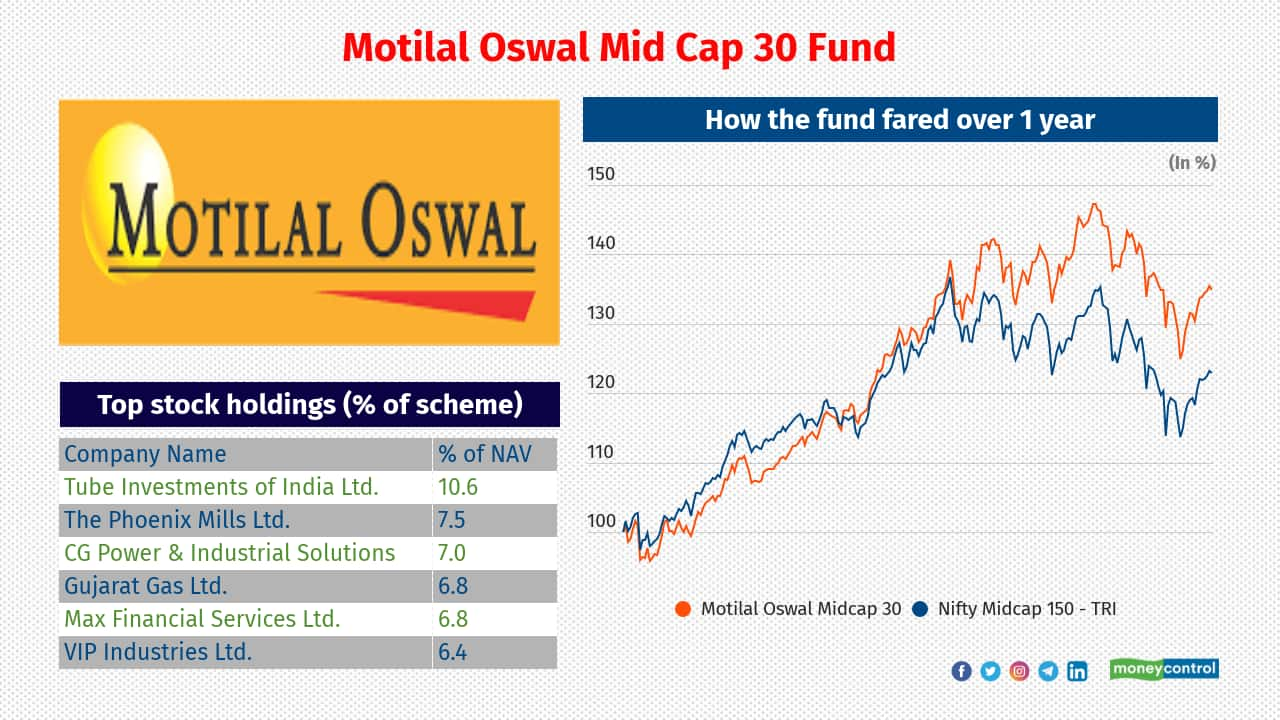

Motilal Oswal Mid Cap 30 Fund follows focused style of investing, where the fund manager takes high-conviction calls with concentrated bets. The fund will not invest in more than 30 stocks at any given point of time. In financial year 2021-2022, the fund delivered 34.9 percent returns.

4/11

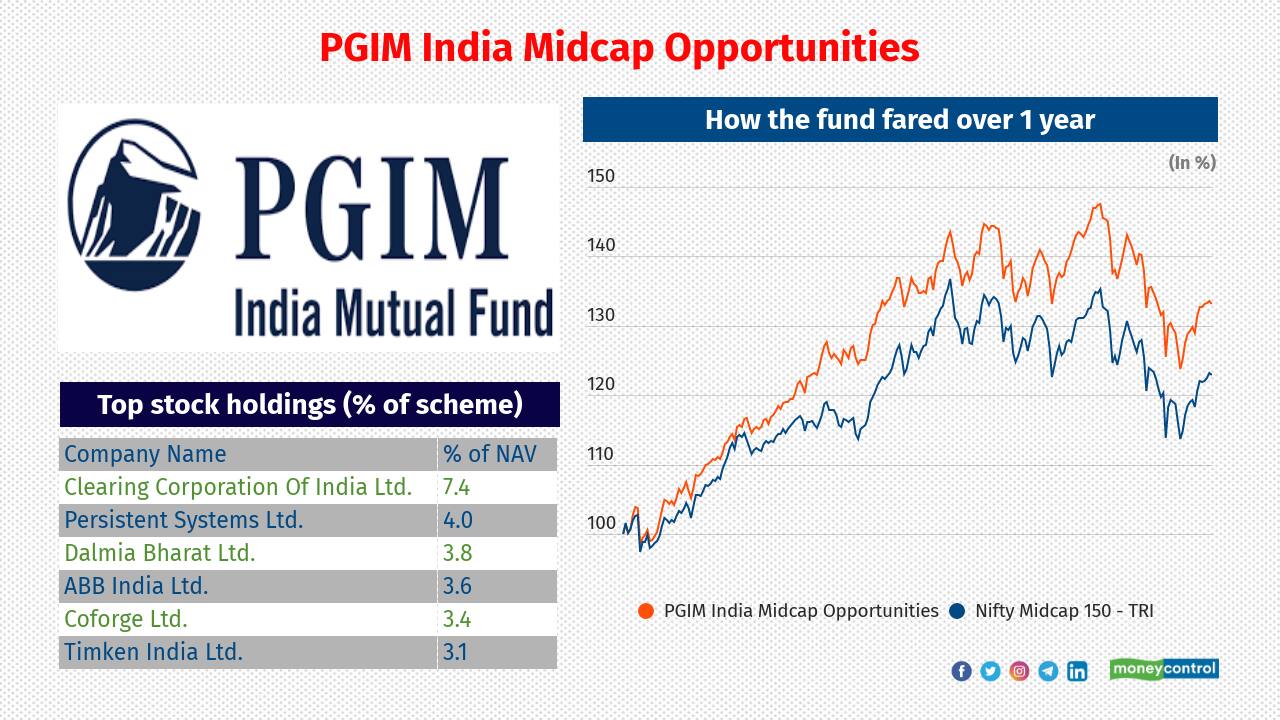

PGIM India Midcap Opportunities delivered returns of 33 percent in financial year 2021-2022. The fund manages investor assets worth Rs 4,766 crore.

5/11

Aditya Birla Sun Life Midcap Fund manages investor assets worth Rs 3,362 crore. It delivered returns of 29.5 percent in financial year 2021-2022.

6/11

Nippon India Growth Fund is managed by Manish Gunwani, who is the chief investment officer-equities at Nippon India Mutual Fund. The Rs 11,800 crore-sized fund has delivered 27.6 percent returns in financial year 2021-2022.

7/11

Mirae Mutual Fund had a rough start in India back in 2008. But, the fully foreign-owned fund house has come a long way on the back of strong performance of its equity schemes. Mirae Asset Midcap Fund has delivered returns of 25.6 percent in financial year 2021-2022.

8/11

Mahindra Manulife Mutual Fund aims to use the wide presence of Mahindra & Mahindra Financial Services in smaller towns, to make inroads in beyond the top-30 cities (B-30). In financial year 2021-2022, the fund house's mid cap fund delivered returns of 25.4 percent.

9/11

Union Midcap Fund delivered returns of 24.7 percent in financial year 2021-2022.

10/11

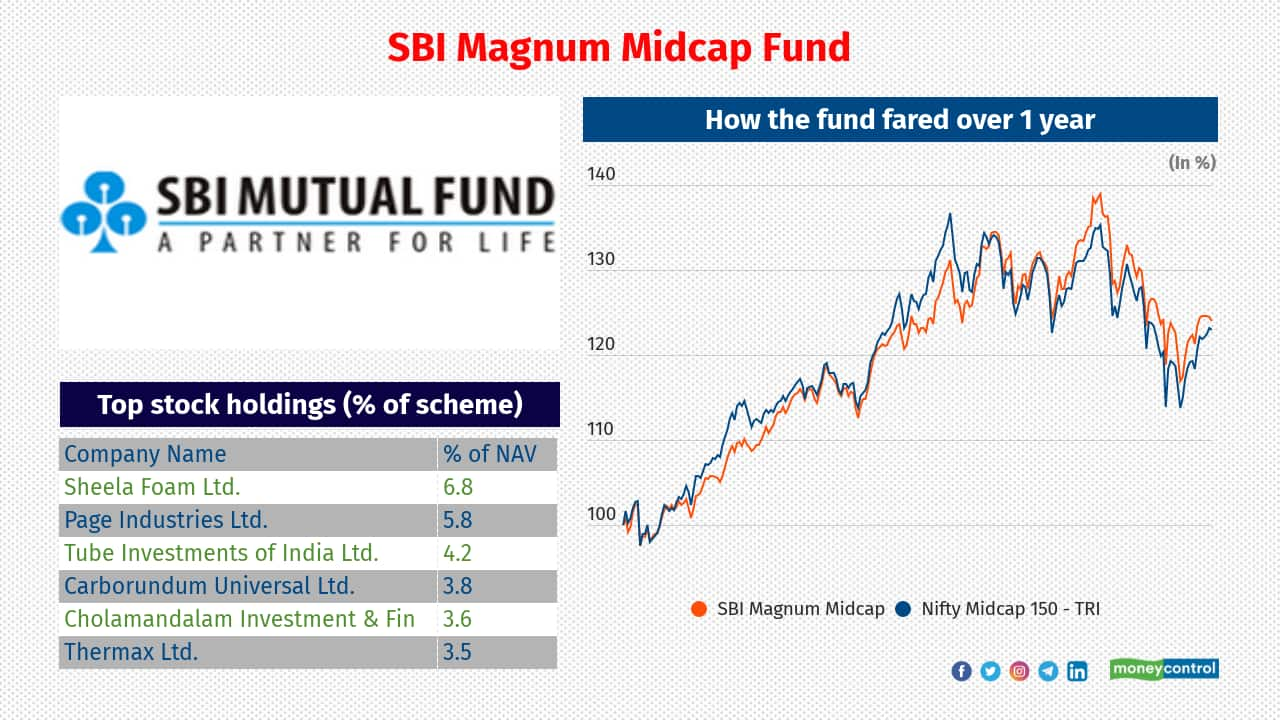

SBI Magnum Midcap Fund, which manages investor assets worth Rs 6,677 crore, delivered returns of 23.9 percent in financial year 2021-2022. SBI Mutual Fund is the country's largest asset manager with AUM of Rs 6.27 lakh crore.

11/11

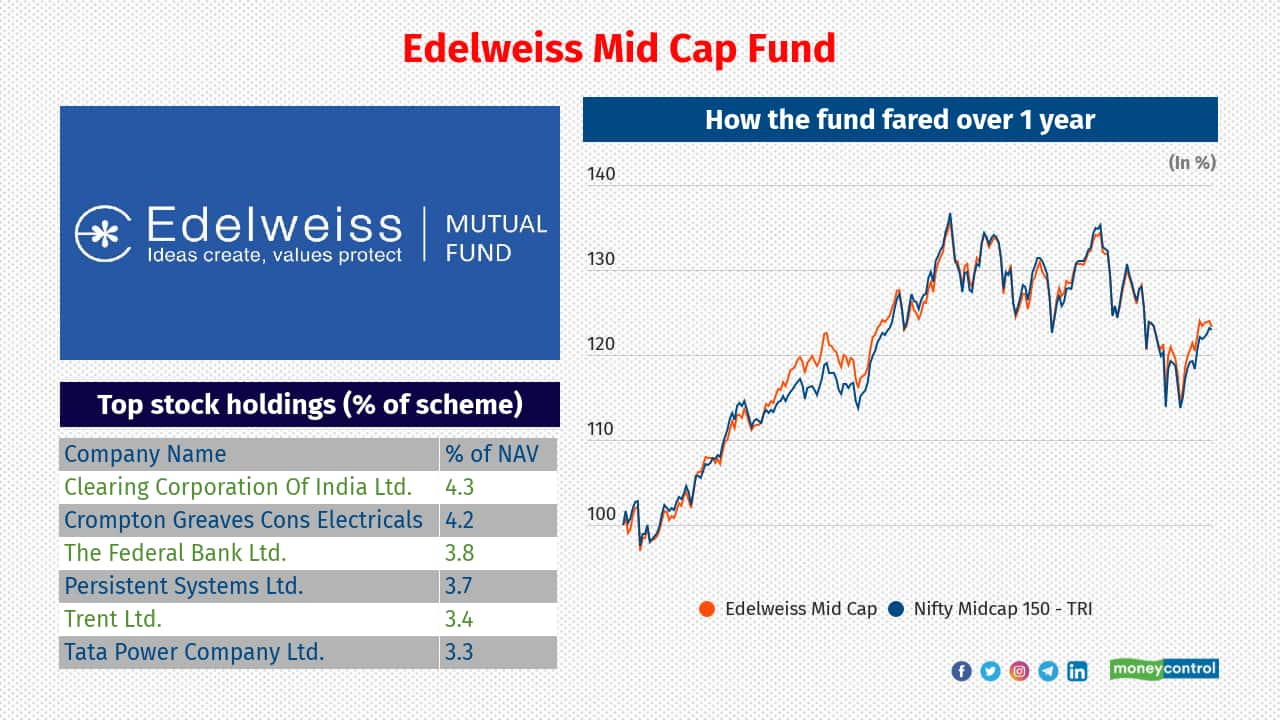

Edelweiss Mid Cap Fund manages investor assets to the tune of Rs 1,880 crore. The fund delivered returns of 23.3 percent in financial year 2021-2022.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!