BUSINESS

HDFC AMC seeks growth at reasonable price with AIF entry

The company told analysts in a recent call that it has filed an application with Sebi to start a Category III AIF.

BUSINESS

Nifty, Sensex set to fall as Ukraine-Russia tensions intensify

MOEX Russia Index, the benchmark for the country’s stock market, plummeted over 10 percent in the worst rout for stocks since the Global Financial Crisis while the Russian rouble sank more than 2 percent as investors feared further economic distress if US imposed sanctions

BUSINESS

Sensex gyrates nearly 1,000 points as Russia-Ukraine standoff unnerves investors

With investors unwilling to risk, most chose to cut back on adding positions leading the Nifty 50 and BSE-Sensex to close 0.4 percent and 0.3 percent lower.

BUSINESS

India’s new policy step could make it 'Middle East of green hydrogen'

The announcement of the green hydrogen policy is in line with the country's efforts to transition itself away from fossil fuels as it looks to meet the commitment of being a net-zero carbon-emitting economy by 2070.

BUSINESS

Coal India rises about 3% as profit recovery seen gathering steam in March quarter

“We expect profitability to recover further in March quarter,” Motilal Oswal said. The brokerage firm has retained its ‘buy’ call on the stock and raised the estimate for adjusted operating profit by 15 percent for 2022-23.

BUSINESS

RIL, L&T and others rise on new green hydrogen policy

Analysts believe that the impetus given towards the use of renewable energy for the production of hydrogen to be used as an energy source should be beneficial for power companies like NTPC, ReNew Power, and power infrastructure companies like Thermax and Larsen & Toubro

BUSINESS

Jeremy Grantham’s GMO revs up bullish bets on ICICI Bank, Infosys

GMO added 308,300 American Depository Receipts of ICICI Bank to take its holding to 334,900 ADRs in the December quarter

BUSINESS

ICICI Value Discovery Fund uses ONGC’s sharp January rally to book profits

Shares of the oil producer rallied around 21 percent last month on the back of a 15 percent surge in global crude oil prices during the period to a seven-year high aided by rising geopolitical tensions in Eastern Europe and increasing global demand

BUSINESS

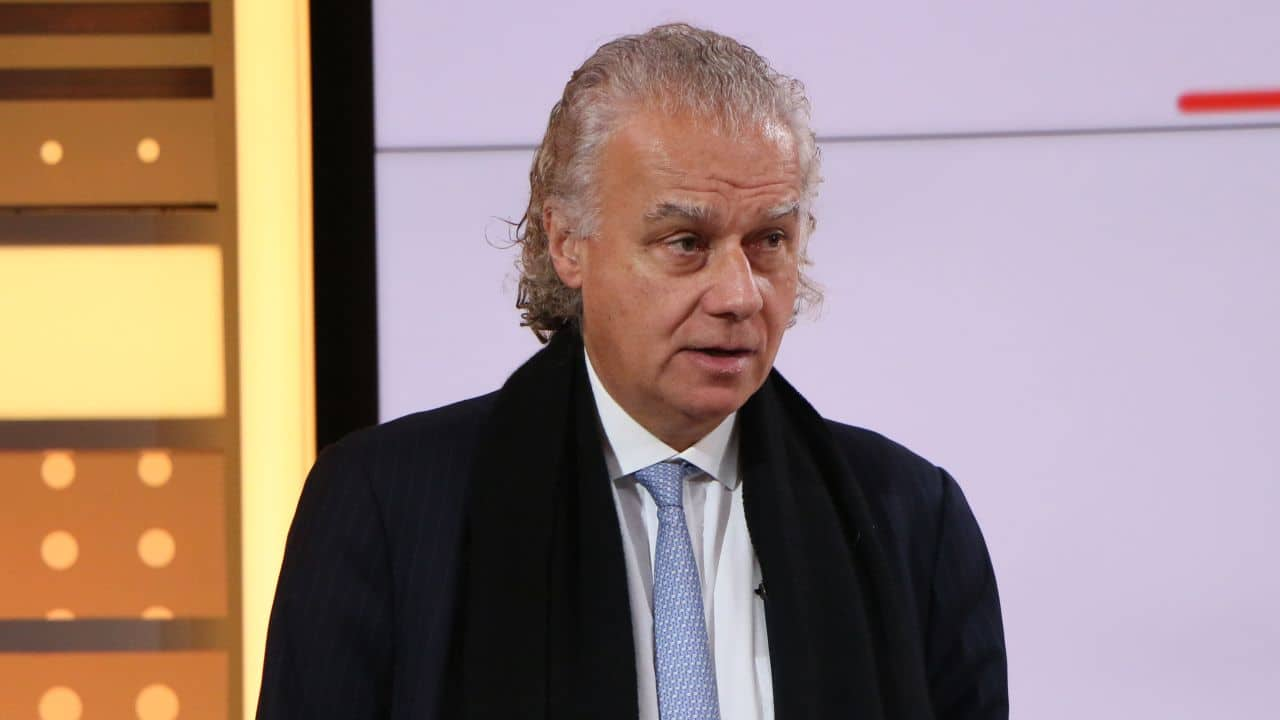

Flat returns in near term is the best investors can hope for, says Sanjeev Prasad of Kotak Equities

The risk-reward for investors has deteriorated in the face of rising bond yields and growing concerns on the macro-economic front led by a surge in crude prices, says Kotak Institutional Equities

BUSINESS

LIC IPO may come at discount to listed peers, says UBS Securities

LIC on February 13 filed its much-awaited draft red herring prospectus with the Securities and Exchange Board of India. As part of the IPO, the government is looking to sell around 5 percent stake in the life insurance giant.

BUSINESS

Manic Monday evaporates $4 billion of industrialist Gautam Adani’s wealth

The benchmark indices themselves sank over 3 percent with midcap and smallcap indices falling more than 4 percent in one of the worst single-day crashes on Dalal Street since the beginning of the pandemic

BUSINESS

LIC IPO | Life insurer’s rising appetite for passive investment products

LIC IPO | The insurer has invested Rs 12,221 crore in ETFs in the first six months of this financial year, higher than the Rs 10,062 crore in all of 2020-21, DRHP shows

BUSINESS

Coal India Q3 preview | Consolidated PAT seen rising 31% YoY on higher realisations

Coal India’s consolidated revenues are likely to rise by 16.3 percent on a year-on-year basis to Rs 27,552 crore.

BUSINESS

LIC books profit of over Rs 29,000 crore from sale of investments

LIC filed its draft red herring prospectus with the Securities and Exchange Board of India on February 13.

BUSINESS

LIC IPO | The stock investor's guide to navigate the DRHP

BUSINESS

Tata Group stocks’ market value nearly triples under Chandrasekaran’s reign

The total market capitalisation of the listed entities of the group has risen by 199 percent in the five-year period starting February 2017 to Rs 23.8 lakh crore, making it the highest valued Indian conglomerate, data from AceEquity showed

BUSINESS

LIC IPO | LIC may become biggest stock in equity market, says Chris Wood

LIC is expected to bring its public issue at a valuation of around Rs 12 lakh crore to Rs 15 lakh crore, which would help the government raise enough funds to meet its Rs 78,000-crore divestment target for 2021-22

MARKETS

Solara Active sinks 31% in 2 days on weak Q3, CEO exit

The stock has now lost nearly two-thirds of its value from its 52-week high hit in May last year. The fall comes after the stock rose more than 300 percent between April 2020 and May 2021.

MARKETS

Quess Corp shrugs off CEO’s exit to focus on strong Q3 earnings

Quess Corp on February 10 announced that the board has accepted the resignation of Moraje just two years after his appointment at the company

BUSINESS

RBI’s dovishness delights stock market but risks lurk

Money managers say the delay by the central bank in withdrawing support for an economy showing robust growth may force it to take action too aggressively later

BUSINESS

Hindalco Q3 preview | PAT to zoom 487% YoY on high aluminium prices

Hindalco has benefitted from the rally in global aluminium prices over the past 12 months aided by a rise in demand after the re-opening of the global economy and tighter supply conditions

BUSINESS

Nykaa sinks on weak Q3 but Goldman Sachs, Morgan Stanley remain optimistic

Nykaa’s consolidated net profit for the December quarter was down 59.5 percent on-year to Rs 27.9 crore, however, consolidated revenue jumped 36 percent to Rs 1,098 crore

BUSINESS

Gujarat Gas share prices falls sharply as analysts cut earnings outlook after weak Q3

Gujarat Gas reported a 69 percent year-on-year decline in net profit to Rs 121.9 crore for the quarter ended December due to a sharp increase in raw material prices

BUSINESS

The retail punter is dead, long live the retail punter

Retail investors have drastically reduced their participation in the cash market as regulator Sebi introduced norms to curb their enthusiasm and reduce their risks. However, the investors are now embracing an even riskier product — equity options