Madhuchanda DeyMoneycontrol Research

The three private sector banks that have reported quarterly numbers so far this earnings season didn’t fail to impress with their headline numbers. For Yes Bank, the asset quality issue stole the thunder but what captured our attention at the trio – HDFC Bank, IndusInd and Yes -- was the performance on business growth. In FY17 while deposits and credit growth in the system stood at 11.8 percent and 5.1 percent, respectively, the savvy private sector entities outperformed the system by a wide margin.

Our curiosity led us to analyse slightly long-term data to figure out how much the balance of power has shifted in favour of private banks and what it means for the future of a large number of public banks.

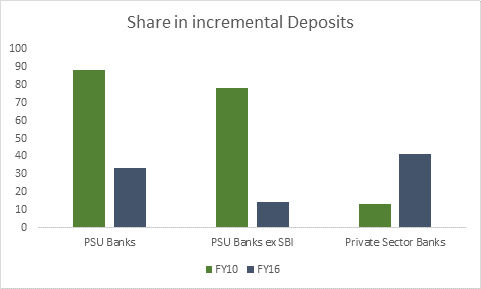

Public sector banks with their wide network of branches, supplemented by their ATM network, were long considered the backbone of the deposit-garnering exercise in the economy. However, the data doesn’t seem to corroborate this notion any more. In FY10, the share of PSU (public sector) banks in incremental deposits was 88 percent, which plummeted to 33 percent in FY16. However, market leader State Bank of India improved its market share in incremental deposits from 9.7 percent to 19 percent over this period. The space vacated by PSU banks was seamlessly filled up by the private sector counterparts.

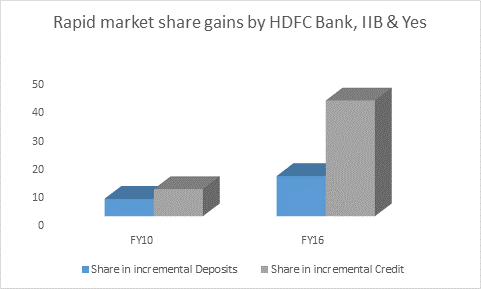

The share of private sector banks in incremental deposits that stood at 13 percent in FY10, improved to 41 percent in FY16. Even within the private sector entities, the smarter boys appear to be gaining market share disproportionately. For instance, the trio of HDFC Bank, IndusInd Bank and Yes Bank (the three entities that have declared their earnings so far) has improved its share in incremental deposits from 6.2 percent in FY10 to 14.2 percent in FY17.

The scenario on the credit side of the business appears to suggest that the majority of the public sector banks are fast losing their relevance in India’s lending business. In FY10, the share of the 24 listed PSU banks in India’s incremental credit growth was 90 percent. The same was down to 15 percent in FY16. The NPL problem, therefore, has broken the backbone of PSU banks much more than what meets the eye. SBI, however, has bucked the trend – improving its market share in incremental credit from 18.8 percent to 23.4 percent. If we adjust for the gains of SBI, the other PSU banks have actually fallen from 71 percent to minus 8 percent between FY10 to FY16.

Private sector banks have made rapid strides – the share of the 16 private sector banks in incremental credit was a miniscule 11 percent in FY10. The same reached 48 percent in FY16. The asset quality issues of banking space in general and corporate lenders in particular have led to unexpected market share gains for the entities who have steered clear of this problem so far.

The trio of HDFC Bank, Yes and IndusInd has improved market share in incremental credit from 9 percent in FY10 to 39 percent in FY17. Even while credit growth was languishing in FY17, the trio improved their share in incremental credit from 20 percent to 39 percent. Since the savvy banks boast of superior credit quality as well, higher-risk borrowers must be finding the doors of banks closed to them.

While in terms of credit, the market has been swept by private sector banks, going by the trend the same is likely to happen with deposits as well. Private banks, nevertheless, have expanded judiciously without adding to bad assets in any meaningful manner. In the total reported Gross NPL of the system, the share of PSU banks is 91 percent, provision coverage ratio (how much of the gross NPL have been provided for) stands at a compromised 40 percent and the share of net NPL to net worth is 61 percent. For the private sector counterparts, the ratio of net NPL to net worth stands at a comfortable 8.6 percent.

The non-SBI PSU pack contributes to 81 percent of the NPL. For this group the ratio of net NPL to net worth is 70 percent. While this ratio doesn’t include overall stressed assets (which is much higher), it goes on to show that for every Rs 100 capital, un-provided bad assets is Rs 70.

However, with most of these entities fast losing relevance in business – both on the credit as well as on the deposit side, it will be an uphill task for the government to do a blanket bailout without irking the taxpayers.

Finally, for most investors who often get intimidated with the premium valuation of some of the private sector banks, there should be no reason for complaint – the tide has decisively turned in their favour.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.