If you were born when India’s fight for independence ended, then there are a host of taxation benefits that you would be eligible to claim now that you too are 75 years old.

From not being mandated to pay advance tax, to availing a higher tax deduction for health insurance, many income tax benefits are allowed for the septuagenarians. Certain other benefits are extended to those above 80 years of age or super senior citizens.

Also read: Those over the age of 75 years need not file tax returns, but conditions apply

But due to the conditions placed or the tax benefit itself, hardly any are availed by 75-year olds. Let us look at some of the taxation benefits.

Exempt from filing tax return

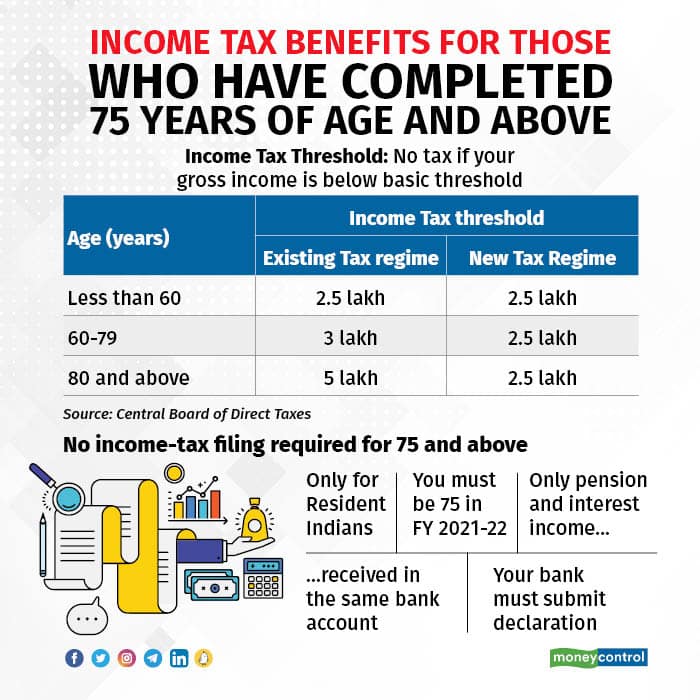

Those above 75 years are exempted from filing tax returns. But to avail this exemption, you have to fulfil certain conditions.

You need to:

· Be a resident,

· Have only interest and pension income, and,

· Both these incomes should come into the same bank account.

On account of multiple and stringent conditions, chartered accountants say that these benefits are largely unutilised so far.

“For instance, one needs to have a single bank account. But most people have multiple bank accounts, and hence, they are disqualified,” says Ameet Patel, Partner at Manohar Chowdhry & Associates.

Worse still, even if you are above 75 years of age and have no taxable income, you need to file your tax returns if you wish to be eligible for a refund at a later date. This happens when, say, tax deducted at source (TDS) is erroneously deducted. And with the ambit of TDS being widened increasingly in the past few years, it actually pays to file your income-tax returns (ITR). Over the years, the government has widened the scope of TDS to be able nab tax evaders.

“I was receiving dividends for years, and in November 2020, I received a letter saying that Rs 430 was deducted as TDS for my dividend in one stock. I used to file Form 15H with my banks, but didn’t know I had to do that for dividends as well,” says Rama Mehta, a Mumbai-based resident.

Typically, those who don’t have any taxable income need not file tax returns. But the situation changes.

“It is often seen that banks deduct TDS for fixed deposits (FDs). If one has filled Form 15G/H, then they need not claim the refunds. To claim refunds from these tax deductions by banks on FDs and companies on dividends, those above 75 years are forced to file a tax return,” says Mehul Sheth, a Mumbai-based chartered accountant.

But these forms are lately requested via email or digital modes and senior citizens find it difficult to fill them digitally. Physically too, one has to submit these forms at the start of the financial year. If they forget to submit these to the banks and even registrars and share transfer agents, then taxes are deducted at source.

Paper-filing of returns

Super senior citizens can file their returns in paper mode under ITR 1 or 4, even though e-filing is mandatory for all other individuals.

“While filing physical returns is permitted for those above 80 years, reconciliation of returns and matching reported income and taxes paid is easier and refunds are faster when one uses e-filing. Pre-filled information would not be available under physical returns. Hence, missing information is highly likely under paper-filing of returns,” says Sudhir Kaushik, co-founder of TaxSpanner.com.

Also read: Mistakes to be avoided while filing income tax returns

Higher threshold

Those above 80 years of age are offered a higher threshold (income-tax exemption) of Rs 5 lakh even though the limit for other individuals is lower at Rs 2.5 lakh and Rs 3 lakh for senior citizens. “In effect, they gain a taxation benefit of Rs 12,500 due to the higher threshold limit of Rs 5 lakh vis-à-vis Rs 3 lakh for senior citizens,” says Seth.

While those above 75 years can enjoy a higher income tax threshold limit of Rs 3 lakh and 5 lakh per annum once they turn 80 years old, they cannot claim these higher limits under the new tax regime, where only income up to Rs 2.5 lakh is tax-free. The simplified new tax regime offers a lower rate of taxation, which could be beneficial for senior citizens as they usually do not have a home loan burden, hefty tuition fees or provident fund investments to claim.

Medical expenses

It is difficult to get a health insurance policy as one ages. Those above 80 years, who don’t have health insurance, are hence permitted to claim medical expenses as tax deduction.

“You can claim the medical expenses as tax deduction under Section 80 D only if you don’t have a health insurance to support. Also, to claim this deduction of medical expenses, one has to collect and preserve the bills for three years from the end of the assessment year as the benefit is available based on the actual amount spent,” says Seth.

Medical treatment costs up to Rs 1 lakh can be claimed as deduction under Section 80DDB for certain specified ailments.

Reverse mortgage

Even though the pension amount is taxed in the hands of senior citizens, the amount paid as reverse mortgage instalment to senior citizens is fully exempt from income tax. However, due to the low awareness and high inertia of using this product, not many have used this facility, where one can receive monthly instalments from banks against their house property.

“Reverse mortgage can help senior citizens live a self-sufficient tax-free retirement life, with high liquidity. But no one wants to opt for it as they want to make sure the property is available for their heirs,” says Kaushik.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!