The S&P BSE Sensex finally reclaimed mount 30K, but it is at the same level where it was in March 2015, but almost 600 stocks more than doubled your wealth in the same period.

The S&P BSE Sensex might not have gone anywhere but a lot has changed since then. The political climate, as well as economic positioning, is very different than what it was back in the year 2015 which makes this rally more authentic.

As much as 66 stocks more than doubled investors’ wealth in the S&P BSE 500 index since then which include names like Jubilant Life, which rose 420 percent, followed by Nilkamal which gained 381 percent, and SpiceJet which zoomed 370 percent in the same period.

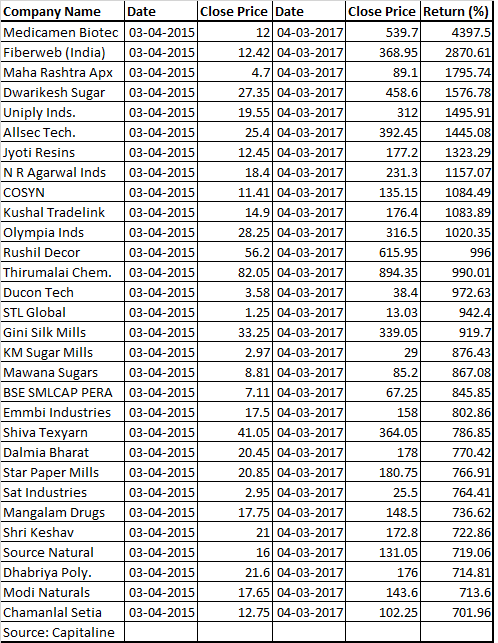

Small & midcap stocks hogged the limelight as 11 stocks rallied more than 1,000 percent since March 2015 which include not so well know names like Medicamen Biotec which rallied 4,397 percent, followed by Fiberweb which gained 2870 per cent, and Dwarikesh Sugar rallied 1576 percent in the same period.

In the S&P BSE 200 index, almost 14 stocks more than doubled investors wealth since March 2015 which include names like Jubilant Life (up 420 percent), Rajesh Exports (264 percent), Natco Pharma (189 percent), Bajaj Finserv (180 percent), Bajaj Finance (174 percent), Biocon (163 percent), among others.

The S&P BSE Sensex, which hit a fresh record high of 30,007.48 on Wednesday rose 18 percent in the last financial year but the rally may not be over yet. Analysts advise investors to maintain their positive outlook on markets but be conservative in stock picking.

Along with strong flows from foreign institutional investors (FIIs) on the back of strong economic fundamentals which makes India one of the sought after investment destinations, domestic flows (DIIs) are picking momentum too.

Fiscal year 2017 was a cherishing year for investors. The FII poured a net of Rs 50,206 crore into Indian equity market in FY17 compared to a net outflow of Rs 17,579 crore in FY16.

The domestic mutual funds pumped Rs 54,735 crore in the equity market, making them a significant contributor in the market besides FIIs.

One major factor which is favouring Indian markets is the political climate which is slowly changing. Political leaders are taking hard decisions which will go a long way for the markets and domestic fund flows will surprise everyone.

“India is going through very exciting times. We are entering a new era of economic development. The way politicians are managing the economy, the way the corporate world is taking shape and the way disruptive growth is happening is all unprecedented. We have never seen such a situation before,” Porinju Veliyath, MD & Portfolio Manager, Equity Intelligence India told CNBC-TV18.

In the last 12 months Nifty did well but the smallcap stock pickers made 100 percent return in the last one year. Going into FY2018, Porinju feels Nifty could well give 15-20 per cent growth in the Nifty and smart stock pickers can make 50-100 percent in the same period.

The market direction in FY18 would be driven by global factors rather than local ones. Triggers for the markets would be a pick-up in global GDP and earnings growth, tax reforms and fiscal stimulus in the US, suggest experts.

“We expect the global corporate earnings growth to pick up from 1 percent in CY16 to 11 percent in CY17. We further expect earnings growth for emerging markets to pick up from 9 percent in CY16 to 13 percent in CY17,” Akash Singhania, Dy CIO (Equities) at DHFL Pramerica Asset Managers told moneycontrol.

“We expect CY17 to be a benign year for FII investments into India, surpassing the investments made in the last two years. This is based on the premise that macro remains strong and India remains an attractive emerging market in terms of robust fundamentals and reasonable valuations,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.