Visited a doctor and struggled to pay for medical procedures, laboratory tests or medicines not covered by your health insurance policy? A health-tech firm based in New Delhi may have a solution.

Navia Life Care, established in 2016, has come up with a product called Aarogya Pay to help patients undergo medical procedures at clinics. It offers a zero-interest instant loan of up to Rs 60,000 that can be paid back in three or six monthly instalments.

The company has tied up with some financial institutions registered with the Reserve Bank of India and doctors who will need to pay a specified fee every time a loan is issued.

The company is working with 400 doctors across four cities—Delhi, Mumbai, Pune and Bangaluru. They include gynaecologists, ophthalmologists, dermatologists or skin specialists, ear-nose-throat (ENT) specialists and dentists who carry out day procedures on patients who may need financial help.

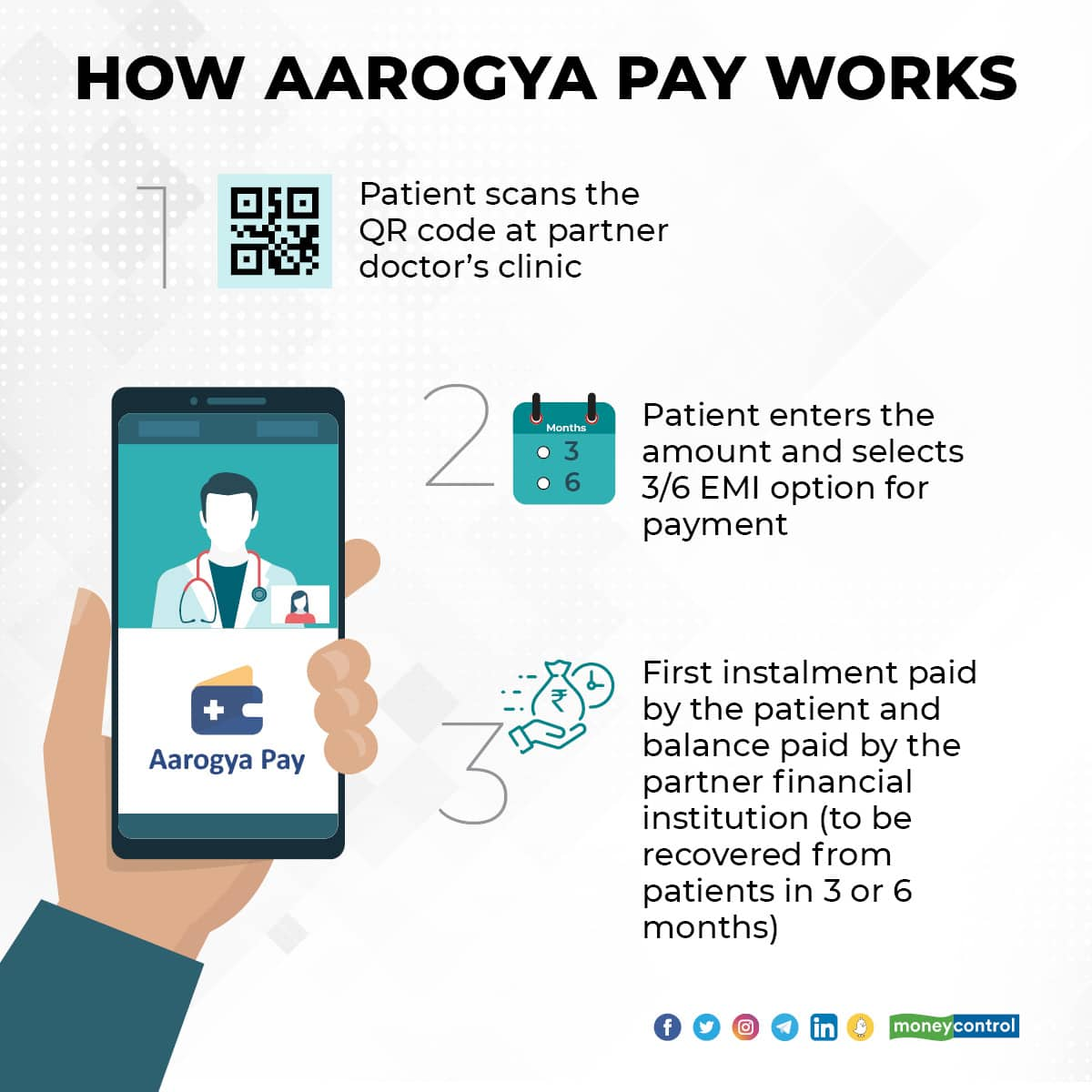

How it works

The company said Aarogya Pay was a digital product to access which a QR code is installed at the doctor’s clinic.

“After scanning the code, Aarogya Pay helps patients to avail of and get a medical loan approved instantaneously,” it said, adding that the facility provides a pre-approved credit limit of up to Rs 60,000 per patient.

Patients can avail of this loan to pay for medical procedures, treatment, consultations, medicines and lab tests.

Navia Life Care’s co-founder Gaurav Gupta said the firm uses holistic patient data to understand the risk associated with lending.

“This data is put in machine-learning based algorithms to provide instant credit to the patients. This is a completely digital process, enabling loans to patients in a matter of a few seconds,” he told Moneycontrol, adding that as insurance penetration in the country is low, it leads to high out-of-pocket expenditure for patients.

“Also as many procedures and medical expenses are not covered under insurance, patients keep pushing them to later dates,” he said.

Gupta explained that after scanning the QR code at the clinic, patients would need to do an e-KYC to instantly know their loan eligibility. KYC is short for Know Your Customer.

“Post-verification, the loan is approved and disbursed instantly,” he said, adding the company has some data on patients already. It is working with around 22,000 doctors to provide digital tools to enhance a patient’s experience and make business easier for healthcare professionals.

Patients would get the benefit of undergoing a medical procedure and lab tests and be able to purchase medicines instantly. Clinics would benefit from providing their services right away.

Expansion plans

The firm plans to expand Aarogya Pay to facilities run by about 600 more doctors by July and have at least 6,000 on board by January next year.

Navia Life Care is aiming for transactions worth Rss 100 crore on the Aarogya Pay platform in the next six months and hopes to develop it into a unified digital health payment system covering even in-patient department (IPD) services for which patients may need financial help.

Medical loans and personal loans for medical expenses are provided by some financial institutions, but according to Gupta, the process of getting a loan is often cumbersome and requires a lot of paperwork.

In addition, patients are required to pay steep interest rates applicable on personal loans.

“In contrast, for those who are eligible for our lending plan, the process is completed within minutes and patients need not pay extra money other than the amount lent,” he said.

Exposing lacunae in the public health system?

But in a country where 63 percent of all the health-related expenditure comes out-of-pocket, what does such a product say about the existing health systems?

Health economist Rijo M John said distress selling of assets and taking high-interest loans from private lenders is common among low-income households.

“Eventually, this further impoverishes many of them. This initiative by Navia Life Care may be bringing such activities more to the formal sector. One needs to see the terms and conditions under which such loans are disbursed and check whether this leads to exploitative practices to take advantage of the dire financial needs of individuals needing urgent hospitalisation,” he said.

The emergence of such products underscores the gaps in India’s public health system, John said, and added that if access to healthcare is made universal and free of cost, no need would be felt for such products.

“That there is a demand for such loans shows the existing public health insurance programs are not sufficiently serving the ones in need,” he added.

Also read: Centre alerts states to quickly identify, isolate monkeypox suspects in hospitals

Public health researcher Dr Oommen John said universal health coverage aims to ensure access to health services to every citizen without financial hardship or impoverishment.

There is no assurance that the availability of such a loan will prevent catastrophic health expenditure, he added.

“These loans might exacerbate high cost, low value irrational medical practice and high-quality primary care is the best insurance for those who can't afford to pay for healthcare services,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.