Seasonality is such a generic term that it fits into every walk of life. There are various things that create a sense of similarity in surroundings that things behave the same way. From broad examples like the weather to the fashion and very particular price of the stocks.

Various factors affect the price of stocks. Major factors are the demand and supply of the stock itself. However, beyond that there are factors like results and board meetings for the stocks. For indices indicative of the entire market factors like inflow and outflow of funds also make an impact.

Simple activity of fresh fund allocation has been blamed for lack of buying power of funds (allegedly international ) for the month of January not being so encouraging in the price action department.

Take a look at this example of Nifty that shows in last 7 straight years Nifty has not been able to gain month over month even in a single year. This kind of information could be crucial for someone planning to trade or invest.

We will look at more such examples and figure out how to best deal with it using Options. Options Analytics applications do provide this data readymade or the same can be pulled out of the website of the exchanges. The idea is to get the price of start and end of the month to figure out what the move has been.

Once we do that put at least 10 years’ worth of data into monitoring. This helps figure out if there is any repetition in the historical returns’ behaviour. If 7 of last 10 years are found to have same direction, we found the seasonality element into the stock/index.

Once established, we now know the most likely monthly direction of the stock/index. This piece of analysis can be used in multiple ways. Let me list down a few here.

To showcase better let me take an example.

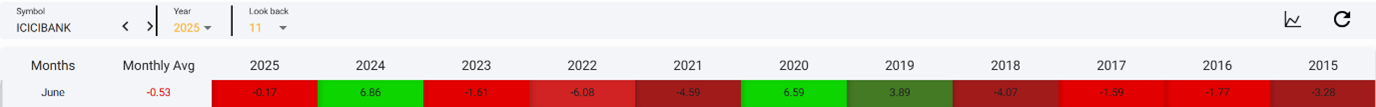

This is ICICI Bank for the month of June. As we can see coming into 2025 the stock has had 7/10 years that gave negative returns.

Following could have been done.

1. Investors Sell Calls: This is pretty straight forward. With more likelihood for the investors to have the stock go down, it makes sense to take an obligation to sell.

Selling a Call with the strike price 5%-7% higher means that if the stock goes against the odds and rises up to the Call sell strike, then the profit is booked in the stock at the strike price of the call sold + premium received.

In more likely scenario, where the stock ends lower than Call Strike. The investor pockets entire premium.

2. Credit Spread for Traders: Expectation of not rising for the month can also be monetized by Selling a Call Option of strike price closest to the price at the beginning of the month. To protect Buy 3-4 steps higher strike Call. This makes it a credit spread.

The Max profit would be net premium received, and maximum loss would be difference between bought and sold strikes minus the net premium received.

These are just 2 examples. The possibilities are endless once we have a reasonable seasonal characteristic expectation.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.