How many traders close at the target?

Answer to this simple question is not too many. If I were to look at my own history, a lot of my trades have been closed at a point that was not the desired target. This is important to the context of “Slow and Spread”.

Before we come to that let me share a market scenario. Imagine indices have been trading with a tight range of around 3% for over 3 months. Right after coming out of that range, we expect the index to blow past the previous highs. When that does not happen, one would like to re-think. This reminds us of the times we are in right now.

Now, to take care of this scenario, one would like to take it slow. With slow we mean less aggressive. With lack of aggression comes inherent reduction in risk. Reduced risk automatically makes us more efficient. The logic behind being more efficient is you either win more or lose less. With lack of aggression, we definitely lose less and thereby become more efficient.

We are talking about lowering the aggression or slowing down by using Option Spreads. This is a topic that has been touched upon often but like Table Salt it has a million use cases. This is one of the sweetest. Let us understand and analyse.

Option Spread means a combination trade where one Buys an Option and Sells an Option simultaneously. There are many kinds of Option Spreads. The one that we are talking about is the Vertical Spreads.

Vertical Debit Spreads are the spreads that has both options of the same type and expiry date. Also, the debit element of spreads indicate we have to pay premium to get into the trade. Higher Strike Calls and lower Strike Puts are relatively less expensive.

Vertical Debit Spreads will involve Buying a Call/Put and Selling a Higher Strike Call/ Lower Strike Put. This will make us have a premium outflow.

Example: With a stock trading at 1500

Bullish Spread = Buy 1500 Call & Sell 1540 Call

Bearish Spread = Buy 1500 Put & Sell 1460 Put

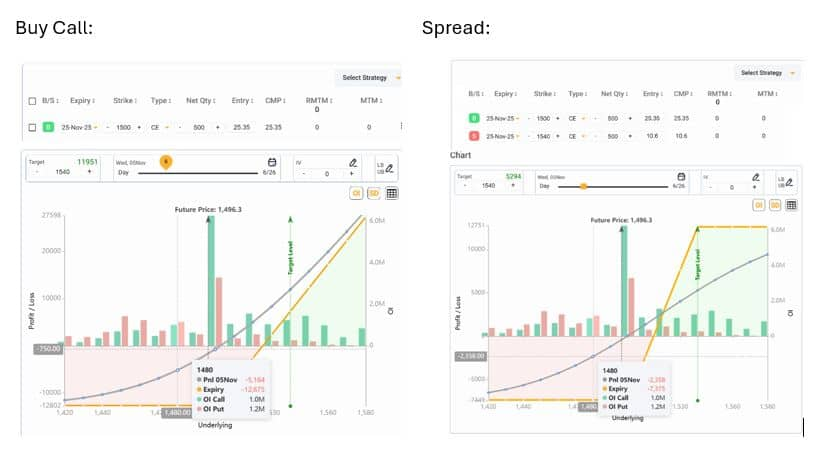

Let us do a Comparative Analysis.

The example carries a stock at 1500 with over 30 days left for expiry. Grey line indicates what would be the profit or loss across the prices of the stock after 6 days, considering there is a weekend in between. We are assuming that the trade has 1480 Stop loss and 1540 Target.

Buy Call has 11951 likely profits at target against 5164 worth of loss if the trade hits a Stop-Loss. This converts into Reward/Risk = 2.3

Call Spread has 5294 likely profits at target against 2358 worth of loss if the trade hits a Stop-Loss. The Reward/Risk = 2.25

In a nutshell, we have 2 trades with almost similar Reward/Risk, but Spread has a capacity to losing a lot less in the same trade than Buy Call.

This way we make Slower money but more efficiently. This is because with the same amount of money to lose now we can 2 trades and not one.

Only downside is that Spread has profits locked at 1540 (Sell Call Srike). But as discussed in the beginning, we don’t wait till target right?

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.