Shubham Agarwal

Open Interest is defined as “The number of unsettled or outstanding contracts of a particular derivative instrument.”. Simply put it is the accounting of derivative instrument. Derivative instrument could be Future, Call Option or Put Option.

Let us look at what is Open Interest. It looks like Volume data but how different it is from volume. Lastly the importance of Open Interest data.

Open Interest can be easily understood with a simple example. This will help us understand Open + Interest. Open being trades taken but not closed. Interest means simply trades.

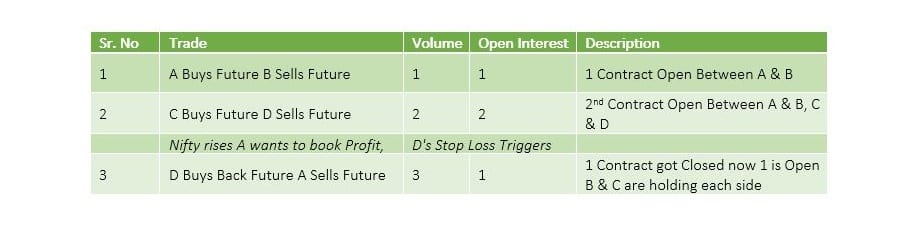

Example: Imagine the market is made up of 4 traders, A, B, C and D. All of them are interested in trading Nifty Futures. We all know that one would Buy Future if one were bullish and Sell Future if one is bearish.

A & C are Bullish. B & D are bearish.

Thus, as we saw even though there were 3 trades that took place which was represented by volume of 3 contracts, the Open Interest at the end of the 3 trades was only 1 contract. This brings out a very crucial difference between volume and Open Interest. The difference is volume will only show the activity, but Open Interest will help in getting to know the direction of the activity.

The rise in activity could be incoming traders with a fresh view or they could be outgoing traders with a profit booking or loss booking intention. That brings us to the importance and benefit of Open Interest data.

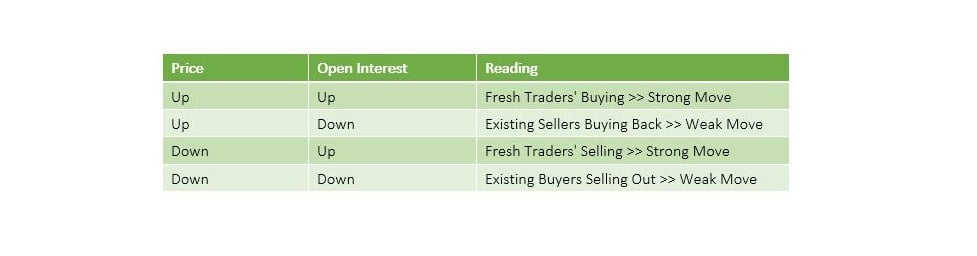

With the help from Open Interest reading, we can now find out whether the price move had fresh traders’ interest or unwinding (profit/loss booking) trades. Benefit of Open Interest is that if we associate this with price, we will be able to filter out the strong moves that have fresh traders’ interest.

Following simple table Explains this Open Interest + Price reading.

This shows how reading the Open Interest data long with Price can help in getting to know the strength of the price move. In over 2 decades of history of Futures & Options this analysis of Open Interest has been very successful in filtering out strong moves and weak moves.

The data of Open Interest is easily available in all Option Analytics apps as well as on NSE’s website as well for absolutely no cost.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!