These five credit cards offer great cashbacks and discounts

Every time you swipe your credit card, you earn certain reward points, which vary with the amount and partner associated. Annual charges are between Rs 250 and Rs 2,999

1/8

One of the most common benefits available with each card is of rewards points. Every time you swipe your credit card, you are awarded certain reward points that can be redeemed against cashback, airmiles, fuel, product catalogues and more. Paisabazaar has researched and identified five credit cards that offer excellent rewards points on your spending.

2/8

Image Source: Standard Chartered Bank | Standard Chartered Platinum Rewards credit card offers 5X reward points on spending Rs 150 at dining outlets and on fuel. It offers 1X reward points for spending Rs 150 on other categories and Amazon Pay gift card worth Rs 500 as a welcome gift. The annual fee is Rs 250 on this credit card.

3/8

Image Source: Citibank | Citibank Rewards Credit Card offers 10 reward points on spending Rs 125 on apparel and at department stores and one reward point on spending Rs 125 at other places. It offers up to 2,500 reward points as a welcome benefit and 300 bonus reward points on spending Rs 30,000 and above in a month. The annual fee is Rs 1,000 on this credit card.

4/8

Image Source: HDFC Bank | HDFC Regalia Credit Card offers 4 reward points on every Rs 150 spent. It offers bonus 10,000 reward points on spending Rs 5 lakhs and additional 5,000 reward points on spending Rs 8 lakhs. It has a foreign currency markup fees of 2 percent. It offers complimentary airport lounge access: 12 in India and six overseas, and other benefits. The annual fee is Rs 2,500 on this card.

5/8

Image Source: HDFC Bank | HDFC Diners Club Privilege Credit Card offers complimentary yearly membership of Amazon Prime, Zomato Pro, Times Prime, Big Basket, etc. It offers 4 reward points for spending every Rs. 150, 2X reward points on dining during weekends and up to 5 per cent cashback vis SmartBuy. It has a foreign currency markup fees of 1.99 percent. It offers complimentary 12 airport lounge access in India and worldwide. There is a complimentary renewal of annual memberships on spending Rs 5 lakh in the previous year. The annual fee is Rs 2,500 on this card.

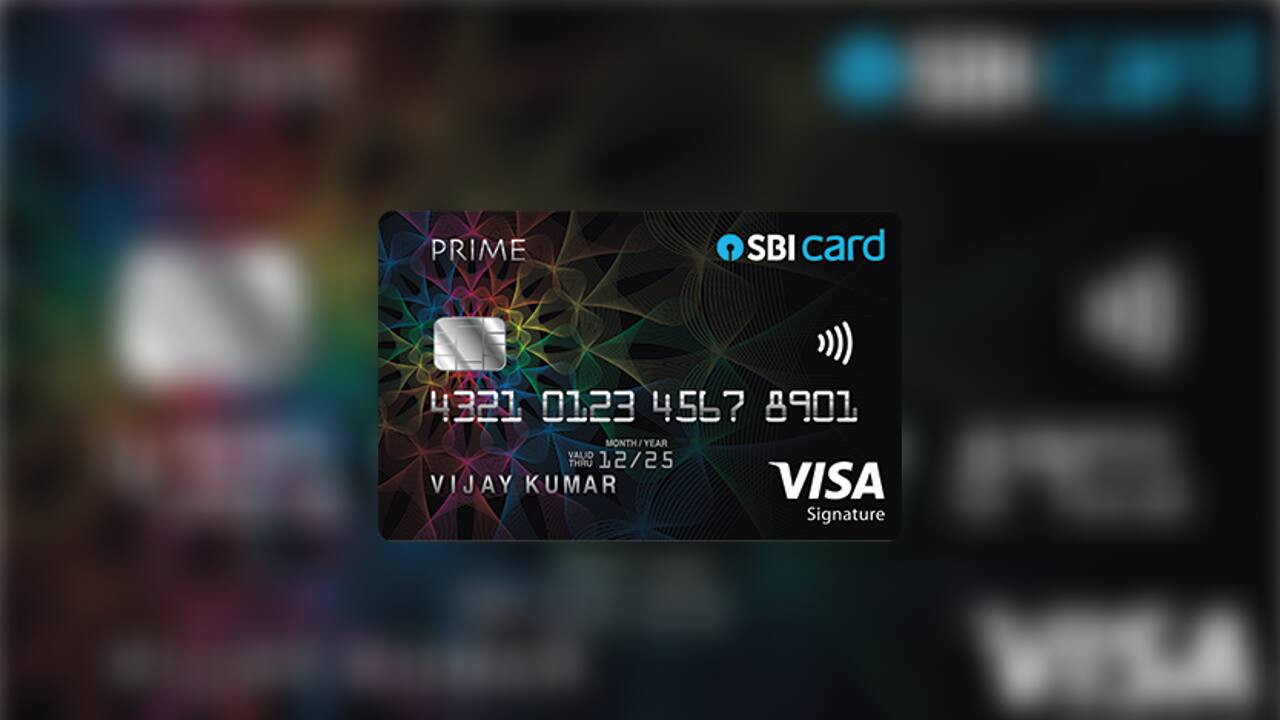

6/8

Image Source: SBI Card | SBI Card Prime offers e-gift voucher worth Rs 3,000 on joining. It offers 10 reward points per Rs 100 spent on dining, groceries, departmental stores and movies and nine club Vistara points for every Rs 100 spent on Vistara flights. It offers complimentary airport lounge access: 8 in India and four overseas. The cardholder gets complimentary Trident Privilege Membership. The renewal fees are waived off on spending Rs 3 lakh annually. The annual fee is Rs 2,999 on this card.

7/8

Have a disciplined approach to your credit behaviour. Once you get a rewards credit card, it is critical that you use it smartly and responsibly. Since credit cards offer a significant interest-free period, there may be a tendency to overspend in multiple categories while shopping. Avoid overspending to earn bonus rewards point and to waive off annual renewal fees. If you spend more than you can repay and cannot pay your credit card bill timely, you will incur hefty interest charges ranging from 28 to 49 percent p.a. along with late payment fees.

8/8

Paisabazaar has shortlisted the credit cards based on the rewards across multiple categories offered by each card compared to their annual fees. All credit card information is sourced and updated as of January 12, 2022. We have arranged these rewards credit cards according to the least annual fees.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!