Small- and mid-cap stocks powering the best-performing PMSes

These are the top 5 holdings of the top performing portfolio management service (PMS) strategies that delivered higher returns over the last year. The top 5 stocks are significant because a higher weight in them dictates fund performance, which in turn helps outperform peers

1/11

The domestic equity market has seen wild swings over the last one month after the sharp run-up post the Lok Sabha elections. Smart managers actively churned their portfolios as the market reached record highs amid rising volatility. Carefully chosen businesses have always produced superior returns for portfolio managers.

Here are the top 5 holdings of the PMS strategies that delivered superior returns over the last one-year period. The top 5 stocks are significant because a higher weight in them dictates fund performance, which in turn helps outperform peers.

Only PMSes that declared the portfolio of the strategies have been considered.

Source: Finalyca PMS Bazaar. Data as of July 31, 2024.

Here are the top 5 holdings of the PMS strategies that delivered superior returns over the last one-year period. The top 5 stocks are significant because a higher weight in them dictates fund performance, which in turn helps outperform peers.

Only PMSes that declared the portfolio of the strategies have been considered.

Source: Finalyca PMS Bazaar. Data as of July 31, 2024.

2/11

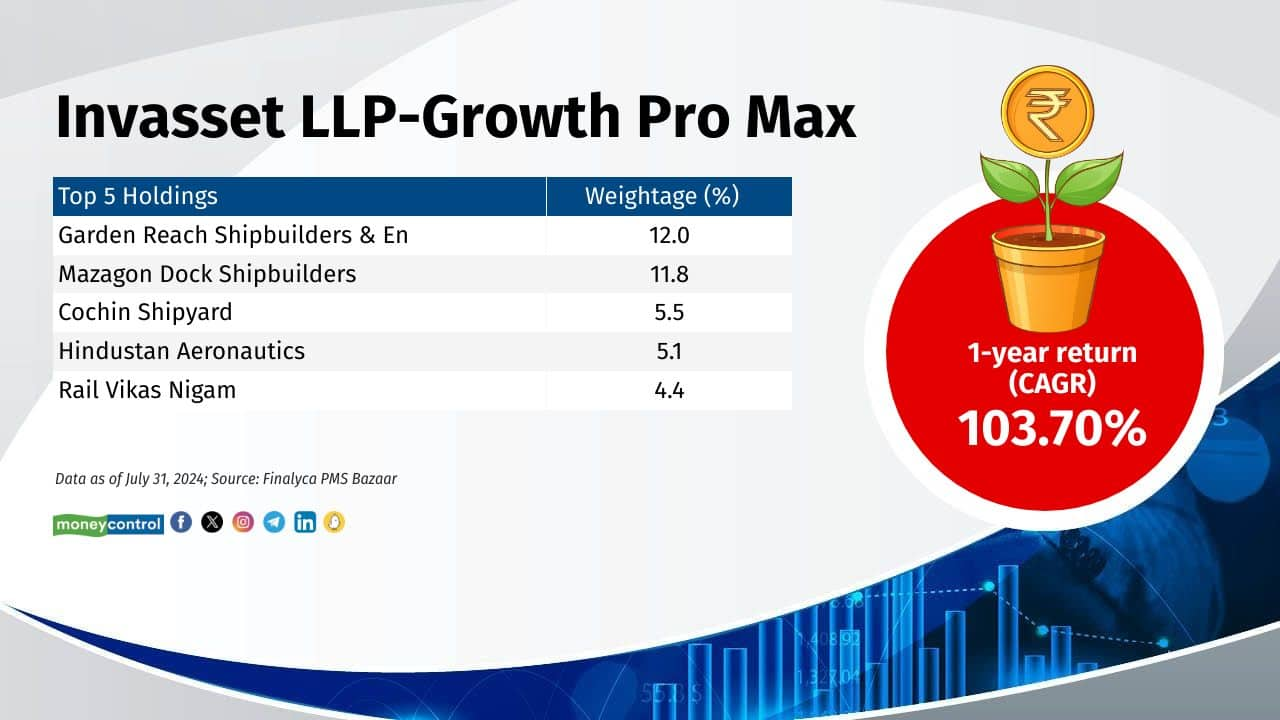

Invasset LLP-Growth Pro Max

1-year return (CAGR): 103.7%

Category: Multi Cap

Inception Date: 8-Jan-2020

Fund Manager: Anirudh Garg

1-year return (CAGR): 103.7%

Category: Multi Cap

Inception Date: 8-Jan-2020

Fund Manager: Anirudh Garg

3/11

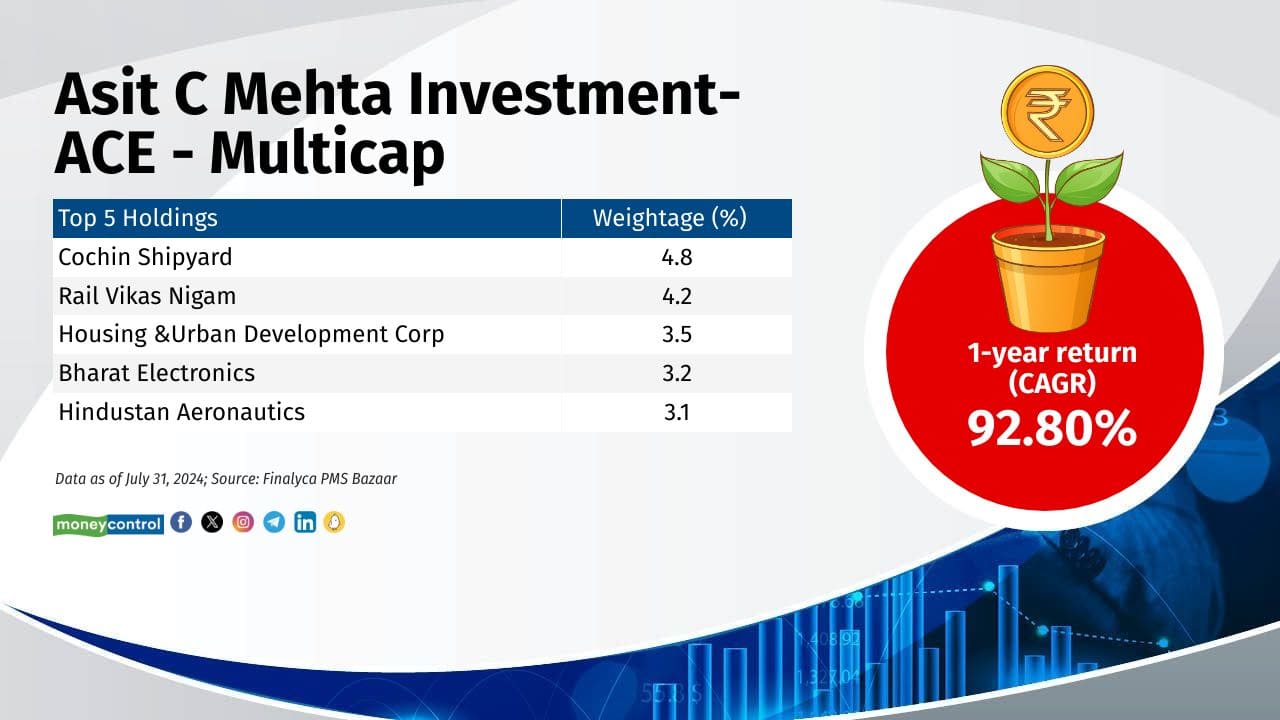

Asit C Mehta Investment Intermediates Ltd-ACE - Multicap

1-year return (CAGR): 92.8%

Category: Flexi Cap

Inception Date: 23-Aug-18

Fund Manager: Deepak Makwana

Also see: Mid-caps beat small-caps in the long term. Here are top performing mid-cap funds

1-year return (CAGR): 92.8%

Category: Flexi Cap

Inception Date: 23-Aug-18

Fund Manager: Deepak Makwana

Also see: Mid-caps beat small-caps in the long term. Here are top performing mid-cap funds

4/11

Asit C Mehta Investment Intermediates Ltd-ACE - Midcap

1-year return (CAGR): 87.5%

Category: Mid Cap

Inception Date: 29-Dec-2017

Fund Manager: Deepak Makwana

1-year return (CAGR): 87.5%

Category: Mid Cap

Inception Date: 29-Dec-2017

Fund Manager: Deepak Makwana

5/11

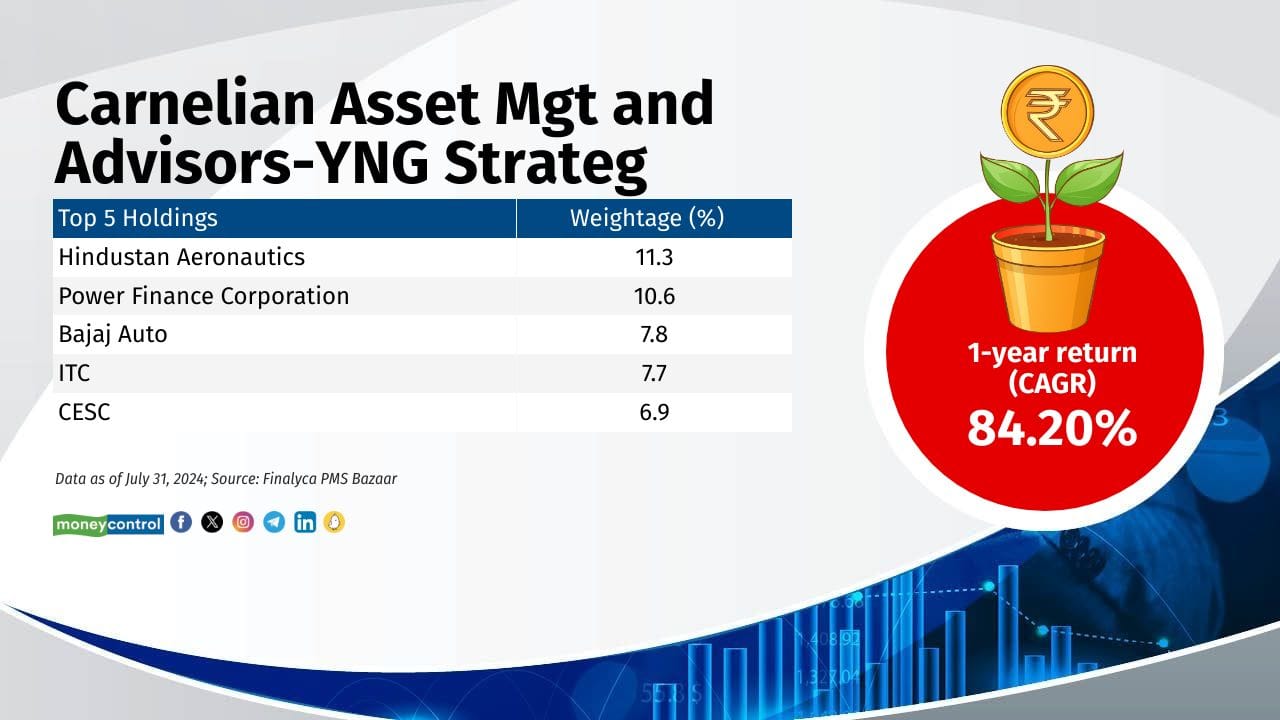

Carnelian Asset Management and Advisors Pvt Ltd-YNG

1-year return (CAGR): 84.2%

Category: Multi Cap

Inception Date: 26-Jan-2022

Fund Manager: Manoj Bahety

1-year return (CAGR): 84.2%

Category: Multi Cap

Inception Date: 26-Jan-2022

Fund Manager: Manoj Bahety

6/11

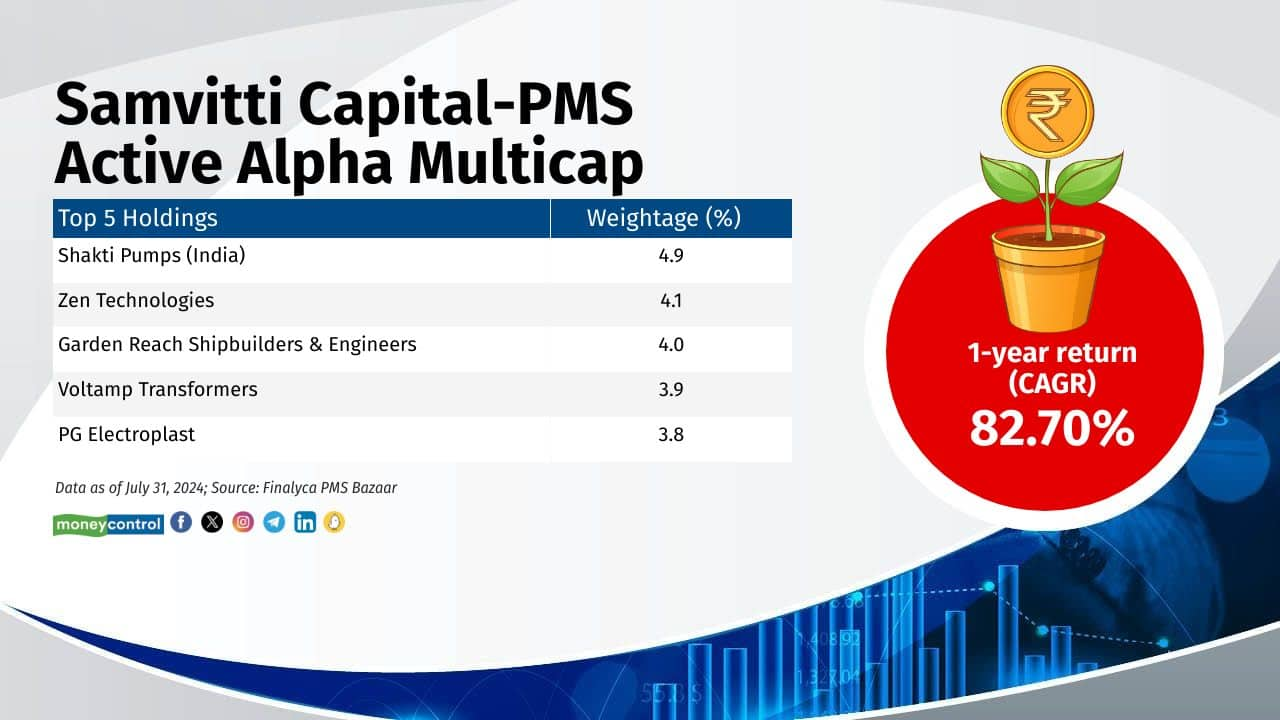

Samvitti Capital Pvt Ltd-PMS Active Alpha Multicap

1-year return (CAGR): 82.7%

Category: Multi Cap

Inception Date: 13-Apr-2021

Fund Manager: Prabhakar Kudva

Also see: 12 new micro-cap stocks that PMS managers bought in June

1-year return (CAGR): 82.7%

Category: Multi Cap

Inception Date: 13-Apr-2021

Fund Manager: Prabhakar Kudva

Also see: 12 new micro-cap stocks that PMS managers bought in June

7/11

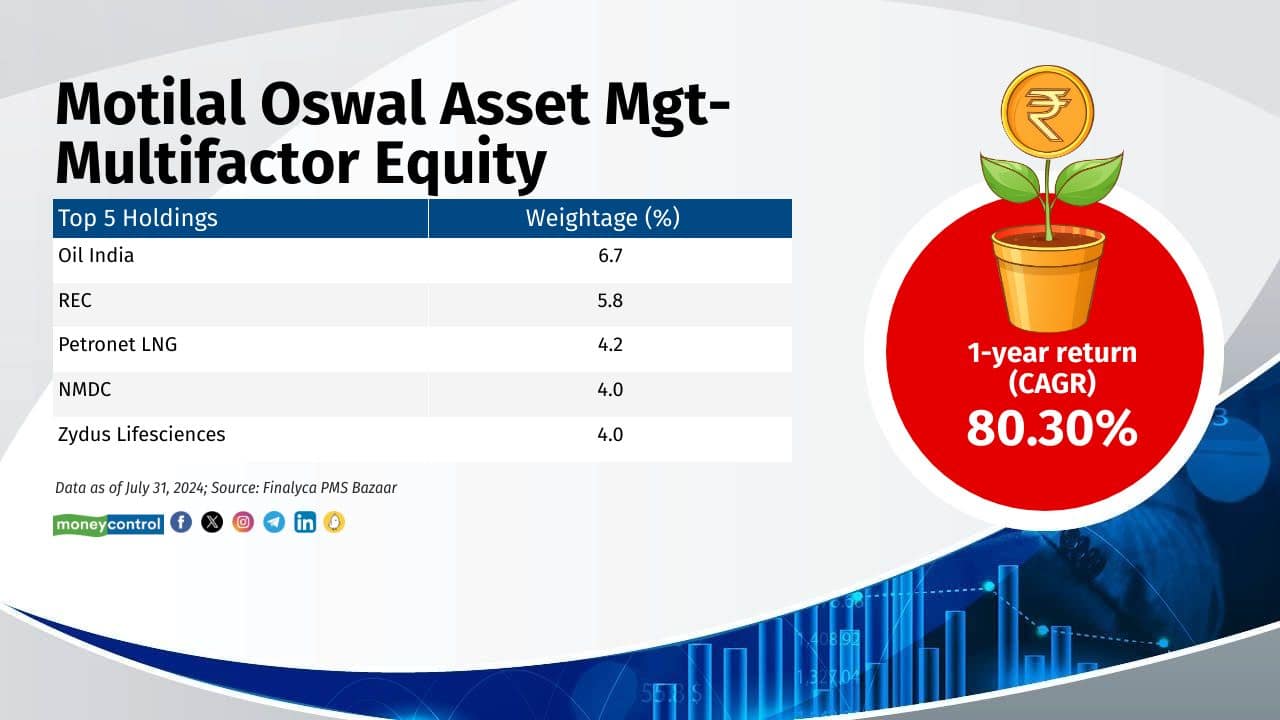

Motilal Oswal Asset Management Company Ltd-Multifactor Equity

1-year return (CAGR): 80.3%

Category: Multi Cap

Inception Date: 6-May-2021

Fund Manager: Sankaranarayanan Krishnan

1-year return (CAGR): 80.3%

Category: Multi Cap

Inception Date: 6-May-2021

Fund Manager: Sankaranarayanan Krishnan

8/11

Green Portfolio Pvt Ltd-The Impact ESG Fund

1-year return (CAGR): 77.4%

Category: ESG theme

Inception Date: 23-Mar-2022

Fund Manager: Divam Sharma

Also see: Down but not out: MFs hold on to these small-cap stocks despite fall

1-year return (CAGR): 77.4%

Category: ESG theme

Inception Date: 23-Mar-2022

Fund Manager: Divam Sharma

Also see: Down but not out: MFs hold on to these small-cap stocks despite fall

9/11

Valtrust Partners LLP-Valtrust Momentum

1-year return (CAGR): 77.3%

Category: Flexi Cap

Inception Date: 20-Jan-2023

Fund Manager: Vishal Khatri

1-year return (CAGR): 77.3%

Category: Flexi Cap

Inception Date: 20-Jan-2023

Fund Manager: Vishal Khatri

10/11

Axis Securities Ltd-Kaizen

1-year return (CAGR): 75.4%

Category: Multi Cap

Inception Date: 15-June-2023

Fund Manager: Naveen Kulkarni

1-year return (CAGR): 75.4%

Category: Multi Cap

Inception Date: 15-June-2023

Fund Manager: Naveen Kulkarni

11/11

Badjate Stock Shares Pvt Ltd-Aggressive

1-year return (CAGR): 72.1%

Category: Small & Mid Cap

Inception Date: 8-July-2021

Fund Manager: Anuj Badjate

Also see: Nasdaq, Nasdaq Next, FANG, Total Market and Value: How to get the best out of US focused MFs?

1-year return (CAGR): 72.1%

Category: Small & Mid Cap

Inception Date: 8-July-2021

Fund Manager: Anuj Badjate

Also see: Nasdaq, Nasdaq Next, FANG, Total Market and Value: How to get the best out of US focused MFs?

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!