Down but not out: MFs hold on to these small-cap stocks despite fall

Here's a list of smallcap stocks have seen a price erosion of up to 43 percent over the past year. While sum fund managers dumped these stocks, many continue to have them in their portfolios

1/16

Not all plans work out for fund managers, especially in the volatile small and midcap space. Many of the carefully chosen stocks take longer than expected to give better outcomes and some just don't perform as expected. Still, fund managers persist with the stocks which they think will do well down the road. Here is a list of smallcap stocks that have seen price erosion of up to around 43 percent over the past year but still enjoy fund managers trust' who continue to hold them. The data is as of June 2024. Source: ACEMF.

2/16

Rajesh Exports

One-year return (absolute): -42.9%

The number of equity schemes that held the stock as of June 30, 2024: 18

The number of equity schemes that sold the stock in the past six months: 6

Also read: Nasdaq, Nasdaq Next, FANG, Total Market and Value: How to get the best out of US focused MFs?

One-year return (absolute): -42.9%

The number of equity schemes that held the stock as of June 30, 2024: 18

The number of equity schemes that sold the stock in the past six months: 6

Also read: Nasdaq, Nasdaq Next, FANG, Total Market and Value: How to get the best out of US focused MFs?

3/16

Tatva Chintan Pharma Chem

1-year return (absolute): -42.1%

No. of equity schemes that held the stock as of June 30, 2024: 6

No. of equity schemes that sold the stock in the past six months: 8

1-year return (absolute): -42.1%

No. of equity schemes that held the stock as of June 30, 2024: 6

No. of equity schemes that sold the stock in the past six months: 8

4/16

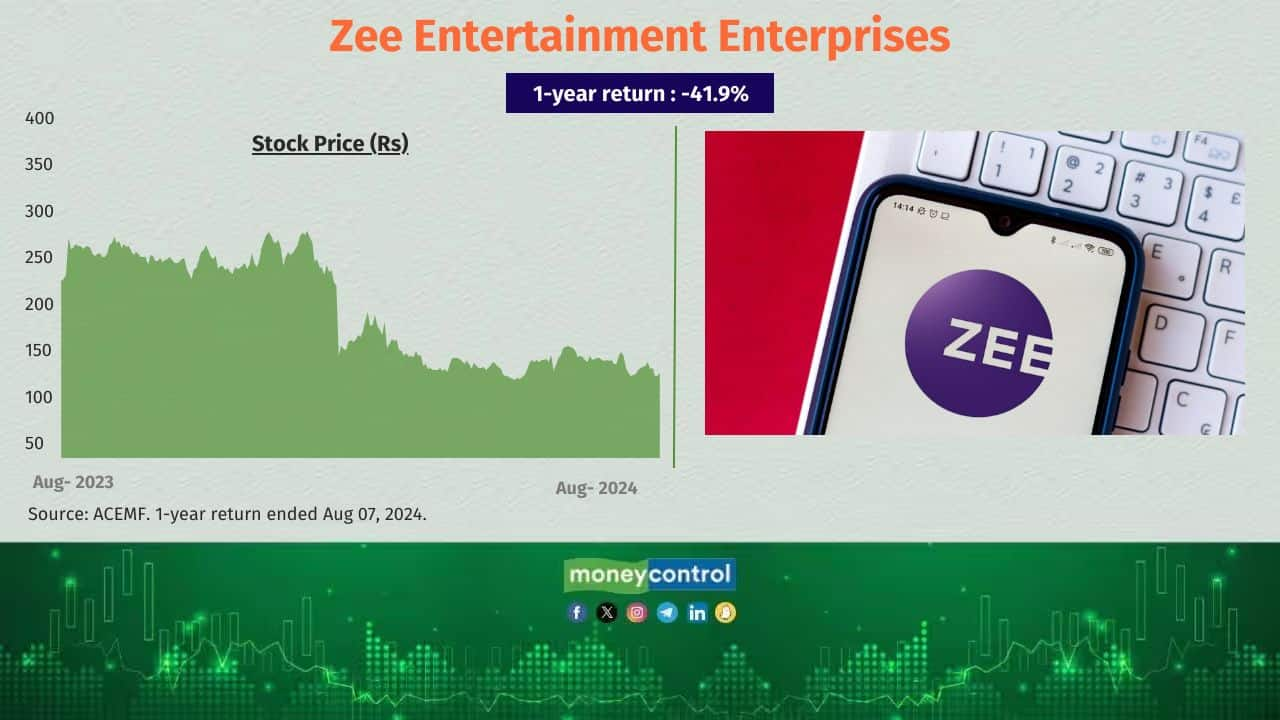

Zee Entertainment Enterprises

1-year return (absolute): -41.9%

No. of equity schemes that held the stock as of June 30, 2024: 68

No. of equity schemes that sold the stock in the past six months: 64

Also see: Mid-caps beat small-caps in the long term. Here are top performing mid-cap funds

1-year return (absolute): -41.9%

No. of equity schemes that held the stock as of June 30, 2024: 68

No. of equity schemes that sold the stock in the past six months: 64

Also see: Mid-caps beat small-caps in the long term. Here are top performing mid-cap funds

5/16

Fusion Micro Finance

1-year return (absolute): -41.5%

No. of equity schemes that held the stock as of June 30, 2024: 24

No. of equity schemes that sold the stock in the past six months: 4

1-year return (absolute): -41.5%

No. of equity schemes that held the stock as of June 30, 2024: 24

No. of equity schemes that sold the stock in the past six months: 4

6/16

HLE Glascoat

1-year return (absolute): -36.3%

No. of equity schemes that held the stock as of June 30, 2024: 3

No. of equity schemes that sold the stock in the past six months: 12

Also see: 12 new micro-cap stocks that PMS managers bought in June

1-year return (absolute): -36.3%

No. of equity schemes that held the stock as of June 30, 2024: 3

No. of equity schemes that sold the stock in the past six months: 12

Also see: 12 new micro-cap stocks that PMS managers bought in June

7/16

Ideaforge Technology

1-year return (absolute): 35.1%

No. of equity schemes that held the stock as of June 30, 2024: 12

No. of equity schemes that sold the stock in the past six months: 5

1-year return (absolute): 35.1%

No. of equity schemes that held the stock as of June 30, 2024: 12

No. of equity schemes that sold the stock in the past six months: 5

8/16

Hindware Home Innovation

1-year return (absolute): 32.5%

No. of equity schemes that held the stock as of June 30, 2024: 10

No. of equity schemes that sold the stock in the past six months: 2

1-year return (absolute): 32.5%

No. of equity schemes that held the stock as of June 30, 2024: 10

No. of equity schemes that sold the stock in the past six months: 2

9/16

La Opala RG

1-year return (absolute): -31.6%

No. of equity schemes that held the stock as of June 30, 2024: 15

No. of equity schemes that sold the stock in the past six months: 1

1-year return (absolute): -31.6%

No. of equity schemes that held the stock as of June 30, 2024: 15

No. of equity schemes that sold the stock in the past six months: 1

10/16

Medplus Health Services

1-year return (absolute): -31.5%

No. of equity schemes that held the stock as of June 30, 2024: 27

No. of equity schemes that sold the stock in phe last six months: 2

1-year return (absolute): -31.5%

No. of equity schemes that held the stock as of June 30, 2024: 27

No. of equity schemes that sold the stock in phe last six months: 2

11/16

Butterfly Gandhimathi Appliances

1-year return (absolute): -29.1%

No. of equity schemes that held the stock as of June 30, 2024: 8

No. of equity schemes hat sold the stock in the past six months: 1

1-year return (absolute): -29.1%

No. of equity schemes that held the stock as of June 30, 2024: 8

No. of equity schemes hat sold the stock in the past six months: 1

12/16

VIP Industries

1-year return (absolute): -27.7%

Total no. of equity schemes that held the stock as of June 30, 2024: 32

No. of equity schemes that sold the stock in the past six months: 4

1-year return (absolute): -27.7%

Total no. of equity schemes that held the stock as of June 30, 2024: 32

No. of equity schemes that sold the stock in the past six months: 4

13/16

Nilkamal

1-year return (absolute): -27.4%

No. of equity schemes that held the stock as of June 30, 2024: 7

No. of equity schemes that sold the stock in the last six months: 0

1-year return (absolute): -27.4%

No. of equity schemes that held the stock as of June 30, 2024: 7

No. of equity schemes that sold the stock in the last six months: 0

14/16

Divgi Torqtransfer Systems

1-year return (absolute): -26.5%

No. of equity schemes that held the stock as of June 30, 2024: 14

No. of equity schemes that sold the stock in the past six months: 4

1-year return (absolute): -26.5%

No. of equity schemes that held the stock as of June 30, 2024: 14

No. of equity schemes that sold the stock in the past six months: 4

15/16

VRL Logistics

1-year return (absolute): -22%

Total no. of equity schemes that held the stock as of June 30, 2024: 26

No. of equity schemes that sold the stock in the past six months: 12

1-year return (absolute): -22%

Total no. of equity schemes that held the stock as of June 30, 2024: 26

No. of equity schemes that sold the stock in the past six months: 12

16/16

Uniparts India

1-year return (absolute): -22%

No. of equity schemes that held the stock as of June 30, 2024: 6

No. of equity schemes that sold the stock in the past six months: 2

Also see: Midcap 11: Stocks that innovation funds love to hold

1-year return (absolute): -22%

No. of equity schemes that held the stock as of June 30, 2024: 6

No. of equity schemes that sold the stock in the past six months: 2

Also see: Midcap 11: Stocks that innovation funds love to hold

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!