Some eagerly-awaited macro data are here and the headline numbers look good, mostly. But local markets don’t seem too happy. While markets were in the red in morning trade, at 12.25 pm they have gingerly tiptoed into positive territory, with a 0.15 percent gain in the Sensex. Is it the buy on hope and sell on news trade or something else? While we don’t know, it’s perhaps best to take things as they come in an uncertain macro situation with so many twists and turns.

The US markets reacted positively to release of consumer inflation data on Thursday. US consumer prices fell for the first time in two and a half years and this was the lowest inflation reading in a year. This has improved the odds of the Federal Reserve gaining confidence in inflation’s downward trajectory, leading to hopes that the next rate hike will be halved to 25 basis points. That cheered US markets overnight.

In the domestic market, consumer inflation and industrial growth are “joined at the hip”, writes Manas Chakravarty in his analysis of these data releases. The good news is that industrial output rose by 7.1 percent in November over a year ago, and this was not due to a low base effect as sequential growth was healthy as well.

But it appears that the recovery in output, signalling better demand conditions, is supporting inflation, too. The latest retail inflation for December at 5.72 percent is well below the RBI’s target of 6 percent, but core inflation continues to be stubbornly high and that means the RBI’s Monetary Policy Committee may feel compelled to continue with its tightening stance.

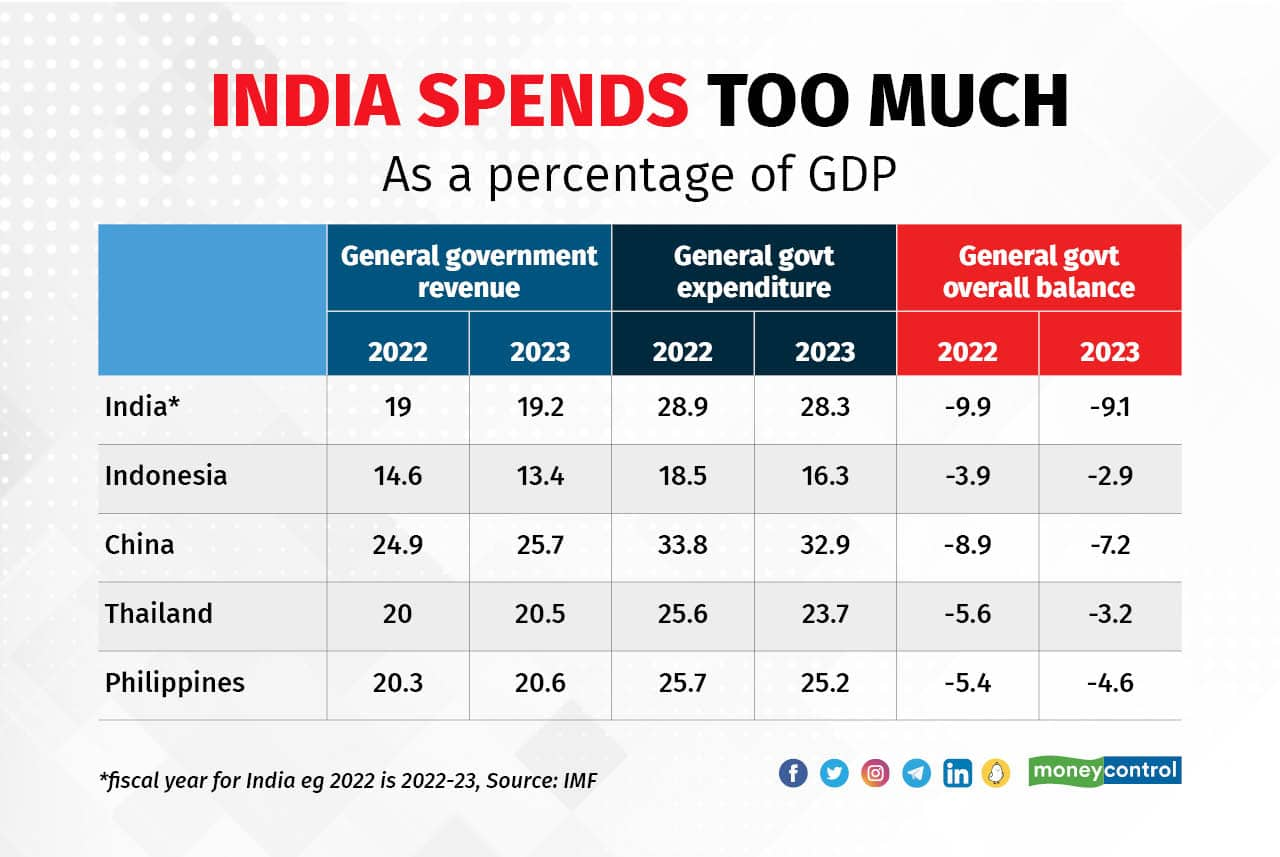

While sturdy IIP growth and steady -- and not worsening -- consumer inflation create fiscal room for the government to manage its finances better, India’s fiscal position does not compare very well with its Asian peers. Today’s edition of Budget Snapshots points out: “The accompanying chart shows that while government revenues as a percentage of GDP for India is only slightly worse than countries such as Thailand and the Philippines, which have a higher per capita income, government expenditure as a percentage of GDP is much higher.” Read the full article to get more insights.

Coming back to equity markets and their “mercurial” movements this week, these should not come as a surprise, writes Ananya Roy. She points to the India VIX rising steadily of late and that the writing has been on the wall since October 2022. What explains the recent sobering of investor expectations? “…we live in a globalised world and cannot remain insulated from global worries for too long. So, we are now seeing global pessimism catching up with Indian markets as well,” she writes, and believes that a long-term rally now depends on fundamentals recovering.

Investing insights from our research teamInfosys Q3 FY23 – Should you buy the growth leader in large cap?

HCL Tech Q3 FY23 – All-round strong show

Weekly Tactical Pick: Why this PSU looks interesting

Cyient: Traction in core business, easing macros signal upside in this IT player

What else are we reading?Budget 2023: Affordability for buyers and financial viability for developers is need of the hour

Why ‘24X7’ cities still remain on paper in India

Joshimath crisis highlights cost to business of ignoring environmental imperatives

The fuzzy world of corporate governance laws

The Green Pivot: India needs a dual market strategy to exploit sustainability sector opportunity

Personal Finance: Invest through volatility in 2023, instead of playing at prediction

What economists get wrong about personal finance (republished from the FT)

Proposed regulations for foreign universities must take a holistic view to benefit students

Technical Picks: Zinc, HPCL, L&T, UltraTech Cement and HDFC Bank (These are published every trading day before markets open and can be read on the app).

Ravi AnanthanarayananMoneycontrol ProDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.