In their latest ministerial meeting held on October 5, the Organization of Oil Producing Countries (OPEC) and its other participating members (OPEC+) decided to cut their target production of crude oil by 2 million barrels per day (2mbpd) effective from November. This is the largest planned cut in production target since 2020 when the demand collapsed due to the COVID-19 pandemic.

The decision of OPEC+ has evoked strong response from the global oil consumers. Commenting on the decision, the US National Security Advisor said, “At a time when maintaining a global supply of energy is of paramount importance, this decision will have the most negative impact on lower- and middle-income countries that are already reeling from elevated energy prices".

Balance The Global MarketsThe 13-member OPEC produces about 30 percent of the global crude oil supply. Besides there are 11 non-OPEC members (including Russia) who participate in the periodic ministerial conference of OPEC that sets the target for crude production by the participating members. The targets so set are mostly recommendatory, and followed strictly by the members. In September, OPEC produced 29.89 mbpd of crude oil, about 3.4 mbpd lower than the set target.

Therefore, practically the cut of 2 mbpd in the target production may result in much less cut in the actual production, since many members may already be producing less than their allotted quota. Various estimates put the likely reduction in OPEC+ supply at 800,000 bpd to 1.1mbpd.

To put the numbers in context, the world crude oil demand is expected to be 100.03 mbpd in 2022, and 102.72 mbpd in 2023. The peak demand in 2023 is expected to be 104.85 mbpd (4Q2023) vs 102.22 mbpd in 4Q2022. At the current rate, the world is facing a shortage of 6 percent in supply as the total production is close to 96.5 mbpd against a demand of 102.7 mbpd.

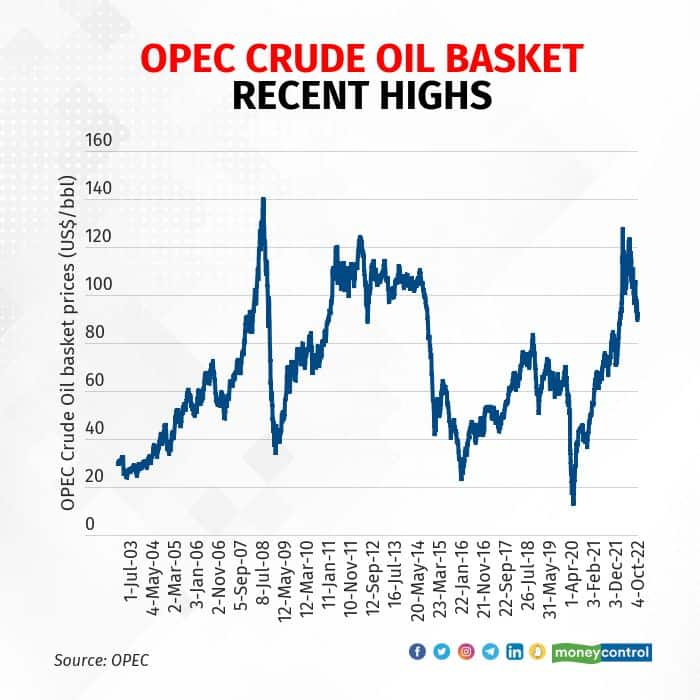

Based on data from the latest monthly OPEC bulletin, the latest cuts are necessary to maintain the balance in the global crude oil market, as the global growth forecasts for 2023 have been lowered sharply, resulting in downward revision in the oil demand forecasts. Recently, the average price of OPEC oil has fallen 25 percent from a high of $123/bbl (June) to $92bbl (October) in line with the widely traded benchmarks, e.g., Brent Crude, and WTI Crude Oil.

Impact on Global EconomyThe global crude prices have surged ~5 percent post the recent announcement of production target cuts by OPEC+. Given that most of the world is struggling to contain inflation, energy prices hold a key to the effectiveness of the efforts of central bankers to rein the prices. Failure to check the energy prices could actually undermine the entire exercise of monetary tightening to trigger a managed demand slowdown.

Eventually the prices of energy will remain a function of demand and supply. Considering that most of the OPEC economies are overwhelmingly dependent on the energy sales for sustenance, there is a floor to the supply cuts that OPEC could undertake. A sharp slowdown in demand could bring down the energy prices notwithstanding the latest supply cuts.

There are other aspects to OPEC action which may be beyond economics. Many observers see the latest OPEC move as driven more by geopolitics than economics. It is assumed that OPEC+ recent move could have been influenced by Russia, the largest non-OPEC producer facing economic sanction from NATO; and China, the largest oil importer which has struck deal with Saudi Arabia to buy oil in petro-Yuan, thus undermining the dominance of the USD in global trade. India, the third-largest oil importer in the world, is also making deals with OPEC+ for pricing of imports in local currencies, instead of the USD. These moves could hurt the global demand for the USD, and negatively impact the US balance of payment.

Some energy experts have also highlighted another dimension of the recent OPEC+ move. In the past decade or so most of the new investments have occurred in the clean energy segment. The conventional energy capacity has not seen much increase though the demand has been inching up slowly; tightening the conventional energy market significantly. Besides, these experts fear that the OPEC members may have overstated their spare capacity (total capacity minus current production) and we may have much less cushion to manage any surge in energy demand. Thus, in case of a global demand recovery towards the end of 2023 we may see a much sharper rise in crude prices even if OPEC+ restores the supply targets. These cuts may, therefore, actually help in controlling larger volatility in oil prices later.

Impact On IndiaOPEC’s share in India’s oil imports has been steadily declining in the past six years. In FY16 India imported about 4 mbpd crude oil from OPEC; constituting 87 percent of its total oil imports. In FY23, India is expected to import 47 mbpd of oil from OPEC, constituting less than 60 percent of its total import. Besides, India has made exclusive arrangement with Russia to import crude. Thus the recent supply cuts by OPEC+ are likely to have much mild effect on India, insofar as the availability of crude is concerned.

As per various estimates a 10 percent rise in crude oil prices leads to about 5 percent rise in CPI inflation in India. Besides, crude oil accounts for almost one-fourth of India’s total import worth ~$750 billion. A 10 percent rise in oil prices could lead to a $18-19 billion rise in our current account deficit (CAD) further pressurising the INR.

It is probable that we may actually not see material production cuts, and the global prices do not change much. It is also probable that we are able to extract favourable deals from key suppliers such as Saudi and Russia. A weaker USD may also offset some impact from oil price hikes. A sharper contraction in demand due to significant economic slowdown may also affect global crude prices. Therefore, for now there is not much actionable for investors and traders; insofar as the OPEC+ decision to lower the production target is concerned.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.