Ruchi Agrawal

Moneycontrol Research

Post reports of Oil Ministry hinting at a possible government intervention for easing the surging auto fuel prices, the stocks of IOC, HPCL, and BPCL saw sharp correction, tanking nearly 5-8 percent intraday, a trend which continued on Thursday. The reports followed the government’s decision of ruling out any near-term excise duty cuts for oil, and calling for oil marketing companies (OMCs) to keep customers' interest in mind.

After being spared in October last year, when the government took over the burden through excise duty cuts, the margins of OMCs were being eyed for quite some time now. We analyse the impact of such a cut for OMCs and what overall bearing it might have.

Background

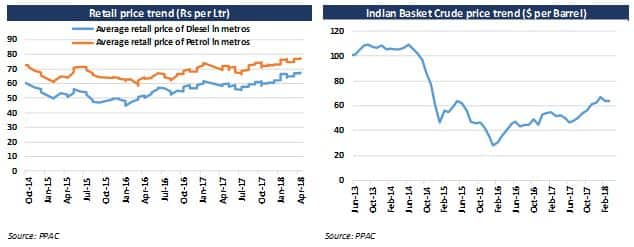

Amid fears of trade war and brewing geopolitical tension, crude prices have flared up, touching nearly a four year high of almost USD 73 per barrel. The price hike also comes in line with Saudi Arabia and Russia’s persistent efforts to manage inventories and push up global prices. Post the sharp hike, concerns about rising fuel prices and consumer panic gained momentum and reports about oil ministry nudging OMCs to absorb the impact started doing the rounds.

Impact on Oil Marketing Companies – still makes healthy marketing margin

The expanding marketing margins of OMCs have been under the scanner for a possible burden sharing. Though reports about margin cuts are doing the rounds, any specific government intervention or nudging has been explicitly denied by company managements.

The margins of OMCs have been steadily expanding in recent times, passing on much more to customers than the rise in crude prices. Since Oct’17 the margins have moved from Rs 2.52 to Rs 3.4 per litre on petrol and from Rs 1.7 to Rs 3.1 on diesel and now they are much above the usual average of Rs 2.5 per litre. Point worth noting here is that the margins remained largely below Re 1 per litre during Nov-Dec 2017 much in sync with Gujarat elections.

The retail prices of petrol and diesel have inched up Rs 2.4 and Rs 5.3 per litre, respectively since 1 Mar ’18. While the prices of the Indian basket have inched up USD 1.5 per barrel or 2.5 percent since the start of the year, diesel has gone up 8.8 percent and petrol by 5.7 percent since Jan 1, 2018.

With a cut in the marketing margins, the overall margins of OMCs are bound to get impacted. Every Rs 1 per litre cut in margin, around 5-8 percent impact is expected on earnings. Of the three downstream PSUs, HPCL might be impacted the most due to relatively higher share of the retail segment in its revenues. However, given the sharp rise in the margins in recent times, we expect little net impact on the companies.

Impact on government

Although it may sound unfair for the government to shy away from duty cuts and instead take shield from margins of OMCs, any cut in duty comes at a heavy costs for the government. The sharp surge in crude has come at a time when the government is under dual pressure of maintaining the fiscal discipline along with avoiding voter resentment ahead of the upcoming elections. Moreover, any reduction in revenue receipts increases the risk of fiscal slippages.

Excise duty on petrol and diesel contributes around 7.2 percent of total budgeted tax receipts for FY18-19. The reduction in the excise duty by each rupee results in a revenue loss of almost Rs 13000 crore annually which is approximately 1 percent of our total budgeted receipts.

Given the already tight fiscal math, any under recovery could come at a heavy cost for the government and there seem pressing reasons why the government stands in a weak position when it comes to reducing excise duty.

On the other hand, VAT imposed on auto fuels by individual state governments still remains largely untinkered. It forms almost 15 percent on diesel and 21 percent on petrol in Delhi and varies from state to state. Although the prices of crude have gone up sharply, only a few states have provided relief through reduction of VAT percentages. Given the relatively little impact on absolute collections, given the higher base of crude price (VAT is calculated as a percentage on the base price), consumer relief through this route could also be explored should crude rally continue. However, states will have to agree to such a reduction.

Impact on Inflation

On one hand rising domestic fuel prices could have a negative impact on the already precarious fiscal deficit, it also impacts inflation and growth. According to India Economic Survey 2018, every $10 per barrel increase in the price of oil reduces growth by 0.2-0.3 percentage points.

Expenditure on petrol and diesel has 6.84 percent weight in the CPI (consumer price index) basket. The recent uptick in petrol and diesel prices could potentially spike up the CPI inflation by around 20-30 basis points directly and the indirect impact might be higher with the potential of pushing up inflation beyond the 5 percent mark.

Outlook

Brewing geopolitical tensions coupled with fears of trade wars and inventory cuts are expected to keep crude up in the near term. However, in the longer term, the possibility of alternate supply flowing might provide some relief.

Upcoming elections put further pressure on government to control voter’s furor. Sustained uptick in the prices holds future headwinds for OMCs who might be asked directly or indirectly to absorb the pressure of rising prices. Although given the sharp hike in marketing margins in recent months, the near term absolute impact might not be substantial. Upstream oil companies might be dragged into absorbing the surge through subsidy burden.

Direct government intervention and policy flip-flop might also deter the interests of global giants who have been eyeing midstream and retail markets in India.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.