How chief executive officer (CEO) Rana Kapoor torpedoed Yes Bank was never foremost on the list of ideas I had shortlisted for a book. In fact, when troubles with the private lender's asset quality review started a few years ago, the inside joke was that Kapoor and Yes Bank's misadventures would likely end up as fodder for not one but many books because of the dozens of skeletons in its closet.

Nine months later, as I become the first to chronicle the rise and fall of one of the country's most promising financial professionals, truth be told, writing the book had as much to do with the fact that tragedy, like charity, begins at and is most felt at home—when Yes Bank ran out of money in March this year, I felt the impact first-hand as an account holder.

There's something dysfunctional in a society when tax-payers who form the white-collar working-classes of this country are subjugated to “bad banks” and their funds are frozen, while the men who make fortunes based off of their savings siphon funds away. No different from cops who exploit and behave like predators instead of serving and protecting. If India was anything like the US, Yes Bank's running out of cash may have led to riots and political backlash.

Flawed foundation

By the time I started tracking and researching the subject, Kapoor had been arrested. He had become notorious for unscrupulous lending practices, a penchant for rubbing everyone around him up the wrong way and that overarching mantra that was a hangover from the 1980s— greed is good.

The more I spoke to those who knew him and worked with him, the more I learned that Kapoor was no different from any ambitious entrant to the city of Mumbai.

He was pursuing the dream most alpha-male financial entrepreneurs do. Start a company. Go Public. Make millions. Or billions. Nothing wrong with the Darwinian ascent except Yes Bank wasn't his to start with.

There’s a lesson there for startups: get the narrative right from the get-go because it does catch up.

As I learned, no matter how hard he had tried to rewrite history, Yes Bank was the brainchild of two other bankers and not his. It would be wrong to undermine the sheer drive that propelled Kapoor to get to where he did, which has also been the common denominator for other billionaires that have amassed huge fortunes in a short period of time.

I observed the same traits in Kapoor that I had when researching diamond billionaire Nirav Modi (now also in jail) for a book I wrote last year.

Balzac hit the bull’s eye when he said, “Behind every great fortune is an equally great crime.” However it’s the execution that defines success with corporate crimes and if one gets the details wrong, there’s a risk of an unspooled plot. Which is exactly what happened.

Kapoor wanted assets under management to grow exponentially year on year and in some senses expand like a tech firm, which it was not. His co-brother-in-law Ashok Kapur counselled him against driving too fast but he refused to listen.

As he played rising master of finance, Kapoor manoeuvred his way to the top of the food chain at Yes Bank. His penchant for growth, coupled with an intense desire to rub shoulders with the beautiful people, may have positioned him as a knight in shining armour for a newly minted bank.

The truth was otherwise. Kapoor may have wanted to build a great bank but the very foundation of his vision was flawed. What was worse was that as I spoke to his niece and other family members, I learned that blinding ambition had a side darker than night.

The manner in which the loan book grew after Kapur tragically died as a victim of the terrorist attack in Mumbai reflected how the rules were thrown out of the window once Kapoor took command. He thought nothing of casting aside the widow and daughter of the very man who had brought him into Yes Bank, resurrected his flagging career as a young banker when Bank of America had fired him.

A chipped armour

It’s almost always the one fatal flaw that reduces success to a tragedy. Think hubris with liquor tycoon Vijay Mallya, impatience with jeweller Nirav Modi and a blind spot by ICICI Bank boss Chanda Kochhar when it came to her husband’s shenanigans. With Kapoor, it was hard to pin down where exactly the chink in the armour was, even as there would seem to be so many. The murmurs of alcohol abuse, evidence of unbridled risk-taking when it came to building a book of business and the roughshod treatment of stakeholders were some.

Either way, brilliant or not, his idea or someone else’s, the reality was that Kapoor had built something of scale, no mean feat in the cut-throat world of Indian banking. But somewhere along his journey, Kapoor forgot that the 1980s were over, greed wasn’t good and that the past would catch up.

While burning Kapoor at the stake is easy today, the other side of the coin is that he served a purpose for a system that allowed and maybe even enabled him to get as far as he did and then yanked the rug out from under his feet when it saw fit to do so. The Rana Kapoors will come and go like changing seasons. The bigger question remains as to the fix for the malfunctioning system that allows for and even supports the greed of corporations, in the guise of corporate growth, no matter how much of a virtue it's dressed up to be.

(Pavan Lall is a senior journalist based in Mumbai.)

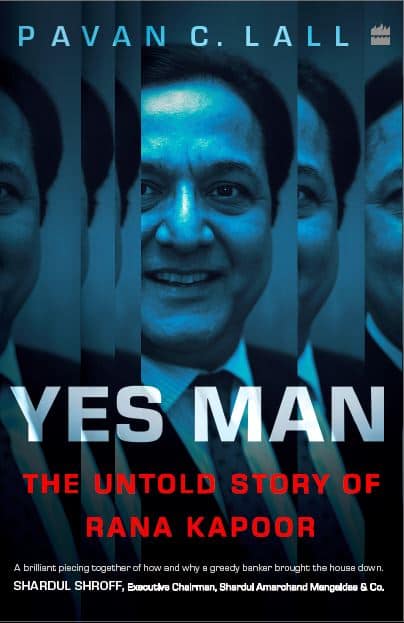

Yes Man: The Untold Story of Rana Kapoor by Pavan C Lall is published by HarperCollins.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.