Generally, once the summer season starts, sales of air conditioners go through the roof. But this year is different as the nationwide lockdown to contain the spread of coronavirus has disrupted the lives of citizens.

Since the economic crisis triggered by the coronavirus outbreak will spill on to spending on some of the discretionary items, AC makers are bound to feel the heat.

"We believe the entire season will be a washout due to fear of COVID-19 and with the further extension of the lockdown. We expect sales in FY21 to be severely impacted due to the lockdown and expect de-growth on a high base of last year. Room Air Conditioning (RAC) being a high-ticket discretionary item, which requires professional installation, is likely to see a relatively slower bounce back in demand," Edelweiss Research said in a report.

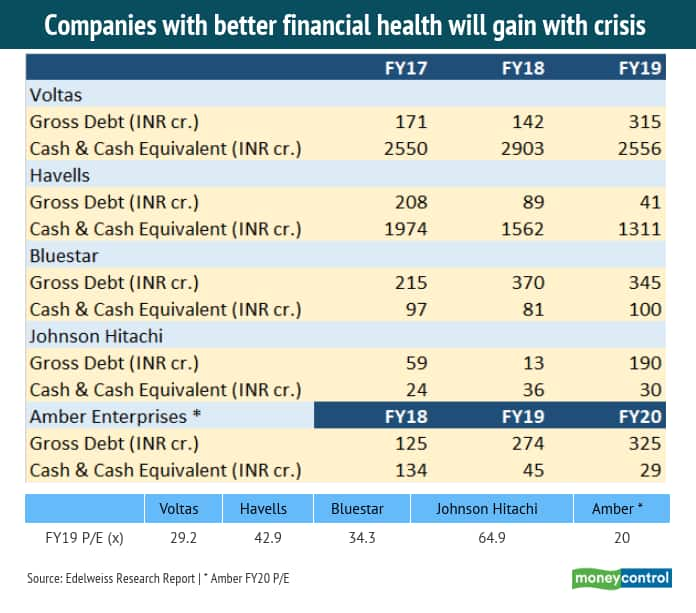

The report also stated that Voltas and Amber Enterprises stand out with lower net debt and better return ratios.

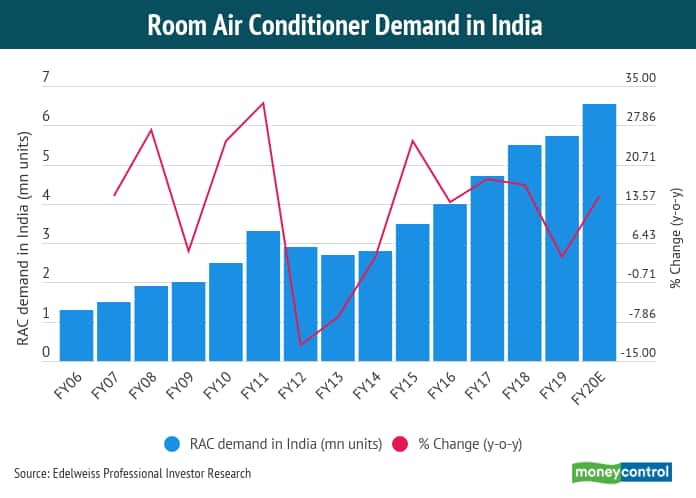

Room air conditioners demand in India: In FY16, 4 million units of room air conditioners were sold and since then we were witnessing a growth of over 14 percent each fiscal till FY18. However, in FY19 we witnessed just 4 percent growth but was expecting 15 percent growth in FY20.

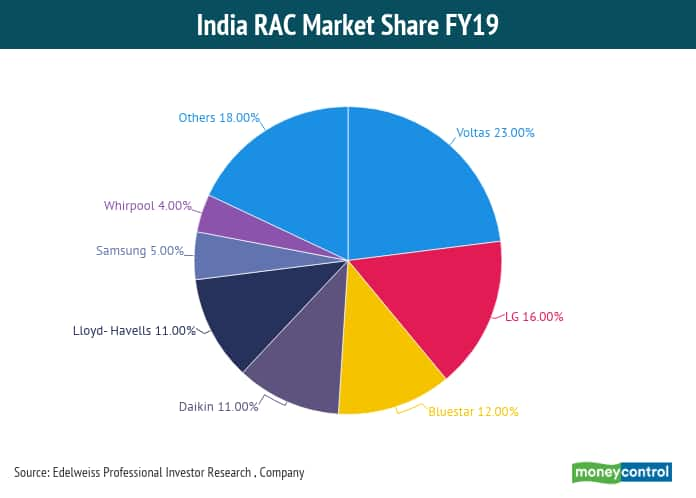

India RAC Market Share in FY19: In India, Voltas leads the air condition market share with 23 percent, followed by LG and Blue star with 16 percent and 12 percent, respectively.

Stock Performance: From the listed entity, in the last one year, air conditioner maker Amber Enterprises remained top performer with 56 percent surge, followed by Whirlpool of India and Hitachi Air Conditioning with rising 42 percent and 29 percent respectively. However, Blue Star and Havells were down over 30 percent each.

Edelweiss research recommendation: "We have two companies under our coverage - Voltas and Amber Emprises - in this sector. We believe FY21 will be a challenging one for both companies. However, we maintain our long-term positive outlook on Voltas and Amber. Voltas will maintain its leadership position in RAC with diversification creating opportunities to scale up its business while Amber will gain from a structural shift in RAC manufacturing to India.

"We have downward revised our earnings estimates for both the companies, Voltas by 25.2% for FY21 and Amber Enterprises by 20 percent and 22 percent for FY21/FY22, respectively. We maintain our 'BUY' rating on Voltas and Amber Enterprises with a revised target price of INR 640 and INR 1500 per share valuing the company at 32x and 20x FY22E earnings (EPS). At CMP, Voltas trades at 31x/22x on FY21/22E EPS respectively and Amber Enterprises trades at 20x/15x on FY21/21E EPS respectively."

Follow our full coverage of the coronavirus outbreak here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.