The S&P BSE Sensex might have just rallied by about 12 percent so far in the financial year 2018, but there were 5 stocks on the BSE which actually gave multibagger returns not just in this fiscal, but in previous two financial years as well.

Although, the saying goes that past performance should not be taken as a barometer of future show, anecdotal evidence suggests that these high-powered stocks have managed to live up to expectations.

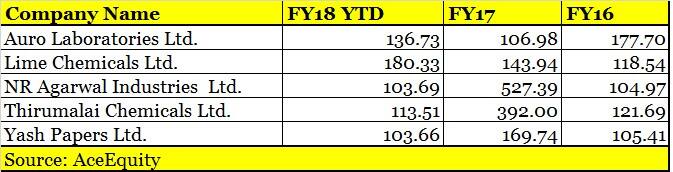

Companies which gave multibagger returns in the last three financial years include names like Auro Laboratories, Lime Chemicals, NR Agarwal Industries, Thirumalai Chemicals, and Yash Papers.

NR Agarwal Industries rose over 500 percent in FY17 while Thirumalai Chemicals rallied nearly 400 percent in the same time frame. Auro Laboratories rallied 177 percent in FY16, Lime Chemicals rose nearly 200 percent, and Yash Papers rallied 169 percent in FY17.

Analysts are not surprised by the relative outperformance of smallcap names which have hogged limelight not just in 2017 but last 5 years as well due to expectations of better growth prospects.

But, as we step into the year 2018, analysts’ are growing cautious on the small and midcap names largely on account of expensive valuations, thanks to multifold rally seen in the last 2-3 years.

Hence, even though the past performance is nothing short of exemplary but analysts advise investors to remain cautious and trade with strict stop losses.

“Smallcap companies witnessed a robust momentum in 2017 delivering about 57 percent on a calendar year basis. Similarly, few microcap stocks witnessed a multifold momentum which delivered more than three digit returns in the same period and beyond,” Dinesh Rohira, Founder & CEO, 5nance.com told Moneycontrol.

“However, given the fact that this company operates on a closed-end business model with uncertain fundamentals, the predictability of future performance remains a blur. Even a short-term correction can trigger a negative sentiment which will potentially erode the wealth,” he said.

Rohira further added that it will be practically inappropriate to gauge a future outlook on the fundamental or sectoral basis for these companies, but it will be more prudent to trade on trailing stop-loss basis. These will enable to sustain on gains and minimizes the loss during the downtrend.

If you hold some of these high-powered multibaggers in your portfolio or even plan to buy one — there is one crucial part of the story which everyone should be aware of and that is these are low liquidity stocks.

FY19 is expected to be a volatile year for equity markets with investors currently adopting a risk-off strategy. Investors should look at investing in stocks which have high liquidity, stable business model, as well as quality management.

“The level of corporate governance and earnings of these companies are also suspect. We have made few observations about these companies which should make investors skeptical about them. For e.g Promoter stake in Lime Chemicals is consistently reducing over last few quarters,” Atish Matlawala, Sr Analyst, SSJ Finance & Securities told Moneycontrol.

“It was 40.49% in June – 17 which came down to 37.45 % in Sep -17, which further came down to 31.31% in Dec -17. In NR Agarwal Industries and Yash Paper, almost entire promoter stake is pledged. Auro Laboratories has never paid any dividend. So except for Thirumalai Chemicals, we would not advice to invest in these companies,” he said.

What to expect from these stocks?Analyst: Ritesh Ashar, Chief Strategy Officer at KIFS Trade CapitalThirumalai Chemicals Ltd is the second largest manufacturer in the domestic phthalic anhydride (PAN) market after IG Petrochemicals. Phthalic anhydride is an ingredient for PVC (Poly Vinyl Chloride) and is also used in construction and electrical insulations.

“Company has posted good numbers in Q3 and expect the same to happen in Q4. One of the main reasons behind the boom in chemical sector is ban in china chemicals capacity due to increased pollution. Thirumalai is quoting at PE of 12x whereas the industry PE is around 50 making it much cheaper as compared to others. Phthalic anhydride (91 percent of FY 2017 standalone sales),” Ritesh Ashar, Chief Strategy Officer at KIFS Trade Capital told Moneycontrol.

“Financials of the company are also in support where from FY 14-18 numbers have been improving. ROE, ROCE, D/E ratios have improved drastically,” he said.

NR Agarwal Industries was in focus sometime back as promoters have released all the pledged shares. “It has borrowed money from BOB where the ROI was 12.25 percent which was reduced to 11 percent thereby reducing the stress on Profit on loss account,” said Ashar.

“Finance cost will be reduced directly impacting the Profitability. The management is also keen on expanding the capacity. Trading at PE of 8 and industry PE at 14 make it cheaper bet and stay invested for better returns. The major turnaround was seen in terms of Profitability in the company from FY13 to FY18. Current EPS – 52.82 and PE–8. On valuations front one can stay invested in the stock,” he said.

Analyst: Soumen Chatterjee, HoR, Guiness Securities.Yash PapersYash Papers Ltd is one of the largest manufacturers of wrapping grades papers in India, with a present installed capacity of 39,100 MT per annum. The Company manufactures MG wrapping papers in both brown and white varieties.

The Net Operating revenue rose 10 percent at Rs 50.11 crore and the Net Profit was up by 218 percent at Rs 5.06 crore. The operating margin improved 160 bps to 19 percent compared to 17.4 percent in the previous quarter.

“The stock is trading at 14.6 times of its trailing earnings. Hold – Industry leading RoE & Operating margin. We expect, Yash to maintain higher operating margin around 19-20% and there will gradual improvement in its debt servicing capacity. Accumulate with Target Price 85 (14.1x of FY19E eps 6),” said Chatterjee of Guiness Securities.

Auro LaboratoriesAuro Laboratories is a manufacturer of Active Pharmaceutical Ingredients (API's), Intermediates and Generic Formulations. The Company’s primary focus has been on Anti-Diabetic Drugs, which is estimated to be one of the fastest growing therapeutic segments.

Auro lab has made its presence felt in international markets with a bulk of its production being exported to South East Asia, Middle East and several European Countries.

“Auro Lab reported excellent Q3 numbers – Pat went higher by 538% at Rs 1.34 cr versus 0.21 cr (YoY) Sharp improvements in Operating performance reported; EBITDA Margin expanded by 210 bps at 15.6% versus 13.5% (QoQ). The stock is attractively priced at 11.6 times of its trailing earnings with superior RoE of over 40 percent. Accumulate,” said Chatterjee.

Lime Chemical LimitedLime Chemical Ltd is the manufacture of "Precipitated and Coated Calcium Carbonate" which is used as basic ingredients across various industries like Plastic, Pharma, and Paint etc.

The company has reported net sales of Rs 13.27 cr during the period ended December 31, 2017, as compared to Rs 11.96 cr during the period ended December 31, 2016. The company has posted a net profit of Rs.2.05 cr for the period ended December 31, 2017, as against Rs.1.38 Cr (YoY).

Chatterjee of Guiness Securities said that the stock is low priced at 5.8 times of its trailing earnings but with Negative net worth. As per the exchange fillings, Promoter holding has come down significantly from 40.49% in June 17 to 31.31% as on 31st Dec 18.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.