As foreign investors took a back seat last month, domestic investors continued pouring funds into mutual funds which took the assets under management (AUM) to a record high of Rs21.4 lakh crore. Total AUM touched a new high, the quickest Rs1 lakh crore jump since February 2015.

According to the Association of Mutual Funds in India (AMFI), the Assets under Management (AUM) of the Indian mutual fund industry came in at Rs. 21.41 lakh crore in October 2017 as against Rs. 20.40 lakh crore in September 2017.

The assets of Equity funds (including ELSS) increased 46 percent on a YoY basis to climb past the 7 lakh crore mark for the very first time, ICRA said in a report.

The total net inflow for October 2017 stood at Rs. 51,148 crore with the maximum inflow of Rs. 40,845 crore witnessed in the Income category.

Equity (including Equity Linked Savings Schemes or ELSS), Balanced and Other ETFs saw inflows to the tune of Rs. 16,002 crore, Rs. 5,897 crore, and Rs. 1,675 crore, respectively.

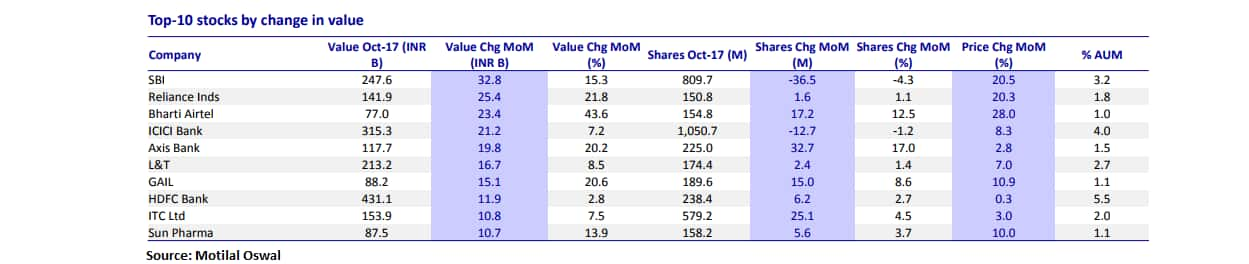

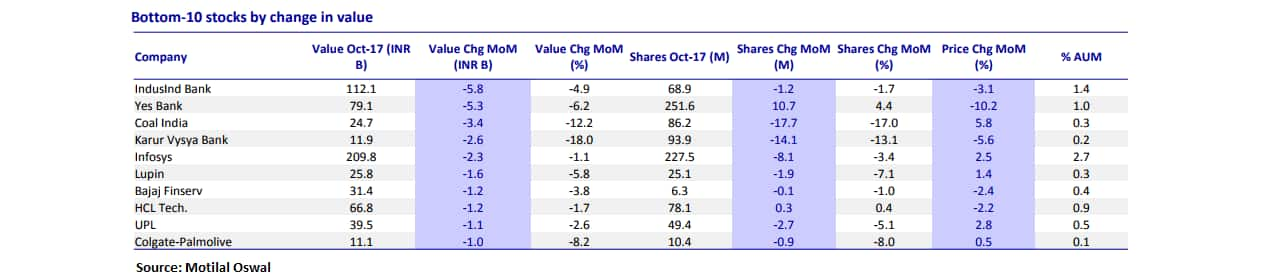

The month saw a notable change in the sector and stock allocation of funds. On a month-on-month (MoM) basis, the weight of PSU Banks, Oil & Gas, Telecom, Consumer, Infrastructure and Real Estate increased, while that of Private Financials, Technology and Metals showed signs of moderation, Motilal Oswal said in a report.

Among the Nifty50 names, stocks which attracted maximum attention from fund managers were banking names. Four out of ten stocks belong to banks, led by State Bank of India (SBI), it said.

SBI saw a value increase of Rs32.8b in October, as the stock was up 20.5 percent. Notably, the stock saw net selling by 14 funds out of the top 20 funds.

HDFC Bank was also one of the preferred stocks among MFs in October, with net buying by 14 funds. Value increased by Rs11.9b, despite the stock remaining flat during the month.

On the losing side, private and some public sector banks, IT and pharma names saw some pullout by fund managers. Coal India, one of the least preferred stocks among MFs in October, saw net selling by 13 funds. Value decreased by Rs3.4b, despite the stock gaining 5.8 percent in the month.

Other prominent losers were IndusInd Bank which saw a decline in value of up to Rs5.8 billion, followed by Yes Bank whose value declined by Rs5.3 billion, and Karur Vysya Bank saw R2.6 billion fall in value, said the Motilal Oswal report.

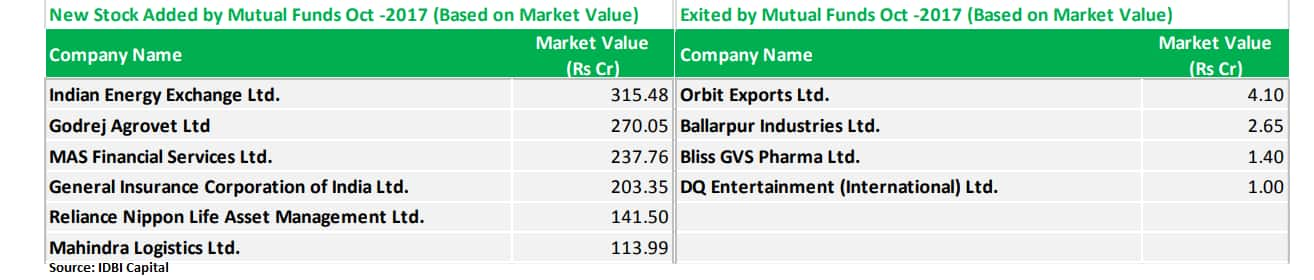

Fresh Additions:

Domestic mutual funds turned out to be net equity buyers for October 2017. Mutual Funds were net equity buyers in 20 trading session for an amount of Rs 9,990.5 crore as against net buying of Rs17,457 crore in Sept 2017.

In October, mutual funds were net buyers in equities for 18 trading sessions and net sellers in the remaining two sessions. Net buying in equities were recorded highest at Rs 1,383 crore on 3rd October 2017; while net selling was recorded at Rs 603.97 crore on 25th Oct 2017.

Fund managers added six stocks to their portfolio for the first time which include names like Indian Energy Exchange, Godrej Agrovet, MAS Financial Services, General Insurance Corporation of India, Reliance Nippon Life Asset Management, and Mahindra Logistics, said an IDBI Capital report.

Some fund managers exited from these four stocks which include names like Orbit Exports, Ballarpur Industries Ltd, Bliss GVS Pharma, and DQ Entertainment Ltd, said the report.

Aditya Birla fully exited from Orbit Exports, Indiabulls preferred to sell out their stake in Bliss GVS Pharma, L&T MF fully exited Ballarpur Industries, and Aditya Birla sold out their holding in DQ Entertainment.

Disclaimer: The above list is for reference and not a recommendation to either buy or sell. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.