Large-cap stocks are clearly leading the momentum on D-Street while the small & mid-cap stocks are catching up but there are some stocks which enjoy faith of top marquee investors such as Dolly Khanna, Ashish Kacholia, and Vijay Kedia.

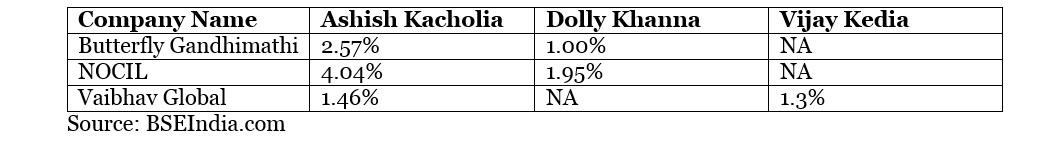

Three stocks which are common in at least two stock portfolios of these three D-Street stalwarts are — Butterfly Gandhimathi Appliances, NOCIL, and Vaibhav Global — which have fallen 5-30% so far in the year 2018.

The media-shy investor, Ashish Kacholia, who is known for picking mid and small-cap stocks early, kept his stake constant in Butterfly Gandhimathi Appliances for the quarter-ended June 30. The stock has fallen a little over 30 percent in 2018.

Butterfly Gandhimathi Appliances is a household cooking appliance manufacturing company. It is the flagship company of the Butterfly group, which was originally incorporated as Private Limited Company on February 24.

The portfolio of Chennai-based Dolly and Rajiv Khanna, who have a reputation of spotting value in small and midcaps, have decreased their stake in as many as 11 stocks including Butterfly Gandhimathi Appliances from 1.42 percent in March to 1 percent in the June quarter.

Another stock which is part of Ashish Kacholia and Dolly Khanna's portfilios is NOCIL. The company is the largest rubber chemicals manufacturer in India with the state of the art technology for the manufacture of rubber chemicals.

Ashish Kacholia has 4.04 percent stake in NOCIL while Dolly Khanna has 1.93 percent stake as of March quarter. The company has not updated its June shareholding data with the exchanges.

The stock that is common in the portfolio of Ashish Kacholia and Vijay Kedia is Vaibhav Global. The company is a multi-national electronic retailer, wholesaler and manufacturer of fashion jewellery and lifestyle accessories.

Both marquee investors raised their stakes in Vaibhav Global in June quarter. Ashish Kacholia raised his stake from 1.45 percent in the March quarter to 1.46 percent recorded in the June quarter.

Vijay Kishanlal Kedia raised his stake from 1.07 percent at the end of March quarter to 1.3 percent in the June quarter.

Disclaimer: The above report is compiled by inputs from Ace Equity database and BSE India. The views and investment tips expressed in this section is only for information and not a recommendation from the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decision.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.