Indian market which was hitting record highs in the run-up to the Budget 2018 came under pressure soon after it got announced on 1st February. The S&P BSE Sensex lost over 1600 points in a matter of 8 trading sessions.

Investors’ lost over Rs4 lakh crore in market capitalization on the BSE for the period starting February 1 to February 12th. The bulls managed to recoup some losses but the word of caution still lingers on.

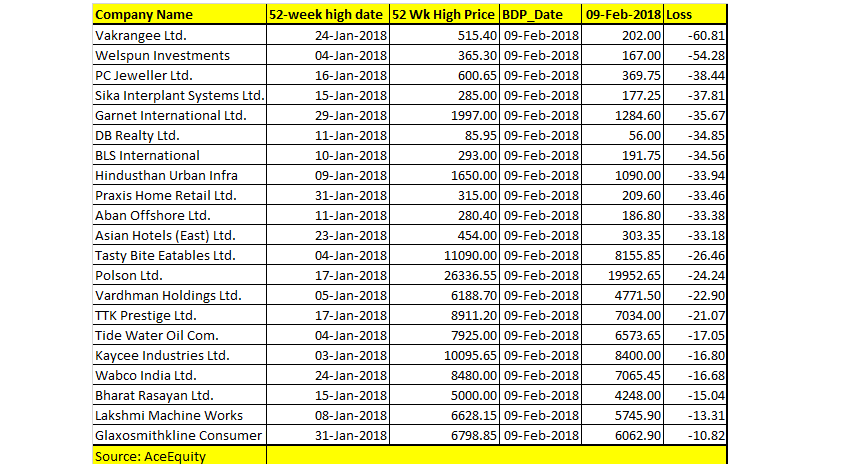

The S&P BSE Sensex might have corrected by 4.6 percent so far in the month of February but there were plenty of stocks which got hammered and fell up to 60 percent from their respective 52-weeks highs recorded in the month of January 2018.

Although most of the largecap stocks braved the fall but quality midcaps failed to stand still and witnessed deep cuts in a matter of days.

Stocks which slipped up to 60 percent from their respective 52-week high include names like Vakrangee, Welspun Investments, PC Jeweller, DB Realty, Aban Offshore, Asian Hotels, TTK Prestige, Tide Water Oil, Wabco India, Bharat Rasayan, and GlaxoSmithKline Consumer etc. among others.

"The correction in the mid-cap and small caps have been a lot more pronounced compared to the large caps. In terms of investment focus, investors should look at shifting out of mid-caps, where valuations are steep, into more sustainable large-cap stocks,” Amarjeet Mayurya of Angel Broking Pvt Ltd told Moneycontrol.

“Strategically, the focus now should be on sectors that are showing good traction in terms of sales growth and profit growth with healthy improvement in operating margins. Investors must also focus on themes like rural spending, discretionary consumption and defense as sound themes for the future,” he said.

After the initial round of selloff, the market seems to be stabalising. The S&P BSE Sensex bounced back in the first two trading sessions of the week largely led by short coverings and stable global cues.

Investors are advised to stay cautious as far as midcap space is concerned and stay with quality stocks rather than looking to catch a falling knife. Investors should use different parameters such as PE Multiple, valuation ratios to find out stocks which are available at decent valuations.

“The basic criteria to select stocks usually when we are looking at market rotation from small to mid-cap or from both of them to large cap is going through time-proven fundamental ratios like PE Multiples, relative valuations and stocks which are available to at discount as compared to their sectoral valuations,” Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

“Any stock that is available at discount in terms of PE multiple and EPS as compared to their sector or incases a peer comparison can also be done to find out the same. There are other tools like relative analysis which can be done by comparing the index to a sector and then to a Stock making it a top-down approach,” he said.

Should one bet on largecaps now?

Largecap stocks are indeed looking attractive if somebody has a holding period of more than one year. However, in the near term, there could be some volatility in largecap space thanks to the exchanges’ action on SGX Nifty data feed.

“The exchanges’ action on SGX nifty data feed is an emerging event with possible ramifications on larger caps that have exposure in the globally tracked indices like MSCI. So there is a bit of volatility expectation there, but advantageous from an accumulate point of view, with a long term perspective,” Anand James, Chief Market Strategist at Geojit Financial Services told Moneycontrol.

“Secondly, midcaps will continue to have GST tailwinds that could ideally reflect in earnings surprises. Now with elections bringing in a bit of uncertainty, the idea would be to recalibrate the investment horizon to a quarter to quarter approach for those stocks where risk capital is employed,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!