Indian market rose effortlessly in the year 2017, thanks to global and domestic liquidity which pushed benchmark indices to record highs. The liquidity rally drove many stocks beyond their historical averages but what will the momentum continue if liquidity tapers?

Most of the high beta stocks saw strong momentum in the year 2017 and is finding favour in the year 2018 as well. But, will it work every time? Well, analysts are of the view that out-of-favor stocks have beaten the benchmark in the last 10 years.

An analysis conducted by Motilal Oswal suggest that over a longer term, neutral to moderately popular stocks delivered significant outperformance, even better the performance of the most popular stocks.

“In this quarter, neutral to moderately popular stocks as well as the most popular stocks failed to beat the benchmark. The most popular stocks delivered the worst return in this quarter, whereas the least popular stocks performed the best,” it said.

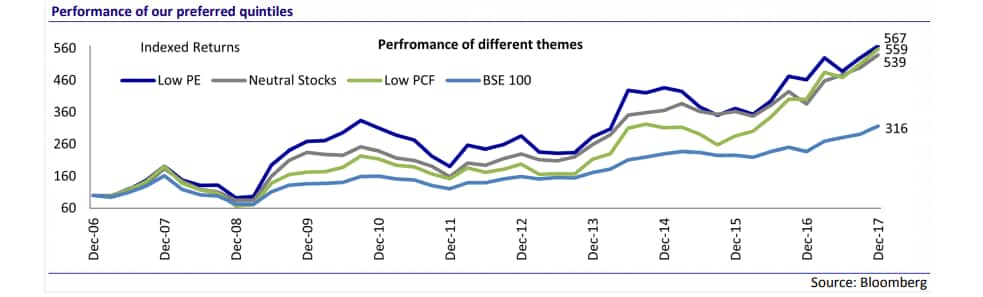

Over the long term, out-of-favor low P/E stocks delivered disproportionate returns, significantly beating the benchmark. In contrast, the performance of high P/E stocks is dismal.

In this quarter, high P/E stocks delivered the best returns, whereas the low P/E quintile failed to beat the benchmark. Similarly, out-of-favor low price/cash flow or P/CF stocks deliver disproportionate returns, significantly beating the benchmark, said Motilal Oswal.

In contrast, the performance of high P/CF stocks is dismal. In this quarter, low P/CF stocks delivered the 2nd best returns, whereas the high P/CF quintile performed the worst.

Motilal Oswal findings suggested that a simple strategy of investing in stocks for which analysts’ consensus has changed from “net sell to net buy” with a holding period of one year has delivered 24.1% annual returns over the last 10 years.

Net Sell to Net Buy stocks for 3QFY18 include names like Jet Airways, Marico, PNB, United Spirits, and Dr. Reddy’s.

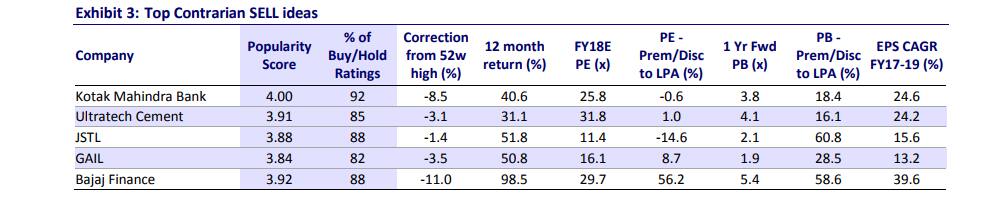

Contrarian sell ideas include names like Kotak Mahindra Bank, UltraTech Cement, JSTL, GAIL, and Bajaj Finance.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.