The broader indices broke a two-week outperformance and ended lower, in line with main indices, in the highly volatile week led by mixed quarterly earnings, inline RBI policy outcome, fear of US recession and geopolitical escalations.

During the week, the BSE Smallcap index, BSE Largecap index and BSE Midcap index shed 2 percent, 1.5 percent and 1 percent, respectively.

This week, BSE Sensex declined 1,276.04 points or 1.57 percent to close at 79,705.91, while the Nifty50 index shed 350.2 points or 1.41 percent to finish at 24,367.50.

On the sectoral front, Nifty Metal and PSU Bank were down nearly 3 percent, Nifty Energy index shed 2.5 percent, Nifty Bank and IT indices were down 1.5 percent each. On the other hand, Nifty Pharma index added 1.5 percent and Nifty Healthcare and FMCG indices rose 0.5 percent each.

Foreign institutional investors (FIIs) sold equities worth Rs 19,139.76 crore, however, Domestic Institutional Investors (DII) bought equities worth Rs 20,871.10 crore.

"The Nifty-50 Index and Sensex declined around 1.5% each in the past week, while the mid-cap index lost around 1.3% and small-cap index lost 2% underperforming large-caps. Market focus has swiftly moved on from the Union Budget, unveiled in the week, to the ongoing QFY25 earnings season and global factors. The market performance was impacted by a confluence of global factors, such as (1) a sharper-than-expected weakening of the US labor markets, (2) a sharp appreciation of USD-JPY, resulting in the unwinding of Yen carry trades globally and (3) increase in geo-political tensions in the Middle East," said Shrikant Chouhan, Head Equity Research, Kotak Securities.

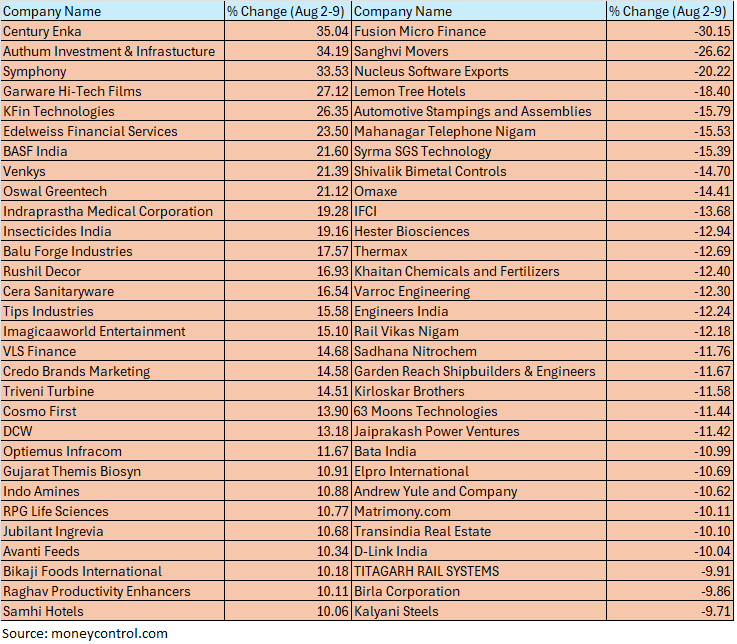

The BSE Small-cap index fell nearly 2 percent with Fusion Micro Finance, Sanghvi Movers, Nucleus Software Exports, Lemon Tree Hotels, Automotive Stampings, Mahanagar Telephone Nigam, Syrma SGS Technology falling between 15-30 percent.

On the other hand, Century Enka, Authum Investment & Infrastucture, Symphony, Garware Hi-Tech Films, KFin Technologies, Edelweiss Financial Services, BASF India, Venkys, Oswal Greentech gained between 20-35 percent.

Looking ahead to next week, momentum could be triggered if prices break out of 24,000-24,400 range. A breakout above 24,400 - 24,450 might generate optimism, potentially filling the recent gap at 24700. However, given the ongoing global uncertainty, any bounce could be an opportunity to reduce long positions.

On the downside, support is seen at 24,100 - 24,000, and a break below this range could lead to further declines in the near term.

Traders should closely monitor these levels and plan their trades accordingly. It's also advisable to focus on stock-specific actions, adopting a selective approach. Since market movements were primarily driven by global cues, it's essential to stay updated on those developments as well.

Amol Athawale, VP-technical Research, Kotak Securities:Technically, the larger texture of the market is still on the weak side. However, as long as it is trading above 24200/79200 the pullback formation is likely to continue up to 20-day SMA or 24,525/80,400. Further upside may also continue which could lift the market to 24625/80800. On the other side, the dismissal of 24200/79200 could accelerate the selling pressure, below which it could slip till 24,00/78,700 or 50-day SMA and 23850/78200.

For Bank Nifty now, 50,000 would be the immediate reference point for the bulls. Above 50000, it could bounce back up to 50,800 and 50-day SMA or 51,200. On the flip side, below 50,000 uptrend would be vulnerable. Below the same, we could expect 49,700-49,500.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.