Infrastructure as a broad segment was always high on the market radar but now it appears that water treatment & distribution segment within the infrastructure space is fast emerging as a hot favourite following some of the announcements made in the Union Budget.

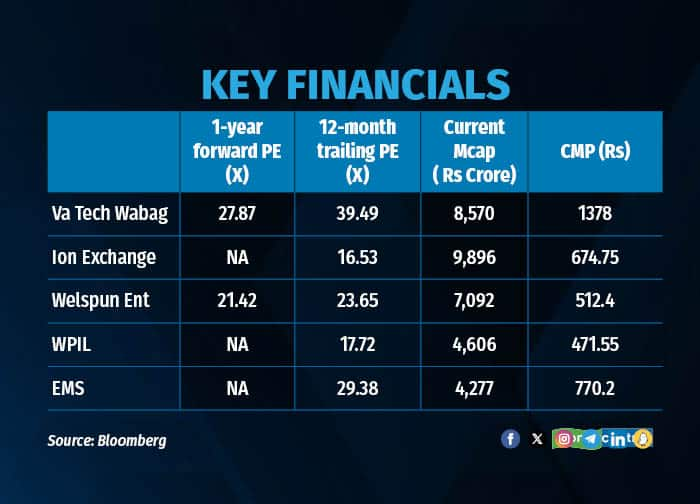

Stocks like Va Tech Wabag, Ion Exchange, Welspun Enterprises, WPIL and EMS Limited are suddenly being talked about in the analyst and investor community and have also been gaining steady ground in an otherwise weak market.

While presenting the budget on July 23, Finance Minister Nirmala Sitharaman said that the Centre will be working in partnership with the state governments and Multilateral Development Banks to promote water supply, sewage treatment and solid waste management projects and services for 100 large cities through bankable projects.

More importantly, the Finance Minister announced a budgetary allocation of Rs 69,926.65 crore for the Jal Jeevan Mission, up from around Rs 69,846.31 crore in 2023-2024. This is the government's flagship mission that aims to provide “functional water connections” to every rural household.

Further, the Department of Sanitation and Water Treatment has received a budgetary allocation of Rs 77,390 crore against Rs 77,032.65 crore in the previous budget (FY23-24).

Also read: Why this water treatment stock merits attention, post Budget“This sector continues to remain under focus as it addresses the basic need for water availability, which the government needs to fulfil,” notes SBI Cap Securities' Sunny Agrawal in a latest report, adding that the schemes will continue to be a priority for the next 3-4 years, as the agenda is still a work in progress.

Analysts further believe that the investment opportunity in India's water and wastewater sector is substantial, with an estimated market size of approximately Rs 25,000-30,000 crore per annum, split roughly 40:60 between water and wastewater.

“Currently, only about 40 percent of sewage is treated, and many cities lack adequate sewerage networks and water supply. India still has a long way to go in enhancing its water infrastructure,” says Arvind Kothari, smallcase Manager & Founder of Niveshaay.

The market is expected to grow by 12-15 percent over the next 4-5 years, according to research done by Niveshaay Investment Advisory. They expect to see investments of around Rs 50,000-60,000 crore in the space through government schemes over the next three years.

“Many companies and sectors will benefit, including those involved in pipe structures, structural tube pipes, and large and small diameter pipes as well as water treatment companies. These companies have strong order books in water treatment or sewage treatment,” says Agrawal.

Here are some of the key players in the segment to keep watch out for.

Ion Exchange (CMP: Rs 674.75): The Mumbai-based company provides solutions for water, wastewater treatment, solid waste management and waste to energy. They offer products and services, including ion exchange resins, water treatment chemicals, and turnkey project execution with industrial, institutional, and municipal clients. The stock has gained around 266.7 percent over the last five years.

Va Tech Wabag (CMP: Rs 1,378): Va Tech Wabag is India’s largest and the world’s third largest water treatment multinational. It specialises in water treatment solutions, offering a range of services including design, construction, and maintenance of water and wastewater treatment plants. The stock has gained around 337 percent over the last five years.

Welspun Enterprises (CMP: Rs 512.4): Welspun Enterprises is a part of the Welspun Group and focuses on infrastructure development with projects such as road construction, water supply, and sanitation. The stock has gained around 365.79 percent over the last five years.

WPIL (CMP: Rs 471.5): WPIL Limited specialises in pumps and pumping systems. It serves a variety of sectors, including water supply, irrigation, power, and oil & gas.

EMS limited (CMP: Rs 770.2): EMS is a multi-disciplinary EPC company which specialises in providing turnkey services in water and wastewater collection, treatment and disposal. Over the last five years, the stock has gained 510.13 percent.

Vishnu Prakash R Punglia (CMP: Rs 225.4) : Vishnu Prakash is an integrated infrastructure company with its principal business operations in the field of water supply, railways, roadways and irrigation networks.

Regarding valuations in this segment, they are not very expensive, though slightly higher compared to other construction sectors due to strong profit and revenue growth visibility, Agrawal notes.

Abhinav Kapadia, Research Analyst- Institutional Equities at Asit C. Mehta Investment Interrmediates concurs, “The sector has seen a significant rally. Valuations are a bit stretched at this point of time. Having said that, if growth is higher than our expectations, companies may see an up move.”

Currently analysts do not see many headwinds for the sector except for slow execution.

“In the past, several significant water projects have stalled due to delays in receiving payments from government authorities. However, this issue has been largely addressed for projects funded by multilateral agencies such as the Asian Development Bank and the World Bank,” says Kothari.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.