Leading IT stocks as well as select pharma, metal and paint companies bore the brunt of analysts’ sell calls in October, as global headwinds, combined with operational challenges, darkened the outlook for these counters.

In contrast, ICICI Bank topped the list of the most sought-after stocks, with the maximum number of "buy" calls, as per Moneycontrol’s Analyst Call Tracker for October.

Team Optimism

Hindalco tops the list of companies with the most optimism, which is based on the percentage share of "buy" calls in analyst recommendations in total.

Analysts believe Hindalco is well-placed in the metals space due a number of factors such as a drop in thermal coal prices and opening of captive mines, rising focus on high-margin value-added products and gradual improvement in per ton EBITDA of its subsidiary, Novelis, led by resilient developed economies and gradual improvement in consumer demand from China.

Also read: Analyst Call Tracker: Strong Q2 performance by RIL leads analysts to upgrade outlook

But it was ICICI Bank that emerged as the company with the most number of "buy" calls, getting the better of previous month’s winner SBI.

India’s second-largest private sector lender clocked a 35.5 percent year-on-year (YoY) rise in standalone profit at Rs 10,261 crore in Q2 FY24, beating estimates. The company’s net interest income (NII) jumped 24 percent YoY to Rs 18,308 crore as bad loan provisions saw a significant drop.

“ICICI Bank has been demonstrating reasonable consistency in sustaining growth leadership across segments, especially in unsecured loans, which has witnessed growth in excess of 35% for six straight quarters, while simultaneously managing a superior asset quality.

“Coupled with incremental investments around digital and physical channels, we are confident of the bank’s ability to drive productivity and efficiency gains on its way to deliver and sustain RoAs in excess of 2%,” analysts at HDFC Securities said.

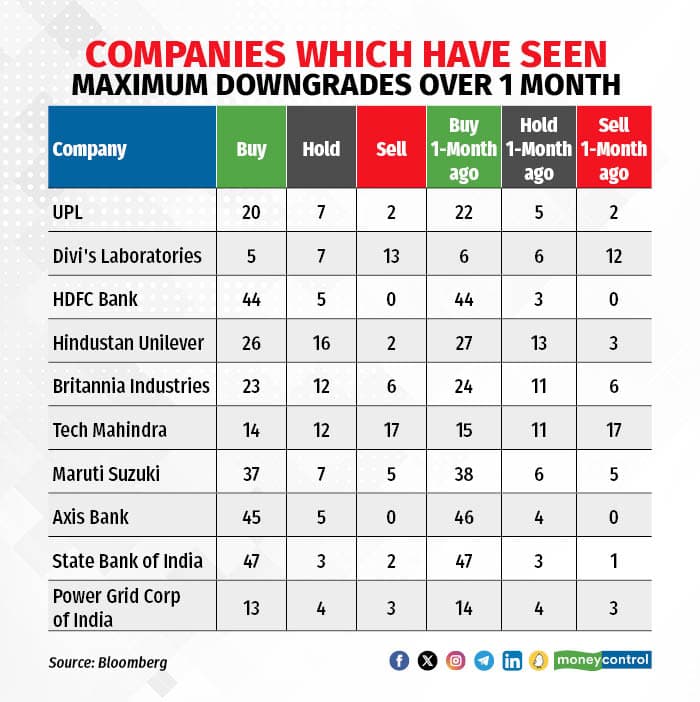

Compare this to the sentiment surrounding HDFC Bank, which features in the list of firms to see the most downgrades over the past quarter as well as over the previous month.

HDFC Bank, which reported its first quarterly results after it merged with the parent Housing Development Finance Corporation (HDFC), posted a net profit of Rs 15,976.11 crore in the July-September period, with an NII of Rs 27,385 crore.

While the Q2 numbers are not comparable to the pre-merger period, HDFC Bank’s management provided proforma numbers for the first quarter to give a sense of how the merged entity would look.

As per an analysis by Jefferies, adjusted for the merger, HDFC Bank’s net profit declined 2 percent sequentially against the reported 33 percent jump.

More worryingly, its net interest margin (NIM) tumbled 70 basis points sequentially to 3.4 percent against the 4 percent-level HDFC Bank has traditionally maintained.

One basis point is one-hundredth of a percentage point. NIM, the difference between what banks offer depositors and what they charge for loans, is a key profitability metric for lenders.

“Once a poster boy for consistency, HDFC Bank has seen it all COVID-19 (concerns on unsecured), management transition, the RBI ban and now merger pangs,” Elara Capital has said. HDFC Bank is facing concerns regarding deserving a premium, post the merger (challenged differentiation unlike earlier cycles). "While merger has its own challenges, we believe these are nearing an end, but HDFC Bank lacks positive triggers. Given near-term concerns, time correction may play through," it added.

Ctrl-Alt-Delete

One look at the pessimism list and it is clear which sector has the most naysayers at the moment. Six out of the total 10 firms belong to the IT industry.

Elevated interest rates and weak consumer sentiment in Western economies, their biggest markets, have continued to slow down discretionary spends, leading to delays in decision-making as well as deal conversions for domestic software services firms.

TCS, the country’s biggest IT company, posted a sequential decline in dollar revenue for the first time since the pandemic-marred June 2020 quarter.

The bigger shock was Infosys slashing its FY24 revenue growth guidance for the second straight quarter to 1-2.5 percent from 1–3.5 percent.

"We continue to believe that Infosys is going through some company-specific issues, exacerbated by weak macros. We, hence, expect Infosys to underperform peers in the near to medium term," said Nuvama Institutional Equities.

Also Read: IT midcaps outshine largecap peers, attract foreign investor attention

However, it is Wipro which is the most unloved stock in the Nifty50. The Bengaluru-based IT major saw its revenue decline for the third consecutive quarter, coming in at $2.7 billion for the July-September period, a fall of 2.3 percent sequentially.

The decline was primarily due to the continued weakness in the banking, financial services, and insurance (BFSI) vertical as well as the company's high exposure to consulting at a time when discretionary spending has plummeted.

Wipro had the weakest growth among its large-cap peers.

Not just that, for the upcoming quarter, the company expects a revenue decline in the 3.5 percent to 1.5 percent range.

“The near-term demand environment remains challenging as the clients remain cautious regarding the evolving macroeconomic situation, especially in the US and Europe; and consequently, we expect muted revenue performance in the near term,” analysts at Yes Securities said.

More than a bite

Another industry titan which found itself at the receiving end of downgrades was Hindustan Unilever.

India’s largest FMCG firm, considered a proxy for the broader consumer trends in the country, raised a huge red flag at the start of the earnings season after it reported an anaemic volume growth of 2 percent.

Also read: HSBC says HUL 'five-year market laggard' now, downgrades to Hold

This was due to a combination of increased competitive intensity (including the re-entry of regional brands) and weak consumer sentiment in some pockets of the economy.

But beyond these near-term challenges, analysts have flagged HUL’s lacklustre show in the recent past. HUL has been a five-year market laggard now, in part due to unwinding of a significant past re-rating phase, HSBC said in a note.

But is there a case for a rebound?

“We see this as less likely and believe stock returns will likely remain lacklustre. Hence, we downgrade the stock to Hold. Upside risk to this view is that HUL’s defensive appeal rises if market becomes extremely risk averse,” HSBC added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.