The electric two-wheeler (2W) industry in India had a roller-coaster year in 2024, filled with highs, lows, and defining moments. From the jolt of subsidy cuts to fierce competition for market dominance and the entry of India's first EV 2W player into public markets, the year showcased India’s growing prominence in electric mobility.

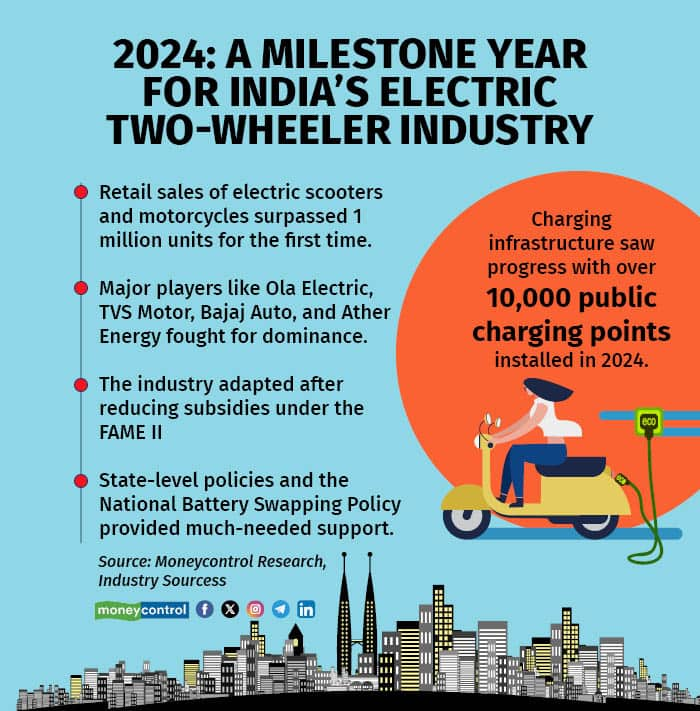

One of the pivotal shifts was the industry's movement away from a subsidy-driven ecosystem following the end of the FAME II scheme in June 2023. Despite initial disruptions, the market stabilized and matured, achieving a historic milestone as retail sales of electric scooters and motorcycles surpassed 1 million units in a single year.

As of November 30, 2024, cumulative EV 2W retail sales had crossed 10.7 lakh units, up 37 percent year-on-year, according to Vahan data. However, November’s standalone sales saw a 15 percent dip month-on-month to 1.18 lakh units, attributed to a post-festive demand slowdown.

Year 2024 in reveiwThe Fight for Market Leadership

Year 2024 in reveiwThe Fight for Market LeadershipIn a hypercompetitive landscape with over 170 players, six original equipment manufacturers (OEMs)—Ola Electric, TVS Motor Co., Ather Energy, Bajaj Auto, and the Greaves Electric-Ampere Vehicles combine—dominated the market.

Ola Electric maintained its leadership position, expanding market share despite subsidy cuts. Aggressive discounts and a rapid expansion of its retail network were key to its strategy. The company grew its store network from 800 to 4,000 outlets.

“With our newly opened stores co-located with service centers, we have redefined the EV purchase and ownership experience. We promised, and now we have delivered! Today marks a significant milestone in India’s EV journey,” Ola’s founder and MD Bhavish Aggarwal said on November 25.

Other players like TVS Motor and Bajaj Auto solidified their positions by introducing diversified models targeting Tier 2 and Tier 3 cities. TVS iQube and Bajaj Chetak gained traction in these regions, which are emerging as EV growth hotspots.

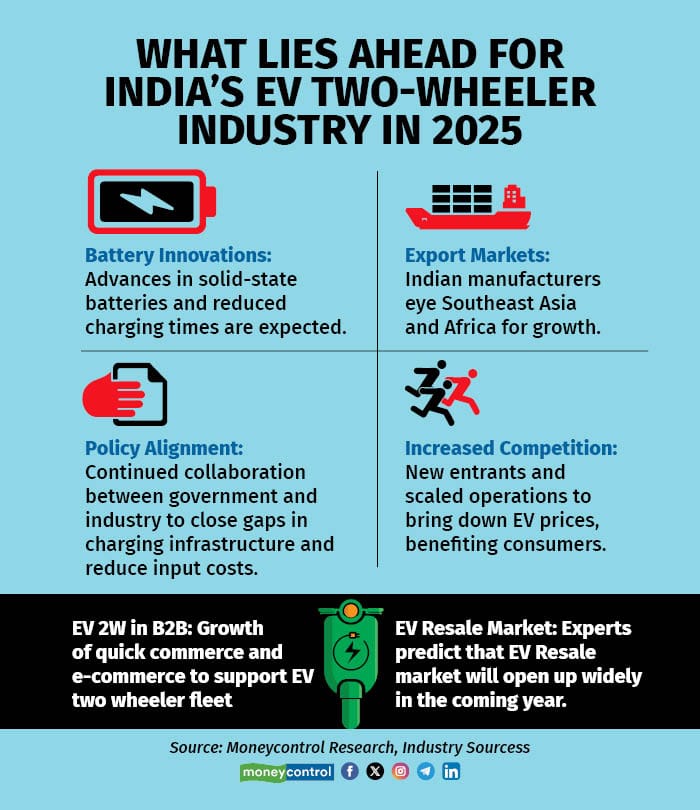

Ather Energy focused on technology upgrades, such as improved battery efficiency and connectivity features, enhancing its appeal. “You will see market share becoming even more competitive in 2025 as players adopt aggressive strategies to expand EV adoption across India,” an industry insider noted.

2024 also marked a turning point in India’s EV 2W sector, with Ola Electric’s IPO raising Rs 6,000 crore at a valuation of nearly $7 billion. This landmark listing reflected strong investor confidence in the sector.

Ather Energy announced plans to go public, signaling the maturing ecosystem. However, overall EV investments declined, from $808 million in 2023 to $586 million in 2024 (YTD).

VC Investments in EVs

VC Investments in EVsExperts noted a shift in funding priorities toward infrastructure players like Battery Smart and Exponent Energy, which raised funds for fast-charging and battery-swapping solutions.

“Even though we saw lower investments, newer players emerged and apart from just OEMs players like Exponent and Battery Smart raised significant funds. Showing investors interest in the overall ecosystem,” An active EV sector investor told Moneycontrol.

Investment in EVsCharging Infrastructure: Progress and Challenges

Investment in EVsCharging Infrastructure: Progress and ChallengesCharging infrastructure remained a priority. The Union Budget 2024 emphasized expanding EV manufacturing and charging networks, with programs like 'Charging Bharat' enabling the installation of over 10,000 public charging points. Ola Electric also committed to deploying 10,000 chargers by the year’s end.

Exponent Energy introduced fast-charging networks for commercial EVs, further driving adoption. However, challenges like range anxiety and lack of standardization persist, particularly in remote areas.

Battery swapping also gained momentum, with solutions aimed at improving urban mobility. Pulkit Khurana, co-founder of Battery Smart, said, “Strengthened infrastructure and government support have accelerated EV adoption in smaller cities. Battery swapping, especially for two- and three-wheelers, has emerged as a game-changer.”

Policy LandscapeThe policy environment was a mixed bag. The central government reduced FAME’s allocation by 44 percent to Rs 2,671 crore for FY25, down from Rs 4,807 crore in FY24. However, the PM E-DRIVE scheme, with a Rs 10,900 crore outlay, aims to support EV adoption until 2026.

"Government initiatives like the PM E-Drive scheme have played a pivotal role in making EVs more accessible and cost-effective compared to ICE vehicles. However, the much-anticipated FAME III scheme remains a key piece of the puzzle. As we step into 2025, the industry is poised for even greater strides, and I believe the next big milestone will be achieving 1 million sales solely within the 2-wheeler category," said Suhas Rajkumar, CEO and Founder, Simple Energy.

State-level policies provided a silver lining. Tamil Nadu, Karnataka, and Maharashtra introduced incentives like tax rebates and subsidies on charging infrastructure. The National Battery Swapping Policy was also announced, but its lack of implementation timelines left stakeholders skeptical.

Bounce co-founder Vivekananda Hallekere said, “We need a stable, long-term policy. Whether subsidies are available or not, certainty is crucial for planning and growth.”

Trends to Watch in 2025As the EV 2W industry moves into 2025, key trends are set to shape its trajectory:

Key Trends in 2025 to lookout for

Key Trends in 2025 to lookout forQuick commerce and last-mile delivery players will increasingly adopt EV fleets to cut costs and emissions. “Bounce and others are tailoring vehicles for the growing quick-commerce segment. The B2B side will pick up significantly by atlast 3X to 4X,” Hallekere added.

Mainstream financing players are expected to make EVs more accessible, boosting adoption. Niche models like battery-as-a-service will also gain traction.

"We foresee a growing interest in electric fleets and corporate EV adoption. As such, our approach as the EV financier will continue to be customer-centric, ensuring that financing options are not just accessible but tailored to meet the specific needs of every segment," said Kapil Garg, MD of Mufin Green Finance.

"EV financing has made significant strides this year with many innovative solutions coming into the picture. What stood out the most is thr Battery-as-a-Service model because it actually makes EVs cost of ownership lesser than its ICE counterparts from day," said Xitij Kothi, co-founder of EV startup Vidyut. Pricing will also play a key role in increasing adoption.

Kothi also added tht there is rise in interest within the EV resale market. “ We are seeing consumers getting more resale value of EVs and this market will result in more players and business models coming in”.

"OEMs are integrating BaaS as a core offering in their product launches. It is now a USP for many vehicles specially in the personal vehicle segment. The coming year will definitely see more customers adopting this vehicle and realise its true value," Kothi added.

Battery technology advancements will help in improved range and cost reductions will unlock new business models, such as leasing and swapping.

With domestic competition intensifying, more players will explore export markets, leveraging India’s manufacturing strengths to meet global demand.

EV makers are also seeking a GST tax structure relief from the government.

"Looking ahead to 2025, resolving the inverted GST structure in the two-wheeler segment is crucial. While the lower 5% GST on EVs encourages adoption, the 18-28% GST on raw materials creates high working capital demands, increasing costs unnecessarily," said Madhumita Agrawal, Founder & CEO, Oben Electric.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.