Software as a service (SaaS) platform Zoho, and stock broking firm Zerodha reported sharp growth in their earnings once again for the latest financial year (FY2021-22) as the two bootstrapped start-ups became the most profitable new-age companies in India for the period.

Zoho and Zerodha, have stayed away from private equity and venture capital (PE/VC) funding, and are thus considered to be anomalies in this era when new-age technology companies are chasing high valuations and in the process are incurring heavy losses.

Moneycontrol has compiled data on at least 50 unicorns that have filed their FY22 results with the Ministry of Corporate Affairs (MCA), and according to the data, Zoho and Zerodha are the most profitable new-age technology entities.

Founded in 1996 by Sridhar Vembu and Tony Thomas, Zoho provides operating system software for businesses, software for customer relationship management, human resource management, enterprise collaboration platform, and goods and services tax-compliant accounting software. The company has business in over 150 countries and has built a user base of over 80 million in the last 25 years of operations.

A comparatively newer entity founded in 2010 by Nithin Kamath, and Nikhil Kamath, Zerodha is one of the largest stock brokers in India, with a user base of more than 9 million as of FY22. The company said it has an active user base of 6.2 million.

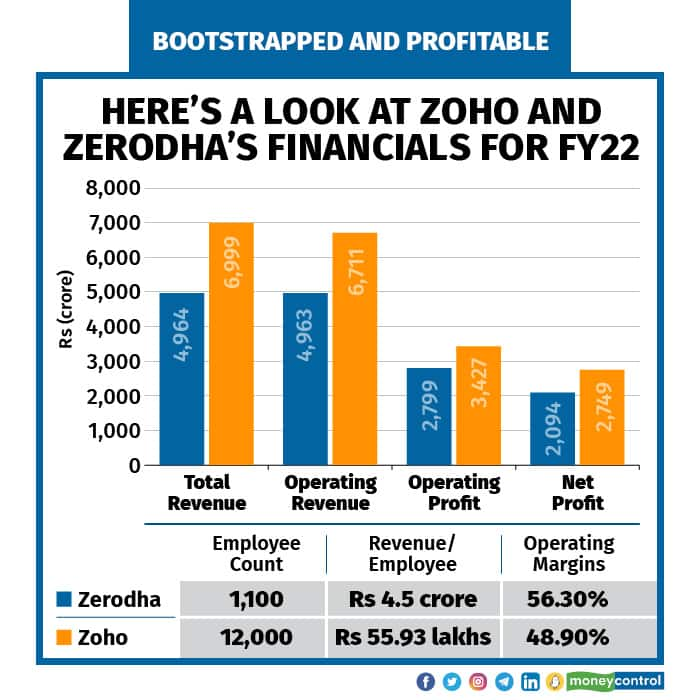

Here’s a quick look at Zoho and Zerodha’s FY22 financials, which were filed earlier this month:

Bootstrapped and Profitable: Zoho and Zerodha (GFX Credits: Sanjit Kumar)

Bootstrapped and Profitable: Zoho and Zerodha (GFX Credits: Sanjit Kumar)

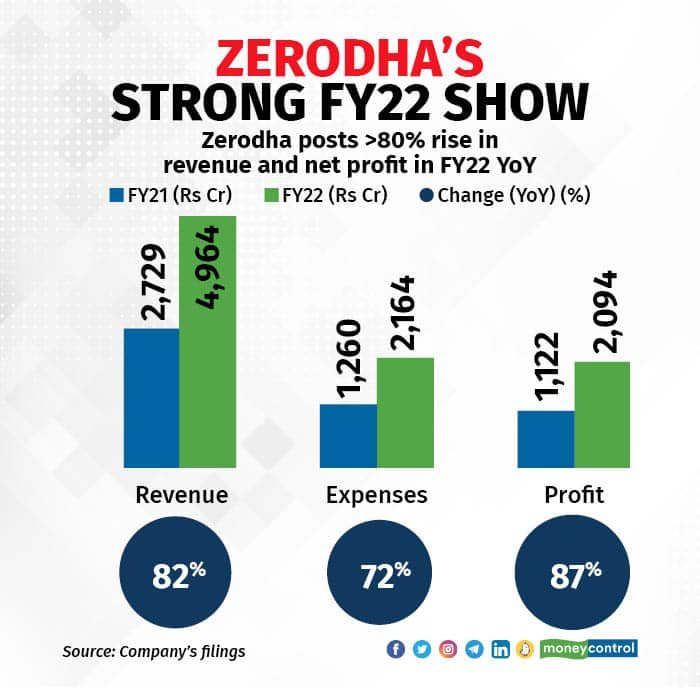

Strong revenue and profitability growth

Zoho’s revenue from operations was up 28 percent to Rs 6,711 crore in FY22 from Rs 5,230 crore in FY21, as per its filings with the Registrar of Companies (RoC) on January 28. Its top line stood at Rs 6,999 crore.

The company reported a consolidated net profit of Rs 2,749 crore in FY22, up nearly 43 percent year-on-year (YoY) on the back of the rise in its revenue from enterprise IT management software business.

Meanwhile, Zerodha reported a consolidated net profit of Rs 2,094 crore in FY22, up 87 percent from Rs 1,122 crore in FY21, the company's regulatory filings with the MCA showed.

The company's operating revenue surged 82 percent to Rs 4,963 crore in FY22 from a year earlier, according to the filings, while its top line stood slightly above, at Rs 4,964 crore.

According to estimates, while the former operates at a margin of 48.9 percent, the latter has an operating margin of 56.3 percent.

With a large workforce of over 12,000 employees, Vembu’s Zoho earns Rs 55.93 lakhs for every individual it employs, while Zerodha earns Rs 4.5 crore each for about 1,100 employees.

Zoho and Zerodha’s robust profitability attains significance as it comes at a time when many new-age start-ups backed by VC firms are facing scarcity of capital amid a funding slowdown, thanks to their cash-guzzling models that chase growth over profitability.

According to media reports, while Zoho and Zerodha topped the charts, other start-ups that were bootstrapped and profitable include gaming platforms GamesKraft and Gameberry, SaaS start-up Wingify and direct-to-customer brand Noise.

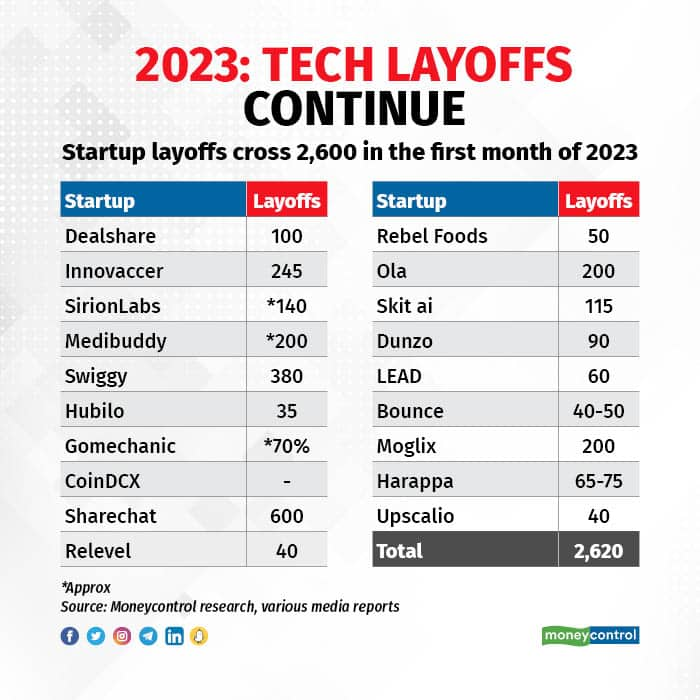

Start-ups that have reported high burn and huge losses are taking up measures like layoffs and restructuring in an attempt to cut costs and extend their runway until the next funding round comes to their aid. Notably, about 20 start-ups in India have laid off over 2,600 employees in the first month of the year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!