Krishna Karwa

Moneycontrol Research

Highlights:

- Reliance Retail will be pivotal to Reliance Industries’ re-rating

- The retailer may be worth as much as half of its parent, Reliance Industries

- Benefits of wide network and multiple product offerings will boost sales

- Economies of scale should yield better margins

- Organised retail, as an industry, is well-poised to grow consistently

--------------------------------------------------

Reliance Retail (RR), India’s largest retailer by revenue and network, has been on an upward trajectory over the years. Going forward, this vertical, along with Jio (the cellular telecommunications arm), is expected to contribute meaningfully and substantially towards Reliance Industries’ overall growth and re-rating.

In the quarter gone by, RR’s revenue growth was attributable to availability of more product offerings, a 21 percent year-on-year (YoY) growth in store footfalls (due to the festive season), healthy same-store sales and outlet additions. Bulk sourcing of goods (results in cheaper costs), high sale volumes and cost management measures aided margin expansion.

What is driving Reliance Retail’s hyper growth?

- India has a large population base across geographies, which provides ample opportunities to explore new regions and gain market share in the existing ones. Since retail is a consumer-facing business, the growth potential is secular too.

- Since B2C (business-to-consumer) segments such as retail are steady in nature and also happen to be less susceptible to economic/global/commodity uncertainties in comparison to the B2B (business-to-business) segments (such as refining, petrochemicals, oil and gas), prospects of revenue and earnings visibility generally tend to be better.

- A diversified portfolio of products and brands, besides enhancing RR’s visibility, ensures that risks associated with overdependence on one category or seasonal buying trends thereof are reduced.

- RR’s loyalty programmes, which already cover the most number of members in India (over 50 million as on 31st December 2018), have been growing by the day. Periodic introduction of schemes and extended 'end of season sale’ periods result in better conversion-to-footfall ratios.

- RR has been on an expansion spree that's more aggressive than any other retailer. Despite a growing base, it has been able to grow its revenues noticeably quarter-on-quarter.

As on 31st December 2018, RR’s presence spans over 6,400 cities and towns across India. The company operated 9,907 retail stores (across categories) and 514 petro retail outlets. This is considerably higher than Future Retail, which operates nearly 1,400 stores in 400 cities.

- Strong logistical, warehousing and distribution capabilities have enabled RR to reach out to markets pan-India. RR’s warehousing space increased from 5.6 million square feet for the quarter ended September 2016 to over 8 million square feet as on 31st December 2018. The company has over 100 distribution centres situated in 23 states.

- In verticals such as telecom and oil, capital investments are significantly higher, gestation periods are longer, project returns are dependent on numerous parameters (qualitative, regulatory and quantitative) and there could be hindrances in scaling up operations or optimising processes. In comparison, retail is much easier to grow with few entry or operational barriers.

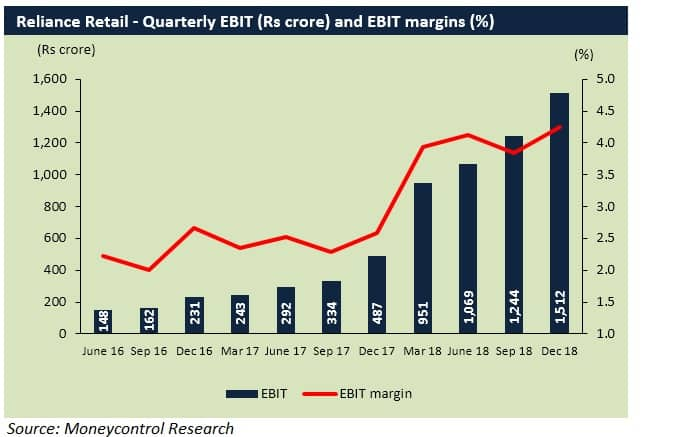

- Benefits of scale and impetus towards efficiencies have helped RR earn better margins over the quarters. A consistent improvement in profitability is indicative of RR’s ability to derive operating leverage sustainably.

- RR is also well-positioned to use Reliance Jio’s robust pan-India coverage (approximately 280 million subscribers as on Q3 FY19-end) and rapid growth (in terms of subscriber additions) to target new customer acquisitions, promote offers/discounts and bolster its presence in the online retail space. Simultaneously, the company is investing heavily in its marketplace-like platforms (such as ajio.com, reliancesmart.in, reliancetrends.com) to drive convenience shopping sales.

How Reliance Retail can unlock value for Reliance Industries?

Mukesh Ambani, in his address to Reliance Industries' shareholders in the FY18 annual report, set his vision to ensure that the revenue contribution of consumer-centric segments (Reliance Retail, Reliance Jio) is on par with the non-consumer ones (refining, upstream oil and gas, petrochemicals) over the next decade.

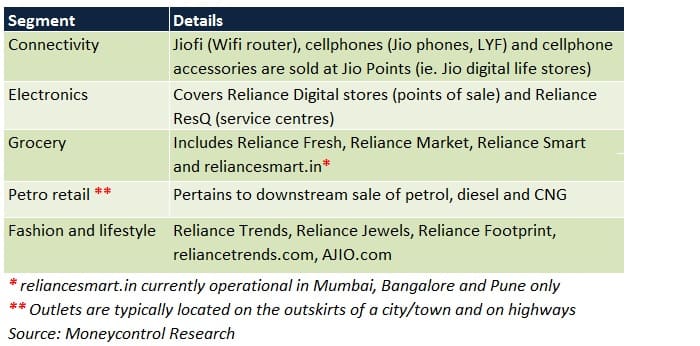

RR has been one of the key drivers behind the conglomerate’s growth. On the back of a slew of initiatives across all segments (grocery, fashion, electronics, fuel retailing, connectivity), established omnichannels (ie. a blend of online and offline retailing), wide store network and private label brands across a series of price points, RR is already a force to reckon with in terms of its top-line.

If RR’s margins continue to witness an uptick and free cash flows also remain positive (in spite of heavy investments in infrastructure), it could command premium valuations in due course. This will, undoubtedly, have a positive rub-off on Reliance Industries’ valuations as well.

Today, RR’s contribution to Reliance Industries’ overall EBIT is not significant - close to 8 percent. This figure masks the value of a business that is waiting to get unlocked. If one conservatively assumes a market cap to sales multiple of 3 times for the retail business, on an annualised revenue basis, the value of RR works out to Rs 3,75,612 crore. This is nearly 49 percent of Reliance Industries' latest market capitalization. Should this value get unlocked, the re-rating potential for Reliance Industries may be significant.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!