When we consider any asset class, we often view it as a store of wealth. The fundamental question we ask is simple: Will this asset retain its value over the next 5, 10, 15 or even 50 years, or will it lose its worth? The general principle is clear: If an asset can be produced in infinite quantities, its value will eventually diminish. However, if an asset is limited in supply and holds intrinsic utility, it is more likely to retain its value.

Gold has maintained its value over millennia because it is a finite resource with intrinsic qualities that make it valuable. Unlike paper currencies or stocks, gold is not tied to the economic performance of any single country or company. Its long-standing role as a store of value and a hedge against inflation makes it a preferred asset during periods of economic or geopolitical instability.

Also read | Gold nears Rs 90,000: Time to buy, hold, or book profits?

Legendary Investor Ray Dalio and his firm Bridgewater Associates are long-term advocates for gold and they also hold gold as an investment in their all-weather portfolio.

"Gold is the ultimate store of value because it is the only asset that is not someone else's liability. It is the only asset that has been a store of value for thousands of years.” - Ray Dalio

Gold and Indian equities

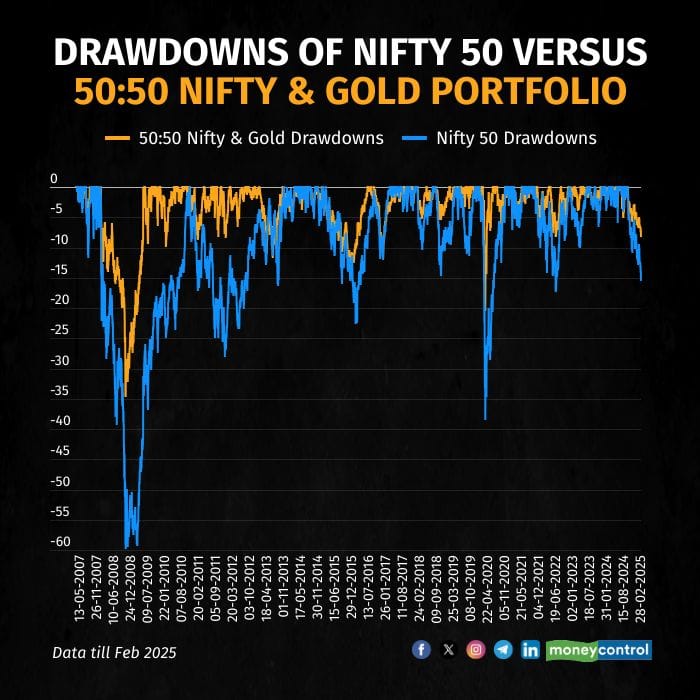

Historically, equities and gold have exhibited either low or inverse correlation. Consider the following data comparing the returns of the Nifty 50 index against a portfolio that equally divides its holdings between the Nifty 50 and gold.

From April 2007 to February 2025, the Nifty 50 index has generated a return of 10.51 percent with a -59 percent drawdown, while the portfolio of Nifty 50 and gold returned 12.30 percent with a significantly better drawdown of -34 percent.

What this demonstrates is that investors in the Nifty 50 have seen almost identical returns as those holding an equally divided portfolio of Nifty 50 and gold but with nearly double the risk.

This simple analysis highlights how gold contributes to diversification and reduces the overall risk of a portfolio. The inverse correlation between gold and equities is also evident, and there are logical reasons behind this.

1. Risk-off sentiment: During economic downturns or times of financial crisis, investors and the public lose confidence in government-backed assets and prefer shifting their capital to hard assets like gold.

2. Currency weakening: When an economy is underperforming, the national currency typically weakens. This leads to a rise in gold prices, as investors seek a store of value that is not subject to the fluctuations of the local currency.

Gold as a hard asset and its key role in the monetary system

One of the key features that sets gold apart from other investment assets is its classification as a hard asset. Hard assets are tangible resources that hold intrinsic value and are not reliant on any financial system or credit risk.

A significant moment in the history of gold came in 1971, when Richard Nixon as the US president at the time made the landmark decision to abandon the gold standard. Prior to this move, the US dollar was directly tied to a specific amount of gold, meaning the government needed to hold gold reserves equivalent to the amount of currency in circulation. This system helped stabilise the dollar's value and instilled confidence in the US economy.

Also read | Is the road ahead looking rough for tech funds?

However, in August 1971, Nixon announced the suspension of the dollar's convertibility into gold, effectively ending the Bretton Woods Agreement and ushering in the era of fiat currencies. This transition fundamentally altered the relationship between gold and the global economy.

Following the end of the gold standard, prices of the metal surged. The uncertainty surrounding the future value of fiat currencies, combined with growing concerns about inflation, led investors to seek gold as a safe haven. Between the 1970s and 1980, gold prices skyrocketed from approximately $35 per ounce to over $800 per ounce, fuelled by fears of inflation, economic instability and a weakening US dollar.

Conclusion

Given the rising debt levels in the US and increasing global uncertainty, gold is expected to play a crucial role in future portfolios. While gold may not be a wealth-creation asset in the traditional sense, it remains an essential tool for diversification and capital protection. There are times for wealth creation, and there are times for capital preservation. Striking the right balance in your portfolio is key to successful long-term investing.

Also read | Why are investors moving to focused funds amid market correction?

The author is partner and fund manager at Qode Advisors

Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!