Gold prices in India are nearing the record Rs 90,000 per gram level after surging past the $3,000 per ounce level in the international markets amid safe-haven buying as investors turned positive on exchange-traded funds (ETFs) due to uncertainty and recession fears in the US.

As per India Bullion and Jewellers Association, Gold (999 purity) was trading at around Rs 88,100 per 10 gm level on March 17, 2025.

Over the last week, spot gold price in India has surged around 3 percent driven by uncertainty over US tariffs, trade tensions and growing expectations of monetary policy easing by the US Federal Reserve.

“Trump's tariffs are widely expected to fuel inflation and economic uncertainty and have prompted gold to reach multiple record highs in 2025. Gold is seen as a hedge against political risks and inflation,” said Prathamesh Mallya, Deputy Vice President-Research, Non-Agri Commodities and Currencies, Angel One.

Also read | Is the road ahead looking rough for tech funds?Factors working in favourThe accumulation of gold reserves by central banks across the globe, inflation concerns, and rising demand after the pandemic have helped in the surge in gold prices.

According to Chirag Mehta, Chief Investment Officer, Quantum Mutual Fund, gold's ascent in 2025 has been nothing short of impressive, reaching nine new record highs year-to-date, despite occasional price volatility.

“Since the onset of his campaign, President Trump has consistently promoted the ‘America First’ policy, with imposing tariffs on foreign nations being a central aspect of his economic agenda. These persistent trade tensions heightened concerns about a potential economic slowdown, prompting investors to flock towards assets like gold,” said Mehta.

While gold has not been a direct target of tariffs, market reactions to trade uncertainty have driven a significant shift in trading behaviour and impacted the gold price.

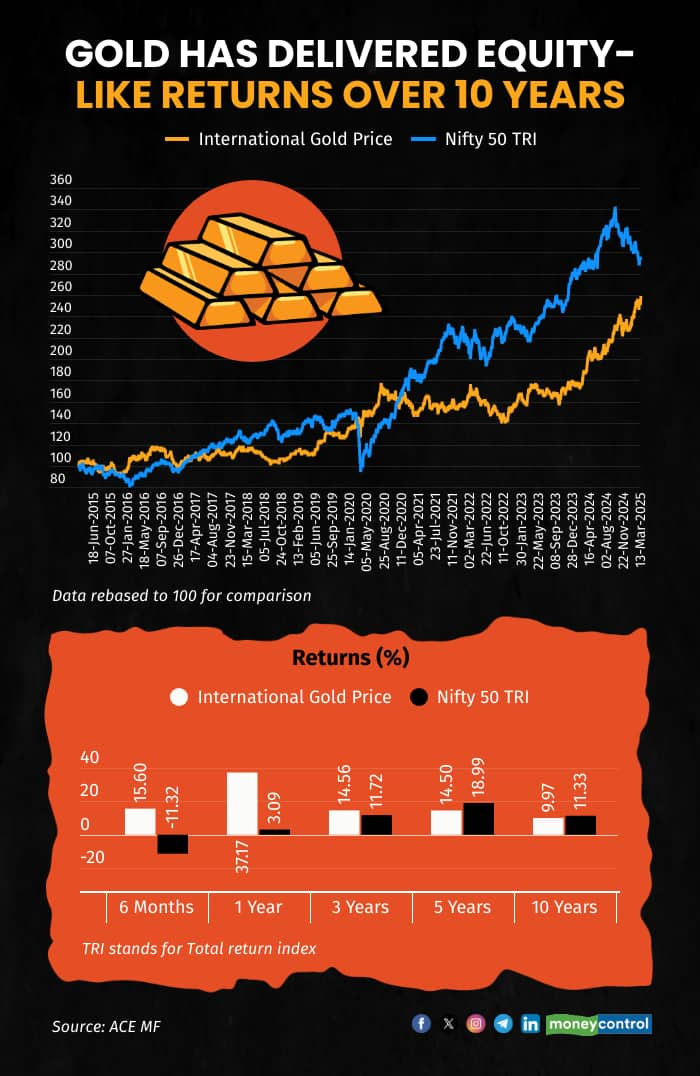

Data till March 13, 2025Outlook for gold

Data till March 13, 2025Outlook for goldIn 2024, gold delivered over 20 percent returns compared to Nifty’s 8.7 percent, further boosting investor interest in the yellow metal.

Meanwhile, early signs of cooling inflation in the US and India have made the way for further rate cuts in 2025.

“When there is an expectation that the interest rate can decrease, people will tend to move towards gold to grab higher returns. It is expected that the gold rally will continue in 2025 until and unless there is a sign of cooling down of broader market volatility,” said Ajay Garg, Chief Executive Officer, SMC Global Securities.

Also read | Why UAE’s golden visa is the top choice for global millionairesFurther, a combination of economic slowdown and job market troubles in the US is whipping up fears of stagflation, which could lead to long-term inflation.

“Gold likes inflation but doesn’t like the higher rates or the strengthening US dollar. No wonder that gold achieved its milestone of $3,000 an ounce and the outlook is brighter with an 8-10 percent further upside,” said NS Ramaswamy, Head-Commodity Desk, Ventura.

What should investors do?As per Quantum MF’s Mehta, in the long term, the policies implemented by central banks are likely to have a profound impact on the gold market.

“Should central banks continue to adopt accommodative monetary policies in response to ongoing economic challenges, this could provide additional support for gold prices,” he said.

Yash Sawant, Commodity Fundamental Analyst at Choice Broking believes the US Federal Reserve’s FOMC meeting on March 18-19 will be pivotal in shaping gold’s near-term trajectory.

“Investors should tread with caution, considering a strategic approach—accumulating on dips rather than chasing momentum, as policy signals and macro risks continue to evolve,” Sawant said.

Also read | Why are investors moving to focused funds amid market correction?SMC Global Securities’ Garg warns that some profit-booking from investors can add to the volatility in gold prices in the near future. “At this time, investors should follow their diversification strategy and may consider investing in gold instruments to manage risk in the long term,” he said.

As inflation and market volatility challenge global economies, gold offers stability and a hedge, making it an ideal option for long-term wealth preservation.

Gold acts as a hedge, and therefore, one may have around 5-10 percent allocation to it. However, understand that gold is volatile too; there are known long periods in history when gold hasn't moved. Experts also warn against going extra bullish on gold at higher levels.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.