Bucking the downtrend in mutual fund inflows, the focused fund category was the only equity fund segment to log a rise in net flows during February.

During the last month, when equity-oriented mutual fund schemes saw a 26.17 percent drop in inflows to Rs 29,303 crore, net investments into focused funds surged 64.45 percent, data from the Association of Mutual Funds in India (AMFI) showed.

Albeit a small number, net inflows into focused funds came in at Rs 1,287.72 crore in February against Rs 783.07 crore in the previous month.

This rise came at a time when Indian equity benchmarks Sensex and Nifty crashed close to 6 percent each during the month and inflows into smallcap, midcap and largecap funds slumped up to 35 percent.

Also read | SIP inflows drop to 3-month low of Rs 25,999 crore in FebruaryWhat are focused funds?Focused funds are equity mutual funds that concentrate their investments in a select group of 20 to 30 stocks, rather than spreading assets across a wide portfolio. This is much lower than that of categories like flexicap, largecap and midcap funds, which can have around 50-70 stocks. This strategy emphasises high-conviction picks, aiming to maximise returns through targeted investments.

With the ongoing market correction, will more mutual fund investors move towards focused funds?

Neglected category

The combination of strong performance in midcaps and smallcaps and increased investor interest in thematic funds contributed to the net outflows from focused funds since January 2023.

In fact, over the last two years from February 2023 to February 2025, focused funds was the only category to see net outflows of Rs 1,821 crore.

“Over the past two years, midcap and smallcap funds have delivered strong returns, leading investors to exhibit recency bias, a tendency to chase recent top-performing asset classes. As a result, many investors reallocated their funds from focused funds into mid and smallcap funds, seeking higher returns. Additionally, thematic funds have attracted significant inflows due to the launch of multiple new fund offers (NFOs) in this category,” Feroze Azeez, Deputy CEO, Anand Rathi Wealth.

Also read | Momentum versus value: Finding the balance in risk-conscious investing

In the last three months, net inflows into largecap funds rose by 11 percent, while focused funds saw a 67 percent increase. However, due to market volatility, net inflows into midcap funds declined by 43 percent, and smallcap funds saw a 10 percent decrease.

Trideep Bhattacharya, Chief Investment Officer-Equities at Edelweiss Mutual Fund, explains the reason behind the shift, “When the business cycle is doing well, in the sense when earnings momentum is broad-based, stocks across the market-cap segments do well. This means that broader strategies with a greater number of stocks tend to do better or outperform strategies with a lesser number of stocks.”

However, as we get into a tough phase of the economic cycle, whether it is a mid-cycle slowdown or later stages of an economic cycle, the economic momentum narrows down.

“Then economic momentum gets limited to a few stocks. What tends to work in these circumstances is high conviction bets on a few stocks rather than a broad-based strategy with multiple numbers of bets straight across multiple names,” said Bhattacharya.

According to Azeez, focused funds have a higher allocation to largecap stocks and in times of volatility, investors prefer higher stability by opting for largecaps.

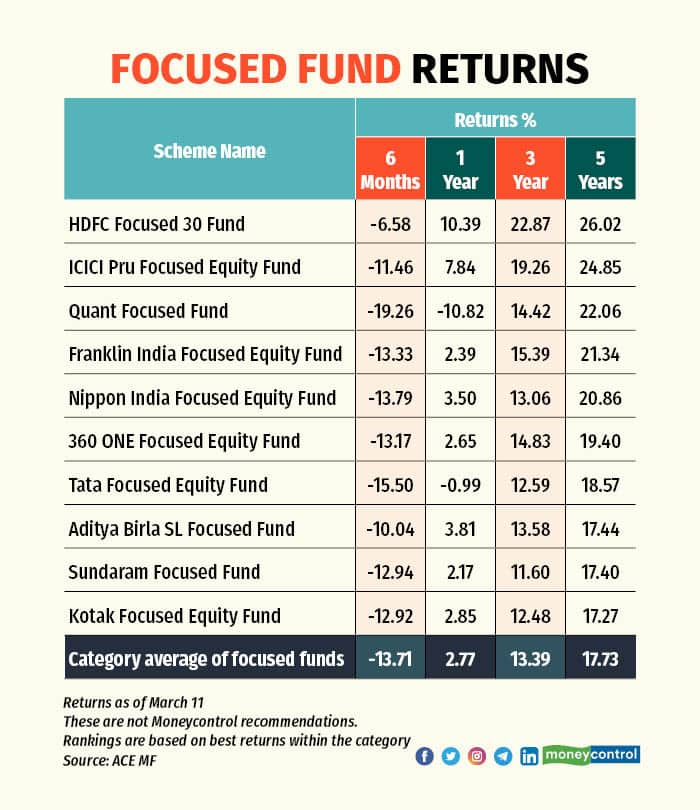

Also read | Passive funds fail to cushion market correction, active strategies outperform“Another reason could be recency bias, as we can see against the other diversified categories which are largecap oriented focus category have been on the top in terms of performance and investors tend to buy past performance,” Azeez added.

Focused funds are also more flexible than other categories from a fund management perspective like a flexi cap which has also seen the highest inflow this month.

The focused fund category has shown a consistent monthly increase in net flows since November with the highest growth in February.

Bhattacharya believes that focused funds are likely to remain in the spotlight going ahead. “Markets will do what they do, but if the economic cycle remains weak, then you will see focused funds shine relatively better versus other categories," he said.

However, with market corrections, experts do not expect investors to shift entirely to focused funds but rather to categories that offer fund managers a greater scope for active management.

Also read | Here's why a shift in wealth-creation strategy is needed under new tax regime“Also, in times of volatility, investors are more likely to move towards the “safer” options such as largecap funds, flexicap funds and dividend yield funds. Currently, there are 29 funds in this category (focused funds) and the majority of them have exposure to largecap stocks. Thus, we are expecting investors to not go all out and invest in this category yet increase allocation partially due to their largecap bias and recent historical performance,” Azeez said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.