The Rs 40-trillion Indian mutual funds (MF) industry has seen many instances of fund managers moving on to set up their own portfolio management service (PMS) or alternate investment fund (AIF) offices.

Tracking net asset values (NAV) on a daily basis, performances on a monthly basis, trying to keep ahead of intense competition, and meeting investor expectations consistently can be daunting for fund managers after a while.

Sometimes, all these can lead to having to take short-term calls on portfolios. Since PMS and AIFs come with lock-in periods in some cases, and both call for higher minimal investment values compared to mutual funds, investors understand the need to stick around and be patient. MFs, on the other hand, see a lot more frequent inflows and outflows.

But Rahul Singh, Chief Investment Officer - Equities at Tata Mutual Fund, is an exception. After having spent nearly two decades outside the Indian MF industry and having set up an AIF named Ampersand Capital Investment Advisors LLP, Singh moved to Tata Asset Management Co Ltd in June 2018. Here, he heads equity funds.

Singh started his career at CRISIL Ltd, one of India’s premier credit agencies as an analyst. Later, he worked at Citibank’s institutional research division, and then at Standard Chartered Securities, a part of Standard Chartered Bank, as an analyst.

Singh spoke to Bhavya Dua of Moneycontrol on where to invest Rs 10 lakh today. Edited excerpts of the interaction:

With Budget 2023 approaching, is it a good time for fresh investors to enter the equity markets, given the volatility?

Yes. Given the valuations of the market at this point, we would recommend a gradual entry into the market, irrespective of the Budget being around the corner. There are uncertainties in the global scenario, but we can see a lot of positives in the Indian economy. Even the Budget is expected to be pro-growth. From a two to three years’ perspective, reasonable returns can be made from these levels.

Assuming I have Rs 10 lakh right now, where should I invest it?

I would recommend a 60 percent allocation to equity and 40 percent to debt. This debt allocation will provide stability to the equity side. The five categories of equity that I will recommend, which will help generate alpha (outperformance over benchmark indices), are large-cap, mid-cap, balanced advantage, multi-cap, and small-cap.

Many experts are talking about debt funds. Interest rates are expected to have neared their peak levels and are even expected to come down in the not-so-distant future. Where should debt fund investors be investing in? Should an investor go for liquid funds or short-term funds?

I think short-term funds, target maturity funds, and dynamic bond funds are the way to plan the (interest rate) cycle. That’s what we are doing, and would recommend the same to investors.

Do you recommend any other asset classes aside from debt and equity?

One should surely have an insurance policy as a safeguard. Also, invest in gold to hedge your portfolio.

MF houses have started to launch new fund offers (NFOs). Should an investor even look at one when there are so many existing funds around?

An investor should look at these new offerings no differently from the existing funds. You should stick to the category of funds that align with your financial goals rather than worrying about whether to invest in an NFO or not.

Talking about the economy, what do you think are some of the major threats we are facing right now? Should we be worried about recession amidst the increasing tech and start-up layoffs?

As compared to developed countries, inflation is still under control in India. India is doing good in terms of global recovery, compared to the US or China. So, even with less than a 7 percent GDP growth rate, we are doing better than the rest of the world.

Any favourite sectors that you feel will outperform in 2023?

Banking, capital goods and manufacturing are the sectors that will do well in 2023. That’s because banking is benefitting from the improving interest margins, and manufacturing from the investment cycle revival, which was not happening for the last many years.

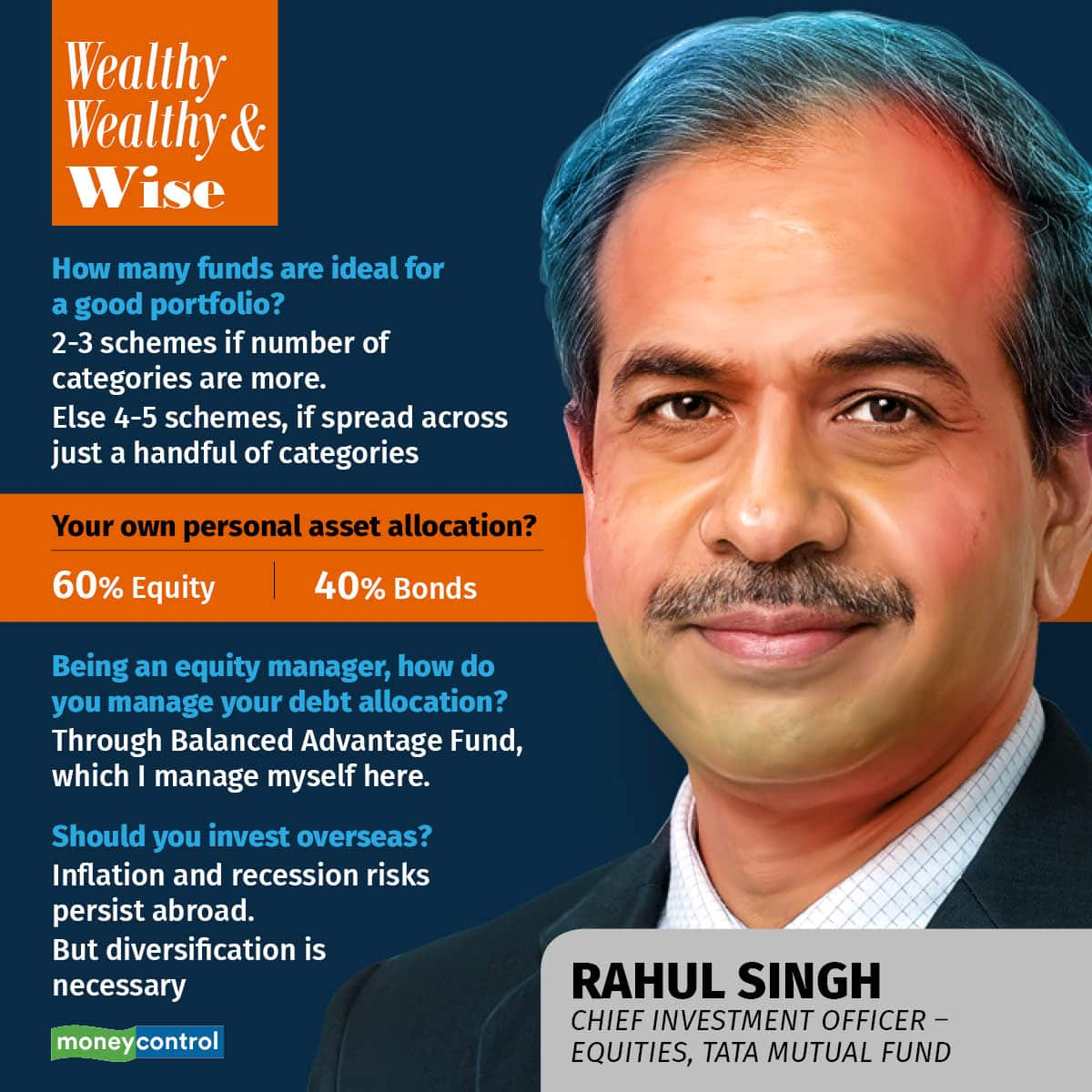

Even given the global scenario, we are seeing young investors getting more inclined towards international investment. Do you think one should have global exposure at this point in time?

As I mentioned earlier, currently the US markets and the developed markets are going through much more economic pain than India. Inflation is much more entrenched there, and even after a significant correction in the US tech market, it is a challenge to take a very concrete view on this aspect.

But that said, the risk is that if the rest of the world starts recovering, and if the recession is not very deep in the US and the UK, and China starts rebounding, then those markets will start to do better in terms of profits.

So, international investing can be viewed as a means to diversify and hedge the risk.

How many MF schemes do you think are ideal to have in one’s portfolio, since a lot of schemes have overlapping investments?

The investor should first decide on the category of funds one wants to invest in. If you want to invest in a balanced advantage fund, a multi-cap and a small-cap, then you should not have more than two to three schemes per category.

But if the categories you are invested in are less then you can opt for four to five schemes per category.

ALSO READ: Forget interest rate cuts in CY2023, go slow on long-duration MFs, says Sandeep Bagla of Trust MF

What does your own asset allocation look like?

My own asset allocation is quite similar to the one I recommended. I am primarily invested in equity-oriented and hybrid funds. And the rest in large- and mid-caps.

ALSO READ: Will L&T Mutual Fund’s acquisition inject fresh life into HSBC India MF? Its co-CEO weighs in

Don’t you invest in debt funds?

Yes, of course, I do. But I prefer to put money in a hybrid fund that does the asset allocation for me, like the Balanced Advantage Fund, which I manage here at Tata Mutual Fund. I would advise around 30-40 percent allocation to debt, in the present times.

What is your one big investment mantra?

Do not chase past performance of the funds and make investments in a small, gradual manner.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.