As interest rates get closer to their peak levels, mutual funds are slowly but surely turning their attention towards bond funds. Trust Mutual Fund, India’s 37th largest fund house with assets of around Rs 1,126 crore, announced the launch of a new fund, Trust Corporate Bond Fund, on January 10. The scheme will invest in high-quality bonds at a time when interest rates are rising and developed economies are staring at a recession.

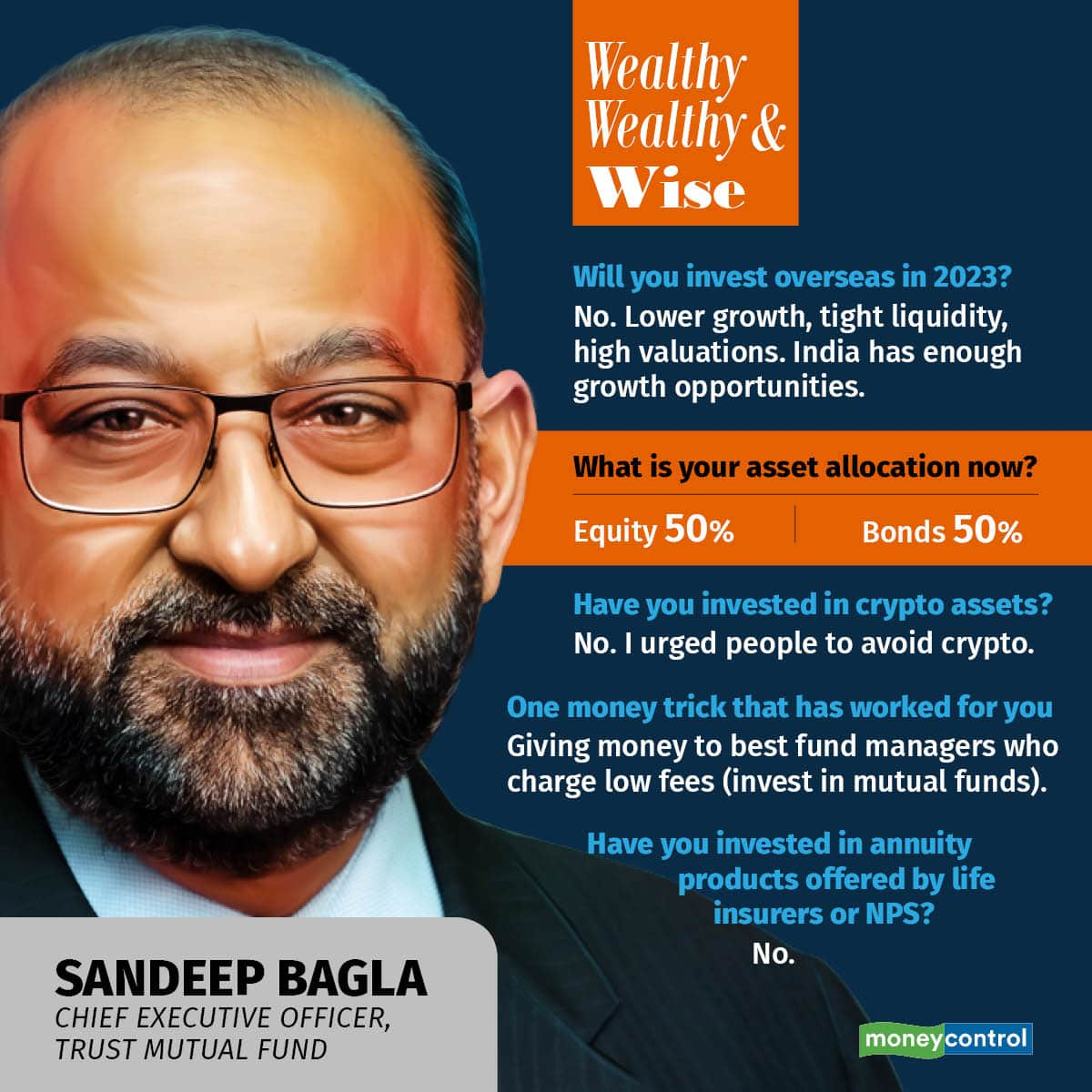

Sandeep Bagla, Chief Executive Officer of Trust Mutual Fund, shared his views with Moneycontrol on key questions faced by mutual fund investors. Edited excerpts:

Has the time come for interest rates to be cut? Will the Reserve Bank of India (RBI) cut interest rates in CY2023?No central bank worth its salt is going to cut interest rates in CY2023.

In the US, recession is a possibility, in Europe, recession is a certainty and in India recession is out of the question. The message we are getting from central bankers is ‘higher for longer’. They are going to keep interest rates high for a longer period of time because the biggest worry today is services inflation.

Because of high inflation, wages are going up in India. It will percolate to the services sector and will show in services inflation, which is difficult to control for RBI. Probably, they will increase the repo rate one or two times and then they will hold and keep liquidity tight.

Therefore, no rate cuts before CY2024.

Inflation is being projected at 5.25 percent one year from now. Historically we have seen the 10-year bond yield quoting 200 basis points above the projected inflation. So the 10-year bond yield is fairly priced (at 7.3 percent). If inflation goes up due to a sudden spurt in crude oil prices, services inflation or rise in geo-political tensions, then only the 10-year bond yield may go up. Otherwise, it will not break the previous high of 7.6 percent recorded earlier this fiscal year.

The natural tendency is that a saver demands real positive rates so that his purchasing power doesn't come down and he gets a real return on savings. Now there can be periods of aberrations such as the one in the COVID19 pandemic when the economy was not normalized. And probably because investors were not getting positive real rates, we saw large money flowing to equity from debt in the last two years.

But as soon as the economy started normalizing, banks started increasing bank deposit rates. As real interest rates turn positive, the allocation will change in favour of debt. Investors will revert to their normal asset allocation.

When investors are getting up to 8 percent on bank fixed deposits, why will you take a chance with equities which are over-valued? A part of the portfolio will shift to fixed income.

Is it a good time to invest in a long-duration fund? Many fund houses are offering medium term target maturity plans and long-duration funds. Are you planning to launch such products?We are going to launch a long-duration fund. Even our corporate bond fund does not have any restriction on the duration of the portfolio and the duration can be increased in a short period of time.

The critical part to keep a watch on is core inflation and when it starts to come down. That will show a weakness in the economy. And also services inflation coming down, as recessions are not accompanied by tight labor markets and increasing wages.

So once that evidence is available in the market, it will be priced in and there will be a rally in bonds. However, investors need to gradually allocate money to long duration. As of now, invest Rs 15 out of Rs 100 in a long-duration strategy. And over a period of time, increase allocation to long-term debt to 30 to 40 percent.

What are the key risks fixed-income investors need to keep in mind?The key risk here is inflation remaining stubborn and going up.

Second risk is bad choice of mutual-fund schemes. For example, you invest all your money in liquid funds and ultra-short duration funds. The yields on these products are higher than what they were a year ago. So your accrual income has gone up. But when interest rates start going down, you won’t benefit from falling interest rates if you have no allocation to long-duration funds.

Do you find equities attractive at this level?India has been a growth market and for an investor with a five-year time frame, there are enough opportunities. But over the next 6-9 months, it may not be a great time for stocks; as global liquidity is tightened, earnings are getting downgraded and valuations are far higher than the historical standards.

There will be volatility. Returns could be muted and even negative in the short term. If you have a 5-year view, there is no problem.

ALSO READ: Why mid and small-caps are poised for a good run in 2023You have launched six debt schemes so far. Are you going to be a debt-only fund house?No mutual fund house can remain focused on debt because it does not provide all relevant investment opportunities to investors. Also, it is uneconomical for a fund house to be focused only on debt funds. We will start launching equity schemes soon.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.