Have equity markets gone up or down?

At 56,579 points, the S&P BSE Sensex is roughly 9 percent below its all-time high last year, which it scaled in October.

It is roughly 20 percent up from the level a year ago and has gained 91 percent in the last five years.

Many investors tend to focus on recent trends more than the long-term ones. But equities held over a long period of time do deliver returns. The question is: how should you react to equity markets now? Where should you invest?

The start of a new year is a good excuse to deploy incremental fresh capital. It’s also the time when some employees receive a lumpsum bonus.

Once you decide how much you wish to invest in equity and how much in debt, here’s how you should choose the right equity fund.

SIP or lumpsum

Whether to invest a lumpsum amount or choose a systematic investment plan (SIP) has been an eternal puzzle. Across different market cycles, it has been found that if you are a long-term investor with a horizon of at least 5-10 years or more, the effort in timing your lumpsum investment is simply not worth it.

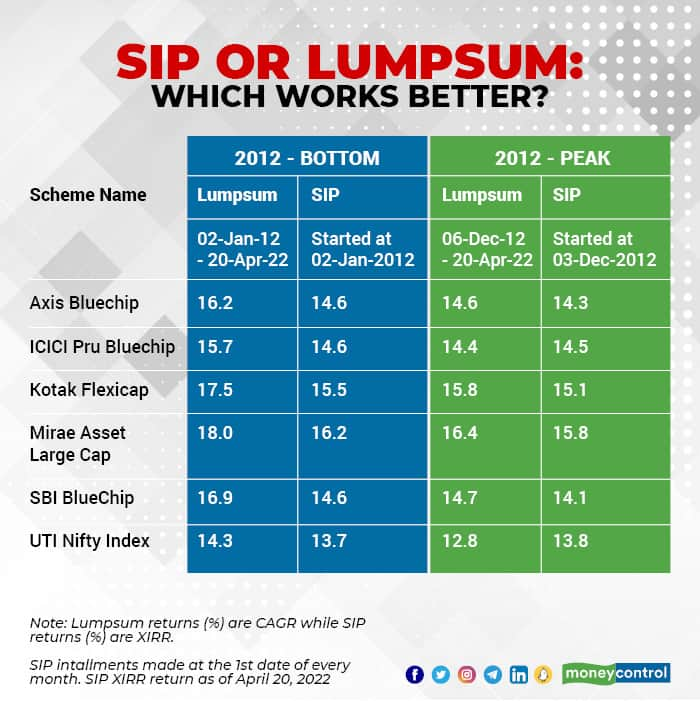

We took five of the largest (by assets under management) diversified equity funds, along with the largest equity index fund, in our domestic mutual fund space. We considered the lumpsum investment returns in four instances; starting your investment in the market peak and bottom, going back 5 and 10 years. This was compared with the returns by the same funds on SIPs started in the same month as the peak or bottom.

Here is what the data shows: in case of the ten year period, lumpsum investment made at the bottom was only marginally better than the SIP result – a maximum difference of 1.9 percent points and minimum difference of 0.6 percent points. To achieve this, the timing would need to be impeccable.

Across different market cycles, it has been found that if you are a long-term investor with a horizon of at least 5-10 years or more, the effort in timing your lumpsum investment is simply not worth it

Across different market cycles, it has been found that if you are a long-term investor with a horizon of at least 5-10 years or more, the effort in timing your lumpsum investment is simply not worth it

Lumpsum investment made at the market peak 10 years ago gave more or less the same return as an SIP started in that month; in fact the SIP fared better.

In the last five years, there has been very little difference between a lumpsum investment or an SIP started at the bottom. If you started your investments at the peak, then an SIP works better than a lumpsum investment.

If you started your investments at the peak, then an SIP works better than a lumpsum investment, typically.

If you started your investments at the peak, then an SIP works better than a lumpsum investment, typically.

But still there is very little to choose from. According to Deepak Chabbria, CEO and director of Axiom Financial Services Pvt Ltd, “If you already have exposure in equity markets, staggered investments make sense. If we see a sideways correction in the market or the downtrend continues, sticking to regular investing through STPs (Systematic Transfer Plans) and SIPs will help long-term investors. For those who are new to equity investing, a partial approach by investing 30%-40% of the lumpsum and keeping the rest for STPs may be better; lumpsum can benefit if markets turn upwards, else the regular investments will take care of any downtrend.”

The verdict:

Keep it simple. Do not choose one over other based on returns. Look at your cash flow.

For most investors, a simple SIP works best. But if you get a lumpsum amount to deploy, say your annual bonus, then top-up your SIP with a lumpsum investment.

Active or passive

Passive funds have become popular in the last few years. Aside from mirroring the markets, they come with low expense ratio. Index funds’ direct plans are as low as 0.10% as compared to a range of roughly 0.50%-1.5% for active funds (direct plan).

Regardless of the low cost, however, when we compared the returns of the three largest actively managed large-cap diversified equity funds with their passive (index fund) counterparts, the long-term returns continued to be superior.

While it’s true that not all actively managed funds are able to beat index returns, there is merit where the fund has a proven track record of quality and consistent performance.

The choice between an active and passive fund depends on your convenience.

The choice between an active and passive fund depends on your convenience.

According to Prateek Pant, chief business officer at WhiteOak Capital Asset Management, “The most important aspect of being an active fund manager is the focus on stock selection. A bottom-up approach rather than looking at market trends and macros to build the portfolio is where we derive consistency in outperformance as compared to the broad market.”

The verdict: Once again, the choice depends on your convenience. There is still scope for active funds to work in India. Ideally, choose a mix of both for your portfolio.

But if choosing a good quality active fund manager is sounding too cumbersome, then a passive strategy works well for long- term investors.

Sectoral/thematic or diversified

Recently, two large sectors of the economy have been under a lot of spotlight. These two sectors, information technology (IT) and banking, are not just large industries, but also critical parts of the economy. Recent news around the sectors has not been great.

But if you are the sort who likes to invest in underrated sectors, then you could look at sectoral funds. And, there are several. Just make sure you have a good understanding of the sector. Sectoral funds come with concentrated holdings. And any bad news in or around the sector can take your fund down.

And a sector fund’s entire fortunes are tied up with how that sector performs.

On the other side, a diversified equity fund invests across sectors and shares; a few sectors going down can always be offset by other sectors that could be doing well at the same time.

Both sector and diversified equity funds can be chosen for investment, but you must see which one you're most suitable for

Both sector and diversified equity funds can be chosen for investment, but you must see which one you're most suitable for

Chabbria said: “A retail investor or even HNIs (high networth individuals) will find it hard to do a sector rotation successfully as the insight for assessing and capturing the cycles is difficult. Moreover, it defeats the purpose of long-term investments.”

Market uncertainty can blur the vision with which you undertake an investment. But there is hardly a good or bad investment choice out there, whether the choice is between a lumpsum investment or an SIP, an active or a passive fund or a diversified or sectoral fund.

The question is: which of these are more suitable for you? Only you and your financial advisor know.

Dhuraivel Gunasekaran contributed to this story

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!