Volatile markets are making investors nervous. Though the foreign institutional investors are cutting their exposure to Indian stocks due to rising geo-political risks and rising interest rates, the domestic investors have shown nerves of steel. The Indian mutual fund industry which manages assets worth Rs 37.5 trillion has been getting inflows in equity mutual funds on a sustained basis.

As of March 31, 5.28 crore systematic investment plans (SIP) accounts were operational. In March itself, that contributed a little over Rs 12,000 crore a month. This shows the rising popularity of mutual funds.

But what are the fund managers thinking? Are they sitting on the sidelines waiting for markets to correct further? Which sectors do they think would come up winners in 2022? Moneycontrol took a poll of some leading fund managers belonging to some of India’s topmost fund houses.

Here is what they said.

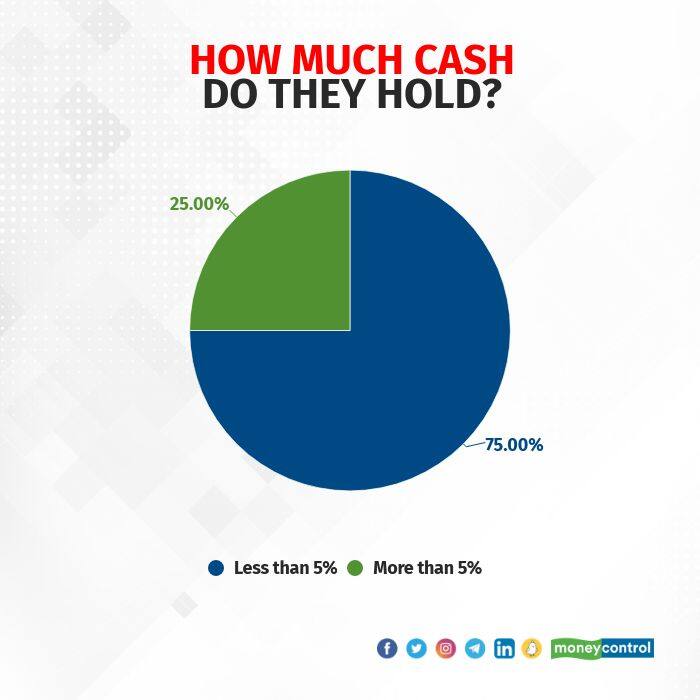

Cash is not the king

Despite all the volatility, diversified equity funds are not taking refuge in cash. 75 percent of the mutual fund houses polled, have less than 5 percent cash in their diversified equity portfolios. “We do not take cash calls,” says a fund manager with a small sized fund house. 25 percent of the mutual fund houses have more than 5 percent in cash and cash equivalents. In some cases the allocation has been as high as 8 percent. But no mutual fund house has taken an aggressive cash call.

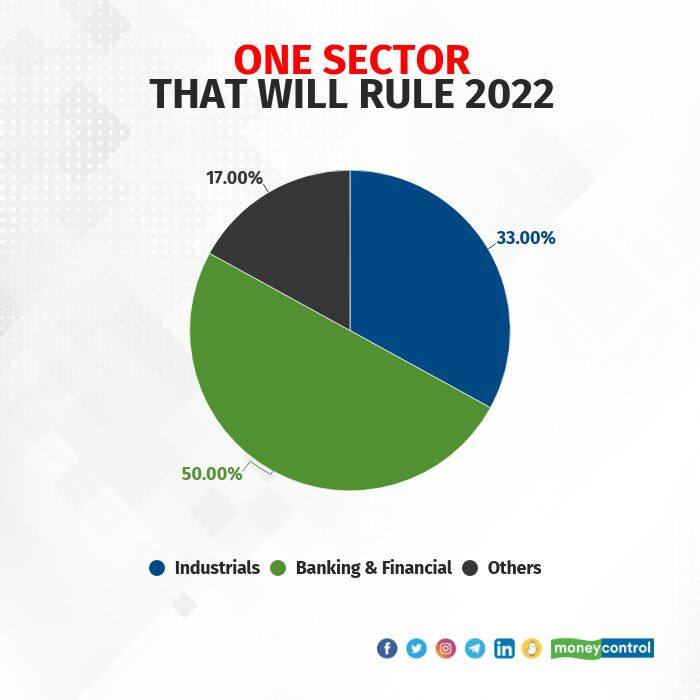

Sector for CY2022

When asked about ‘one sector that should outperform the broad markets’, the fund managers are seen focused on cyclical sectors. Financial services, especially the banking sector has been the most preferred bet for the fund managers. 50 percent of the fund managers voted in favour of this sector. 33 percent of the fund managers expect shares of the industrial goods companies to do better than the broad market. Remaining bet on cyclical sectors such as auto, power and capital goods.

Identifying the beneficiaries of economic recovery is clearly the biggest driver of the expected outperformers.

Banking sector still a favourite

The sector has seen headwinds in the recent past. According to Value Research, in three and five years ended April 21, 2022, banking and financial sector funds have given 5.96 percent and 7.9 percent returns respectively compared to 14.14 percent and 13.35 percent gains posted by large cap diversified equity funds. Among large cap schemes banking and financial services has the largest allocation of 25 percent on an average as on March 31, 2022. The stocks of financial services companies have 35 percent weight in Nifty 50 – the bellwether index.

83 percent of the fund managers are bullish on the banking sector. Depressed valuations, low credit costs, clean corporate loan books are some of the key positives for the sector. “Given this context, decent credit growth outlook as policy measures such as production- linked incentives kick in, the sector should offer higher growth than the broad economy,” says another fund manager.

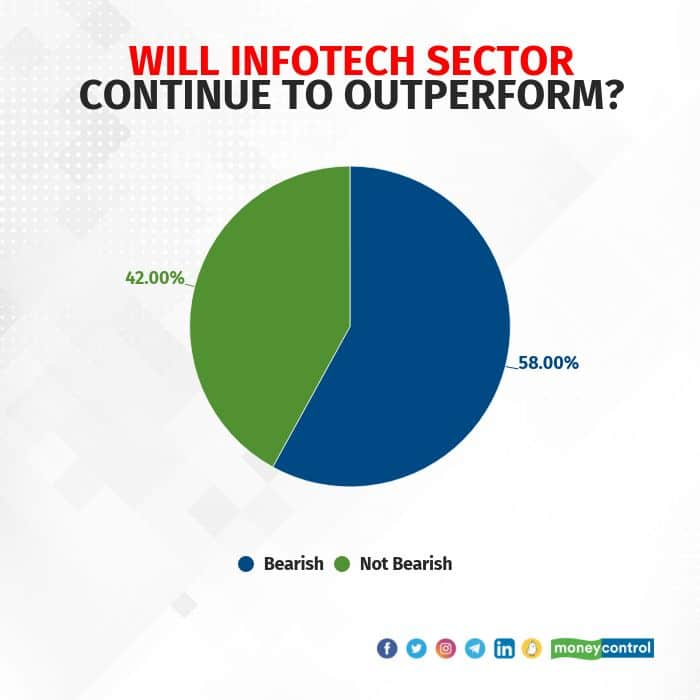

An encore by Information Technology sector is unlikely

Stocks in the information technology sector were one of the biggest beneficiaries of the lockdowns imposed to contain the spread of covid19. The process of digitization, tech adoption and rising demand for the technology related services in various segments of the economy made these companies do well. The sector has been the best performer over last three and five years with tech sector funds offering returns of 30.79 percent and 28.30 percent respectively.

The fund managers however now are cautious about the future of the sector. Six out of every 10 fund managers (58 percent) are bearish on the information technology sector. Remaining views ranging from neutral to positive on the sector. “Valuation zones in many names need continuous positive surprises to go up which may be difficult in current times,” says a fund manager.

What should you do?

Investors have to be conscious of their financial goals and their asset allocation based on the goals. Invest in equity mutual funds only in line with your asset allocation. Chasing past returns may not be the best idea, especially at a time when the interest rates are expected to go up.

But it’s best to continue your SIPs and top them up with lumpsum amounts as and when you generate any. If there’s one trend that you should read from our Moneycontrol poll of fund managers, it is that most fund managers are invested almost fully and hold very little cash.

If you are underinvested into equities then consider investing in good quality equity mutual funds through SIP. You may also consider some of the schemes recommended by MC30.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.